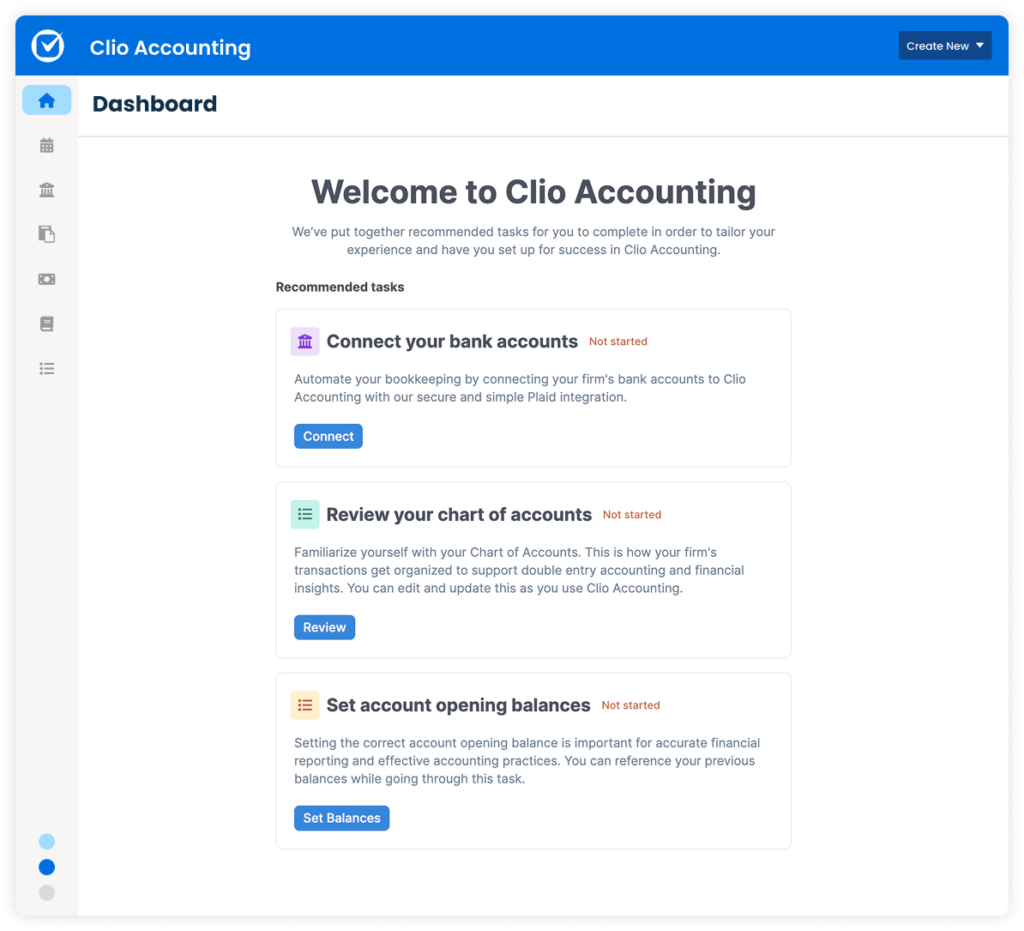

Get your firm set up for success

Ensure a smooth start so you can best manage your firm’s finances

Get to know Clio Accounting with tips, guides, walkthroughs, and more.

