2023

Legal Trends for Mid-Sized Law Firms

Introduction

What distinguishes mid-sized lawyers?

- Introduction. What distinguishes mid-sized lawyers?

- Part 1. The shrinking performance gap

- Part 2. Lawyers are making moves

- Part 3. When work happens

- Part 4. The power of the cloud

- Appendix A. App data collection

- Appendix B. Survey design

Mid-sized law firms have long defined the experience of working at a traditional legal practice.

“Mid-sized” captures a broad category of law firms, from firms that identify as “boutique” to expansive firms with presences across numerous states and practice areas.

What typically distinguishes these firms is a greater amount of overhead and structure. They function like a complex organizational ecosystem composed of many players (including non-legal professionals, such as operations, IT, and finance professionals) and moving parts (including software, processes, and goals).

Traditionalism reinvented

Mid-sized firms have often enjoyed exceptional performance in key business areas, including billing rates and revenue streams.

However, the same traits that define mid-sized firms can also work against them. Higher headcounts and entrenched processes make it more difficult for larger firms to swiftly respond to changing market conditions and client needs.

Many mid-sized law firms and lawyers are resistant to the recent uptake of remote work and flexible schedules—and are failing to meet modern client expectations by making better use of technology. With this, we see a worrying trend of decreased performance in key business areas and dissatisfaction among lawyers in mid-sized firms.

To maintain the recent levels of performance, today’s firms may need to rethink the experience of working at a mid-sized law firm. This will require looking inward at the factors driving lawyer dissatisfaction, what opportunities they offer for career advancement or partnerships, and how to provide experiences that align with modern employee and client expectations.

The Legal Trends for Mid-Sized Law Firms report looks at what distinguishes mid-sized law firms from smaller practices. Since no one-size-fits-all measure of success exists, this report provides insight into key trends across multiple perspectives—including financial performance, personal and professional well-being, and client relationships.

By analyzing these insights, we identify where mid-sized law firms often face their greatest challenges and how they can work toward overcoming them.

The same traits that define mid-sized firms can also work against them.

Mid-sized firms versus smaller firms

This report defines mid-sized law firms as those with 21 or more employees. We compare this cohort to “smaller firms,” or those with 20 or fewer employees. These are broad groups to compare, but in doing so, we’ve been able to shed light on distinct trends distinguishing these two cohorts. While no firm size is objectively better than the other, there is no denying that as the structure and makeup of firms differ, the circumstances for those who work in them differ as well.

However, the findings in this report don’t just apply to mid-sized firms—they can also be useful for any firm that operates similarly, with higher overhead, entrenched processes, and more managerial supervision.

While no firm size is objectively better than the other, there is no denying that as the structure and makeup of firms differ, the circumstances for those who work in them differ as well.

Data sources

This report uses a range of methodological approaches and data sources to deliver the best insights about the state of legal practice and strategies for future improvement.

Clio data

We’ve analyzed aggregated and anonymized data from tens of thousands of legal professionals in the United States, segmented based on firm size, to observe differences in usage patterns among mid-sized firms and smaller firms. This data provides important insights into how firms of different sizes are using technology, and its impact on performance. This analysis includes data collected between January 2019 and March 2023.

Surveys of legal professionals and consumers

We surveyed 1,134 legal professionals, segmented based on firm size, to distinguish and compare responses between mid-sized firms and smaller firms. Additionally, we conducted surveys of 1,168 consumers to compare trends beyond legal professionals. The consumers included in this survey represent the US population by age, gender, region, income, and race/ethnicity based on the most recent US census statistics. We conducted all surveys in April and May 2022.

2023

Legal Trends for Mid-Sized Law Firms

Part 1

The shrinking performance gap

- Introduction. What distinguishes mid-sized lawyers?

- Part 1. The shrinking performance gap

- Part 2. Lawyers are making moves

- Part 3. When work happens

- Part 4. The power of the cloud

- Appendix A. App data collection

- Appendix B. Survey design

By looking at aggregated and anonymized data from tens of thousands of legal professionals using Clio, we’ve benchmarked major trends in business performance throughout the legal industry since 2019.

For lawyers in mid-sized firms, this data provides valuable insight into understanding how their businesses compare to others in the industry while identifying key factors for assessment and improvement.

