Dealing with a chargeback right now? Our team is here to help.

Reach out to our support team who are available 24/5, or speak directly with our team of chargeback experts at [email protected].

Call 1-888-858-2546 (toll free) 604-210-2944

-

What’s the difference between a chargeback and an ACH dispute?

Chargebacks apply to credit or debit transactions and are managed by their respective card networks. ACH disputes apply to eCheck payments and are managed by their respective bank networks.

Understanding chargebacks

-

A chargeback is a disputed transaction initiated by a client with the intention of reversing a credit or debit card payment charged by their lawyer or law firm. If the chargeback is resolved in favor of the client, the payment will be refunded to them.

Types of chargebacks

Chargebacks can occur for any card payment made using MasterCard, Visa, or American Express networks. The most common reason codes in the legal industry are detailed in Clio’s chargeback guide. The type of chargeback will determine what actions you can take to resolve them:

- Card payment chargebacks. You have the opportunity to challenge the dispute according to the rules and processes defined by the card networks.

- Inquiries. Inquiries are requests from American Express networks to provide additional information about a transaction. An inquiry can potentially become a chargeback if you do not respond and provide no information, or after you respond, American Express determines a chargeback is warranted.

-

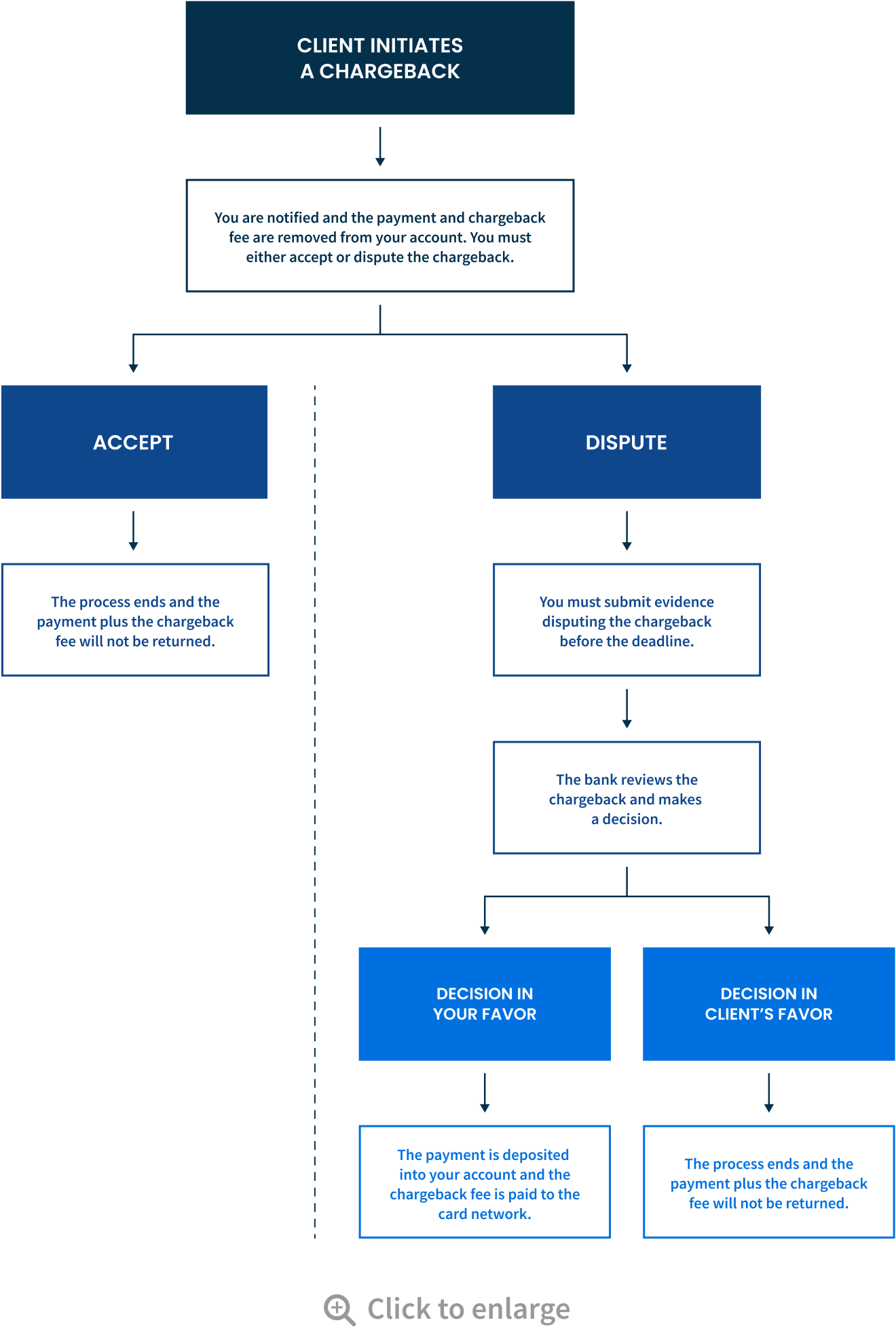

Understanding the chargeback process

-

1. The cardholder calls their bank to chargeback a transaction.

The bank will process the request and assign a reason code to inform the chargeback process.2. You get notified.

Clio will send an automated email with details on the chargeback and how you can respond.3. The chargeback amount plus a capped $15 fee is debited from your operating account.

Clio is required by card network rules to return funds to your client the moment we are notified of a chargeback. To keep you compliant, we will never debit any of your trust accounts for chargebacks or returns. Credit card networks charge an additional variable fee, which can sometimes be as much as $100. While Clio cannot completely prevent this fee, we limit it at $15 to protect you throughout the process.4. You accept or challenge the chargeback.

When challenging a chargeback, your law firm will be required to submit evidence to your claim before the deadline. Clio will support you every step of the way in both challenging the chargeback and assembling the evidence required. If you don’t submit evidence by the deadline or choose to accept the chargeback, no further action is required.

Note: Concerned about attorney-client confidentiality when disputing a chargeback? According to the American Bar Association, rule 1.6 for Confidentiality of Information states that when it comes to chargebacks, documentation may be redacted where necessary as long as required information is revealed.5. An outcome is decided by the cardholder’s bank.