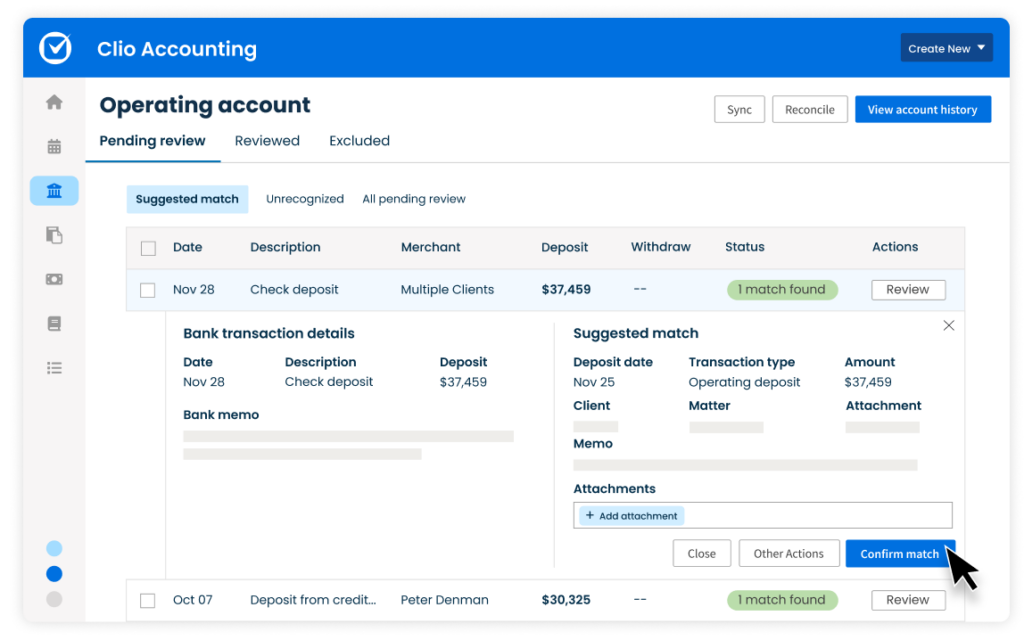

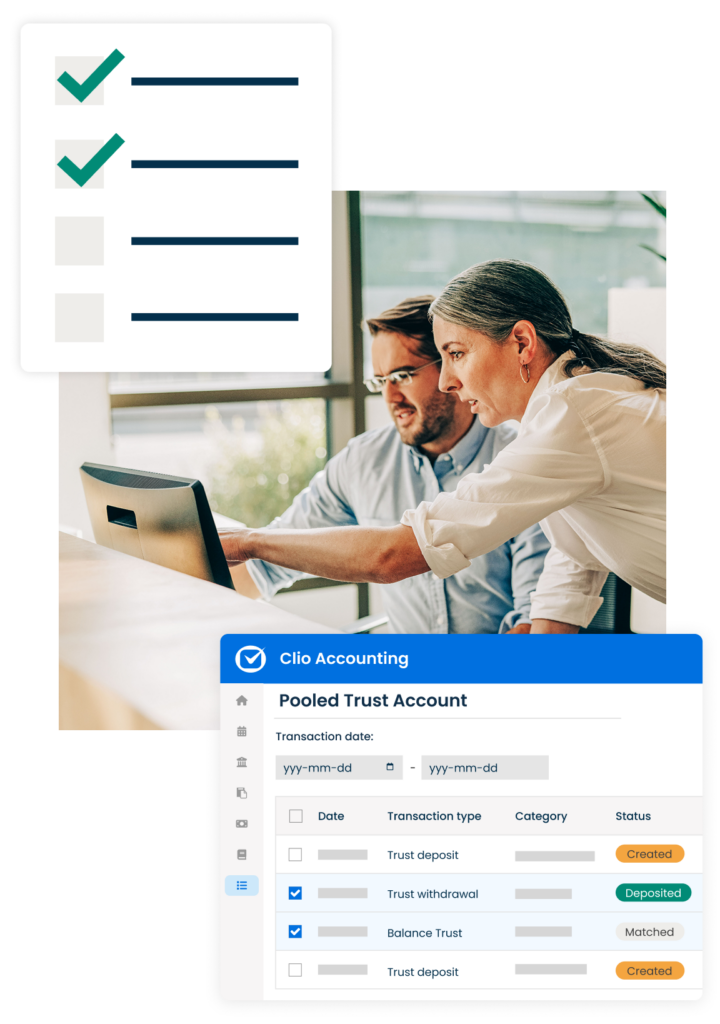

To get started, gather your latest bank and credit card statements, opening balances, and reconciliation records if available. During setup, you’ll be prompted to select which trust and operating accounts from Clio Manage should sync with Clio Accounting, and set a start date for transaction tracking. For more detailed guidance, refer to the complete setup guide.