Features of legal billing software

Generate bills in one click. Spend less time on time and expense tracking, review bills faster and share client invoices easily.

-

Bill securely from anywhere, any time

Create and approve bills on the go, automatically apply interest to late payments, and send bills electronically via our secure client portal, Clio for Clients. Getting bills out fast means getting paid quicker.

Learn More -

Reduce time spent billing

Set up automated payment plans. Make collecting outstanding balances and replenishing trust accounts easy with recurring credit card payments—reducing collection time and increasing cash flow.

-

Get paid faster

Offer flexible payment options with our card processing functionality, Clio Payments, in Clio Manage. Collect payments online through secure click-to-pay links, QR codes, Pay Now buttons on your bills, payment plans, through saved payment information stored from intake, or over the phone. Alternatively, accept payments in person using tap to pay on Clio's mobile app. Sync transactions to Clio and third party accounting systems.

See How -

Accept payment for multiple bills at the same time

Allow clients to pay their balance for all legal bills in one transaction via credit card online. Clio will automatically apply funds to all outstanding invoices.

Reviews of our law firm billing software

Here’s what other law firms have to say about Clio’s legal billing software.

Customizable legal billing solutions

Personalize Clio’s legal time and billing software to the needs of your law firm and clients.

-

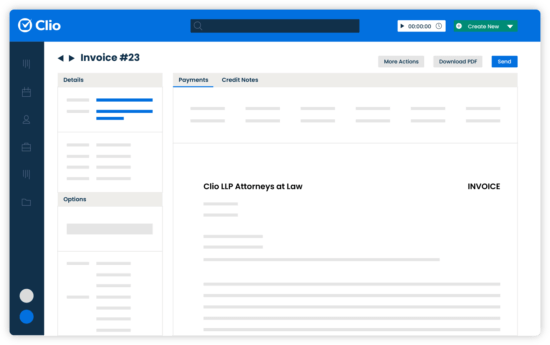

Create branded invoices

Create professional, easy-to-read legal invoices with your law firm’s logo. Offer greater transparency by including aggregated or expanded activity lists and detailed statements of accounts.

See it in Action -

Create customized billing plans

Bill clients based on hourly rates or with alternative billing arrangements such as flat fee or contingency. Make collecting fees and replenishing trust accounts easy with recurring credit card payments.

-

Tailor payment profiles to improve collections

Create custom payment profiles in Clio that include grace periods, discounts for prompt payment, and custom interest rates. Assign payment profiles to specific contacts.

Learn More -

Discount and write off bills

Apply percentage or fixed amount discounts to an entire bill, apply credit notes, or convert time entries to no-charge. Quickly write off full or partial bill amounts when needed.

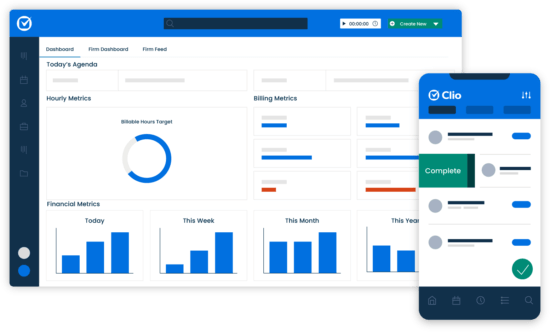

Get clear law firm billing reports

Clio's legal time and billing software delivers comprehensive legal billing reports, including reports on law firm finances, insights into accounts receivables, and more.

-

View, organize, and share bills with clients

See the status of all your unpaid bills in one tab, and in a single click, prompt clients to pay their invoices.

-

Report on detailed account information

Share a client’s legal billing history and outstanding balances with them using Clio’s Statement of Accounts. Filter reports by client, attorney, date, and account type—whether operating or trust accounts.

-

Generate reports on firm-wide billings

Generate clear legal billing reports to make managing firm finances simple and effective. Report on aging receivables, matter balances, client billing histories, and more.

See it in Action

Legal billing software FAQs

What is legal billing software?