Mid-sized firms aren’t taking on many more cases

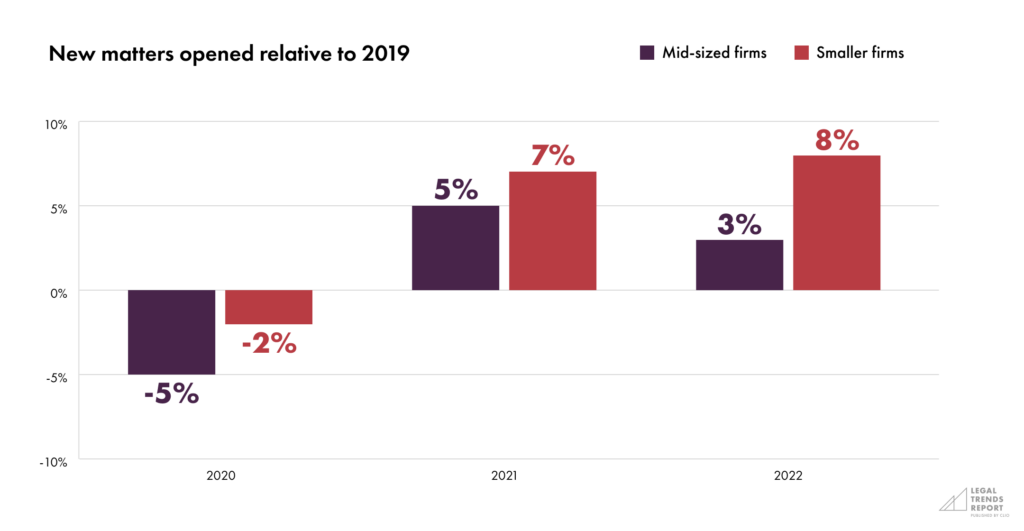

Like all law firms, mid-sized practices saw the demand for legal services drop when COVID-19 emerged in 2020. Despite this drop, mid-sized law firms managed to recover in 2021 and even increase their casework substantially, surpassing pre-pandemic levels. This growth slowed in 2022.

Smaller firms, on the other hand saw a much smaller decrease in casework in 2020, and have maintained a substantially larger increase in casework in the following years. Overall, these trends suggest that mid-sized firms were affected more significantly by the COVID-19 pandemic, and that smaller firms were more able to weather and adapt to shifts in market demand for legal services.

Mid-sized law firms managed to recover in 2021 and even increase their casework substantially, surpassing pre-pandemic levels.

…But mid-sized firms are billing and collecting more than ever

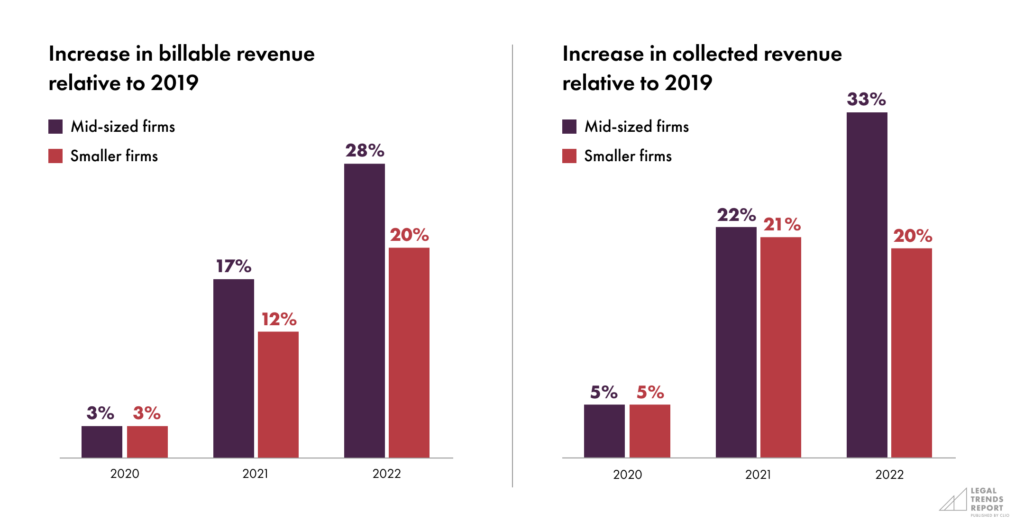

Despite only modest growth in the number of cases they take on, mid-sized firms have seen tremendous growth in billable amounts that has outpaced smaller firms over the last three years.

For example, while firms of all sizes increased their billable hours modestly between 2019 and 2020, mid-sized law firms saw their billable amounts jump by 28% between 2019 and 2022 (compared to 20% for smaller firms).

Similarly, mid-sized firms collected one-third more revenue in 2022 than in 2019, while smaller firms only collected one-fifth more.

In other words, while both mid-sized and smaller firms are billing and collecting more relative to 2019, mid-sized firms are experiencing significantly more growth in revenue than smaller firms. In fact, despite the steady increase in billables, smaller firms saw their revenue growth decline slightly in 2022.

One explanation for these results may have to do with the types of clients that smaller firms and mid-sized firms serve. Our previous research suggests that, as firm size increases, they are more likely to identify their primary clients as businesses rather than individuals.1 Therefore, mid-sized firms may be opening fewer cases due to the nature of the work they are performing for clients. Perhaps, for example, they are providing ongoing legal guidance and counsel to a number of business clients rather than primarily servicing individual clients with one-off legal issues.