The bank may take up to 75 days to make a decision. If resolved in your favor, the chargeback amount will be returned to your account. The $15 chargeback fee is paid to the card network and is non-refundable.

-

Understanding ACH disputes

An ACH dispute (sometimes referred to as “ACH return” or “ACH chargebacks”) is a disputed transaction initiated by a client that reverses an eCheck payment. You don’t have the opportunity to challenge the return through the payment network. You will instead need to work directly with your client. This is a standardized procedure within the payments industry defined by NACHA, the governing body that creates rules and standards for ACH payments.

When a client contacts their bank to request an ACH dispute, the transaction amount and a $15 fee will be removed from your account.

There is no dispute process for ACH disputes like there is for credit card chargebacks, but Clio will notify you immediately of the return so that you can follow up with your client. Typically, the best strategy for managing ACH disputes is to be proactive in preventing them in the first place.

For more in-depth information on chargebacks and ACH disputes, read our downloadable chargeback guide.

Best practices to prevent chargebacks and ACH disputes

Many chargebacks and ACH disputes occur as a result of a misunderstanding between the lawyer or law firm, and the client. In many cases the best way to manage them is to do everything you can to prevent them.

All too often, a client tries calling their lawyer or law firm to resolve an issue but cannot get the support they need. Clients then resort to filing chargebacks.

-

Set expectations and communicate clearly with clients.

Make sure clients understand what work you will be doing, what the timeline is, and what the billing and payment process looks like. Be sure to include clear refund policies.

-

Get written authorization.

Ask clients to fill out a payment authorization form. Written agreements will help in the dispute process, if it occurs. Clio provides some templated credit card authorization forms here.

-

Ensure your statement descriptor reflects your business name.

A statement descriptor is what your client sees when they receive their bill or bank statement. It should be your “doing business as” name included on your invoices, website, or other public-facing communications that will be recognizable to clients. To set and change your statement descriptor in Clio, learn more here.

-

Make it easy for clients to contact you.

Make sure your clients understand that if they have any questions about payments they can contact you at any time, and ensure your contact details are easy to find online.

Resources

We’re here to help.

Contact Clio’s chargeback experts for support or if you have any questions at [email protected]