Legal time and billing software is what lawyers use to keep track of their work and expenses, and to bill clients for that work on a case. This software makes managing every stage of the legal billing process easier and more efficient: including time and expense tracking, invoicing, bill creation, bill review, trust accounting, collections, and payments.

What are the benefits of legal time and billing software?

The main advantage of legal time and billing software is that it allows firms to reduce time spent on invoicing, billing and collections. The best online legal billing software is customizable, with branded invoices and flexible billing plans available to help you get paid faster. Create reports to get a clear picture of outstanding balances/accounts receivables that can be filtered by matter or person.

What is the best legal billing software?

Clio Manage is widely recognized as the best legal billing software, with a rating of 4.5/5 or higher on G2 Crowd, SoftwareAdvice.com, Capterra, and Lawyerist.

Clio Manage is also trusted by over 150,000 legal professionals, and approved by over 66 bar associations and law societies worldwide.

What is the best accounting software for a small law firm?

As the best accounting software for a solo or small firm, we recommend a system that integrates easily with your practice management software. Quickbooks Online and Xero are two leading solutions that integrate with Clio Manage.

How do lawyers bill their clients?

If they bill by the hour, lawyers may track their time in six-minute increments and then add this time to an invoice where they note which activities each time log was spent on. Lawyers may also track their time but use an alternative billing arrangement such as retainers, evergreen retainers, sliding-scale fees, flat fees, contingency fees, or subscription services.

How does generating bills work?

Clio allows you to generate bills from the main dashboard of a matter. Clicking the “Quick Bill” button will instantly generate an invoice with all billable time entries. You can also generate bills in bulk.

Watch this four-minute video on how it’s done.

Can I apply trust funds to bills before sharing them?

Yes. Clio’s legal billing software allows you to approve and apply trust funds to your bills. This applies available trust funds to your invoice and allows the client to pay their balance. If you are out of trust funds, you can always send a trust request.

How do I use legal billing software to send invoices to clients?

The easiest way to share invoices with clients is over email. Once a bill is approved, click “Share”, and your client will receive an email that allows them to pay their invoice with a credit card.

How much does legal time and billing software cost?

Clio’s costs vary depending on the features your law firm is looking for. Our legal billing software offers pricing plans starting at just $39 a month to ensure firms of all sizes can access our software solution.

Can I customize the look of my invoices?

Yes. Clio’s billing software lets you customize headers and themes, and add your law firm’s branded logo to your invoices.

Can I see which clients haven't paid their bills?

Yes. Clio includes a straightforward dashboard of outstanding balances that shows who’s paid their bills, who hasn’t, and when a payment is due.

Does Clio's legal billing software integrate with Quickbooks?

Yes. Clio’s legal billing software integrates with Quickbooks. Read this Help Center article to find out how to sync Quickbooks to your Clio account.

What features does legal billing software have?

The best legal billing software has a range of features to help your law firm bill efficiently. Below is a set of standard options you should look for first (Clio Manage includes all of these):

Varied billing arrangements: Your legal billing software should let you bill by the hour, or charge flat fees or contingency fees

Custom hourly rates and fees: This lets you charge different set hourly rates for different lawyers in your firm, and different flat fees for certain activities.

Timekeepers: You should be able to track time as you work using stopwatch timers in your legal billing software, or have the option to add time entries after the fact.

Expense tracking: Printing costs, mailing costs, and filing fees also need to be billed to clients. Legal billing software helps you keep track of it all.

Accounting integrations: Your legal billing software should integrate directly with your law firm’s accounting software for easy reconciliation of accounts.

Activity codes: These are standard codes assigned to different activities within your firm such as research, document drafting, or contract review.

LEDES billing codes: For firms that need it, your software should allow you to easily format bills according to LEDES (Legal Electronic Data Exchange Standard). You should also be able to use UTBMS codes (Uniform Task-Based Management System Codes) to give further detail on a LEDES bill.

Invoicing: Bills should be automatically generated based on unbilled time and expenses logged to a case.

Customizable bill themes or invoice templates: Your legal billing software should allow you to create clear, professional bills featuring your firm’s logo and any standard copy needed.

Payment reminders: You should have the option to remind payments if an invoice is past due.

