Solicitors’ professional indemnity insurance (PII) can be one of the largest costs and stressors many law firms, particularly those in England and Wales, will face. Organising renewals or first-time applications, professional indemnity insurance quotes, and finding the best solicitors’ professional indemnity insurance provider for your particular law firm can take time and effort.

To help make the process of applying for or renewing solicitors’ professional indemnity insurance, Clio, together with Lockton, a leading UK supplier of PII for solicitors, have put together a free guide: “A Guide to Solicitors’ Professional Indemnity Insurance.”

Clio also spoke to Frances Lodge, Assistant Vice-President of Lockton Solicitors UK, to discuss the state of the UK PII market.

Interview with Frances Lodge

How is the market looking at the moment for law firms that are renewing their professional indemnity insurance?

In recent times we have seen some of the toughest market conditions, with premium rates increasing consistently. With an absence of new insurers entering the market, and a reduced appetite for insurers to take on new clients, choice for some firms at their renewal has been limited.

However, we are now starting to see some green shoots in the market, with insurers more willing to take on new clients, and rate increases beginning to plateau.

Firms undertaking work deemed as low risk such as specialist criminal or employment law firms, with good claims histories, continue to be sheltered from the stormy conditions.

What has caused things to get so tough in the PII market?

In comparison to the PII policies of other professions, solicitors’ professional indemnity insurance has always been more expensive. The SRA’s Minimum Terms and Conditions policy wording provides much wider coverage than that afforded by other professions’ policies. For example, it is the only policy where the insurer is obliged to provide run off cover even when it has not been paid for.

In terms of what has changed over the last 18 months or so, whilst it is not the only factor that has influenced and shaped the market, the main catalyst for change has been claims. With asset and transaction values continuing to rise, the severity of claims is increasing as well as the frequency.

According to our data, the majority of law firms (approximately two thirds) are not experiencing claims. However, the claims emanating from the remaining third are now exceeding the total premium that insurers collect from the whole profession.

Are there any signs of the PII market improving soon?

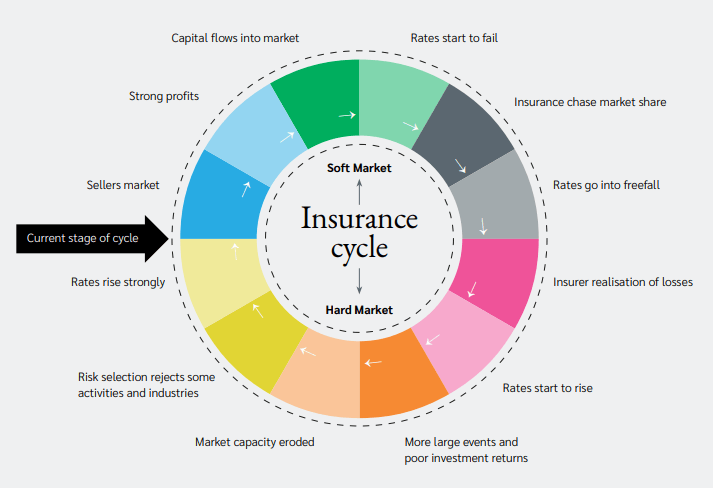

As illustrated below, solicitors’ professional indemnity insurance is cyclical, which means that the market will soften again in time; however, it is difficult to put timescales to these stages.

Image provided by Lockton UK

Whilst there is still an unknown around the impact of the pandemic on claims, it is a good sign that reviewing claims thus far has not resulted in any obvious trend. It is important to note, however, that any such issues may still take another 12 to 18 months to become apparent.

Should claims start to dilute, then this will encourage new insurers to enter the market, which coupled with the lack of any recent insurer exits, will increase competition amongst insurers.

We are also starting to see an increased willingness from insurers to take on new clients in comparison to 12 months ago, which again increases competition by providing law firms with more options.

Is there anything that law firms can do to mitigate the effects of the market on their PII premium?

In current market conditions, it is important now more than ever that law firms ensure they are doing everything within their power to achieve the best result possible for their business in terms of their PII.

Effective risk management has always been key to a well-run practice, to identify where risk lies and to put appropriate measures in place to mitigate this.

The importance of staff wellbeing has come to the fore in recent times, with a common cause of claim being overworked staff who, under pressure, make uncharacteristic errors.

Investing in people through training and continual professional development will ensure that fee earners are able to work and advise clients to the best of their ability.

With underwriters receiving thousands of applications for PII at each key renewal date, the quality of a firm’s presentation can make a significant difference to the underwriting outcome. A clear and comprehensive proposal, in good time before renewal, together with a bespoke covering letter will stand out to insurers.

Examples of some of the topics to address in a professional indemnity insurance covering letter would be:

- Details of typical client base both for private clients and businesses. For example, do they tend to be local? Do they tend to be repeat clients or come through recommendations from current clients?

- Who is responsible for risk management within the firm, and what form does risk management take on an ongoing basis? Does the firm have a clear policy on what work it will not do? Does the firm seek to assess their clients’ experience after providing a service?

- How does the firm ensure that high professional standards are maintained? What is the firm’s strategy in the near-term? Does the firm anticipate any significant changes over the next 2 years?

Further resources for solicitors’ professional indemnity insurance

If this article has raised any general questions, or you would like to talk in confidence about your own firm’s renewal, then please do not hesitate to contact Frances Lodge at the details below.

Or, download Clio’s free resource, “A Guide to Solicitors’ Professional Indemnity Insurance”, which has been prepared and reviewed with kind assistance from Lockton.

Download your free PII guide here.

We published this blog post in March 2022. Last updated: .

Categorized in: Regulation and Compliance, Solicitors' Professional Indemnity Insurance

PII costs a challenge?

Check out this free guide to solicitors' professional indemnity insurance for tips and techniques to getting the best deal.

Download for free