Benefits of payment processing solutions for law firms

Discover the endless benefits of payment processing solutions for law firms, including faster payment cycles, increased convenience for both the firm and clients, and reduced stress and administrative time spent chasing payments.

In some cases, it could be the difference between a client retaining you or not retaining you— 40% of UK legal clients say they wouldn’t hire a lawyer that didn’t offer a simple online payment method.

Clients want to pay in ways that are convenient to them, and lawyers that offer those payment methods will have an edge over the competition.

Whether you’re new to legal payment processing solutions and law firm online payments, or looking to take your payment offerings to the next level, our list of resources will help you every step of the way.

Getting started with payments for lawyers

Looking to dive into the world of legal payment processing? When you first start off, the number of specialised terms (processing rates, card networks, per-transaction fees) can be daunting, but you’ll soon find that it’s actually more intuitive than you think. These resources are designed to help you understand some of the key considerations you need to know about legal payment processing.

Lawyer Payment FAQs

What is the benefit of online payments for lawyers?

Online payments help law firms offer a better, more convenient payment experience with added flexibility. According to Clio’s 2021 Legal Trends Report, growing firms are 37% more likely to use online payments. Additionally, Clio’s UK research shows that two in five UK consumers say that the option to pay online would make them more likely to choose a law firm. By making it easy for clients to pay through multiple payment methods, law firms can reduce friction throughout the process and get paid faster.

What is client accounting?

Client accounting is the need to keep client funds separated from law firm operating funds. It’s necessary for legal practitioners to have a client account to hold client funds (such as court fees, advanced costs, or settlement funds) otherwise they may be at risk of putting clients’ money in danger, facing disciplinary action, or even being struck off.

How do I maintain client accounting compliance?

In order to maintain client accounting compliance, firms need to maintain accurate records showing the flow of funds in these types of accounts to ensure client funds are being handled properly. A few best practices are to keep this client account fund and your matter fund completely separated, ensure credit and debit card payments are deposited correctly and fees aren’t debited or taken from a client account, and never move unearned funds from your client account to an operating account.

Depending on your jurisdiction, you may also be required to have a client account with an approved financial institution. It’s important to check these requirements before you set up an account—for England and Wales, check the SRA Accounts rules.

It’s also important to have a legal payment processor that has safeguards in place to keep your client accounting compliant and ensure your funds are protected from potential third-party debiting (such as fees).

What processing fees come with legal payments?

Depending on the legal payment processor, you may need to pay unclear or unexpected additional fees that weren’t advertised to you upfront. For certain payment processors, that could mean high card rates, interchange fees, a monthly subscription cost, and other processing fees. With Clio Payments, always know exactly what you’re paying. Clio Payments transparent, upfront pricing and no monthly subscription is easy to calculate and understand—and includes no hidden costs or fees.

Can law firms add surcharges for credit cards?

Surcharges—when a firm passes on the credit card processing fees to a client—are prohibited in some countries and jurisdictions (including the UK). Even in the jurisdictions where it is not prohibited, there are strict rules around surcharging. For example, you have to notify both the processor and the client, and you cannot add a surcharge for more than your processing fee.

If you’re considering adding surcharges for card payments, it’s important to do your research to ensure you’re acting legally and compliantly.

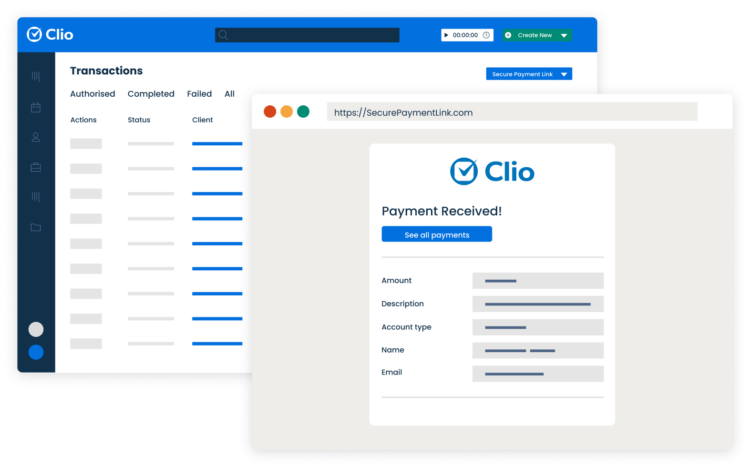

Make it easy to pay—and get paid—with Clio Manage

Clio’s all-in-one, practice management system makes it easy for your clients to pay online using a debit or credit card, Apple Pay or Google Pay, or Pay by Bank without the need for a third-party payment processor.

Payments are automatically deposited directly into your client or operating account and tracked in real-time, so you and your integrated accounting platform are always up-to-date.