Payment plans: Your legal billing software should include the option to put clients on automated payment plans.

Credit card processing: Today’s clients no longer want to pay via check. Your legal billing software should include a credit card processor that allows clients to pay their bills easily via credit card online.

Outstanding client balances: You should easily be able to see the balance of client accounts and whether clients have paid or not.

Trust account management: Your legal billing software should help you keep an accurate record of all trust accounts and transactions. You should also be able to keep track of your IOLTA (Interest On Lawyer Trust Account).

Financial reporting: You should be able to see accounts receivables, outstanding balances, and more in easy to read reports, organized by client, matter, or attorney.

How do I choose the best legal billing software?

The best legal time and billing software has a range of features to help your law firm bill efficiently. Below is a set of standard options you should look for first (Clio Manage includes all of these):

Varied billing arrangements: Your legal billing software should let you bill by the hour, or charge flat fees or contingency fees

Custom hourly rates and fees: This lets you charge different set hourly rates for different lawyers in your firm, and different flat fees for certain activities.

Timekeepers: You should be able to track time as you work using stopwatch timers in your legal billing software, or have the option to add time entries after the fact.

Expense tracking: Printing costs, mailing costs, and filing fees also need to be billed to clients. Legal billing software helps you keep track of it all.

Accounting integrations: Your legal billing software should integrate directly with your law firm’s accounting software for easy reconciliation of accounts.

Activity codes: These are standard codes assigned to different activities within your firm, such as research, document drafting, or contract review.

LEDES billing codes: For firms that need it, your legal billing software should allow you to easily format bills according to LEDES (Legal Electronic Data Exchange Standard). You should also be able to use UTBMS codes (Uniform Task-Based Management System Codes) to give further detail on a LEDES bill.

Invoicing: Bills should be automatically generated based on unbilled time and expenses logged to a case.

Customizable bill themes or invoice templates: Your legal billing software should allow you to create clear, professional bills featuring your firm’s logo and any standard copy needed.

Payment reminders: You should have the option to remind payments if an invoice is past due.

Payment plans: Your legal billing software should include the option to put clients on automated payment plans.

Credit card processing: Today’s clients no longer want to pay via check. Your legal billing software should include a credit card processor that allows clients to pay their bills easily via credit card online.

Outstanding client balances: You should easily be able to see the balance of client accounts and whether clients have paid or not.

Trust account management: Your legal billing software should help you keep an accurate record of all trust accounts and transactions. You should also be able to keep track of your IOLTA (Interest On Lawyer Trust Account).

Financial reporting: You should be able to see accounts receivables, outstanding balances, and more in easy-to-read reports organized by client, matter, or attorney.

Legal billing resources

More Clio Manage features

-

Case Management

Stay organized, and access the information you need—from anywhere, at any time.

-

Document Management

Edit, store, and organize your legal documents securely, from anywhere.

-

Client Management

Easily organize contact details, documents, and communication logs from intake to invoice.

-

Accounting

Simplify reconciliations and comply with trust accounting regulations. Sync to third-party accounting systems.

-

Calendaring

Stay on top of deadlines, with legal-specific features like Court Rules.

-

Task Management

Assign and track tasks. Report on task progress, identify roadblocks, and better manage productivity.

-

Online Payments

Get paid faster and make it easier for client to pay with online payments.

-

Time & Expense Tracking

Make billing easy and accurate with features like Timekeeper and enhanced expense tracking.

-

Law Firm Insights Dashboard

See how many hours your firm has captured, billed, and collected in one dashboard.

-

Client Portal

A desktop and mobile app for clients to communicate and collaborate with their lawyer.

-

Law firm communications

Manage client and firm communication all on one platform.

-

Personal Injury Case Management Software

Clio’s personal injury case management software helps personal injury firms organize every case detail, close cases close faster, and deliver the best outcomes for clients.

Book a Live Demo

Book a live demo to see how Clio can help your law firm maximize efficiency and increase revenue

Try Clio for Free

Try Clio’s legal software free for 7 days with no obligation. Easy setup. No credit card required. Cancel anytime