Another possible explanation may be that mid-sized firms are more inclined to raise their hourly rates than smaller firms. As the following section outlines, mid-sized firms have made significant increases to their hourly rates that surpass inflation trends.

Mid-sized firms collected one-third more revenue in 2022 than in 2019, while smaller firms only collected one-fifth more.

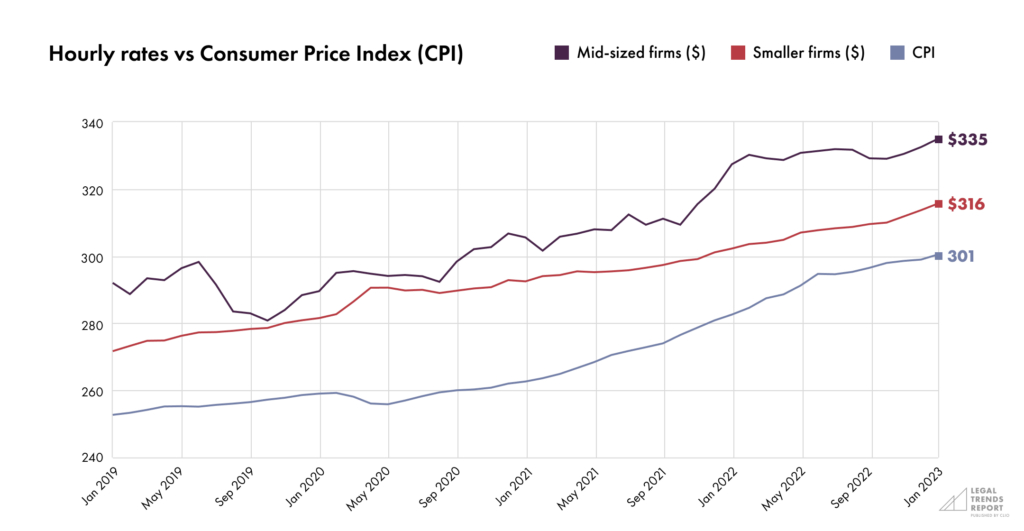

Mid-sized lawyer rates are outpacing the Consumer Price Index

The 2022 Legal Trends Report uncovered that the Consumer Price Index (CPI) had increased at a faster pace than both lawyer and non-lawyer rates, generally, since June 2021, creating challenges for law firm economics that will likely last in the coming years.

Since the beginning of 2020, both small and mid-sized firms have steadily increased their hourly rates, likely in response to the challenges of the COVID-19 pandemic and costs resulting from rising interest rates and inflation. By the end of 2020, mid-sized firms had raised their hourly rates by 6%. By the end of 2022, their rates skyrocketed to 17% while smaller firms raised their rates by 11% compared to 2019. Meanwhile, the average cost of goods and services as measured by the CPI increased by 16% during this time.

So, not only have mid-sized firms consistently outpaced smaller firms in raising their hourly rates—they’re also outpacing the CPI.

But why are lawyers in mid-sized firms’ hourly rates outpacing those seen in smaller firms?

As the 2023 Legal Trends for Solo Law Firms report outlines, many solos pride themselves on running leaner businesses with lower overhead—and, in turn, passing savings on to clients, allowing them to provide more affordable legal services. The same ethos likely applies to smaller firms, which may operate in a similar manner to solo firms, and could be influencing their hesitance to raise their hourly rates.

Mid-sized firms, on the other hand, may have higher overhead costs related to office space, support staff, and outdated technology infrastructure. Amid rising costs, mid-sized firms may have had to raise rates to cover their expenses and maintain profitability.

Another potential factor for mid-sized firms’ willingness to raise their hourly rates may involve the types of clients they serve. As discussed above, larger firms are more likely to identify their primary clients as businesses, rather than individuals. These larger clients may be less sensitive to price increases, giving mid-size firms more leeway to increase their rates. Conversely, smaller firms that primarily serve individuals may be more hesitant to raise hourly rates and impact the affordability of their services.

Finally, reputation, prestige, and marketing strategies may play a role for mid-sized firms when determining whether to raise their hourly rates. For example, mid-sized firms may have lawyers with particular specializations, expertise, or experience handling high-profile cases or otherwise complex legal matters—which may all warrant higher increases in rates. Additionally, higher rates may give a sense of prestige and specialization in the eyes of clients who are willing to pay.

Increasing rates can come with risks, however, especially among firms that primarily serve the general public. Clients have also struggled with the burdens of inflation and may find the higher cost unappealing. As a result, they might opt to handle legal issues on their own or hire a more affordable lawyer. While increasing hourly rates—and at a pace that outpaces the CPI—appears to be benefiting many mid-sized law firms, individual firms should consider a range of factors rather than simply increasing their rates for the sake of it.

Not only have mid-sized firms consistently outpaced smaller firms in raising their hourly rates—they’re also outpacing the CPI.

Is multi-state service the key to increased billable hours?

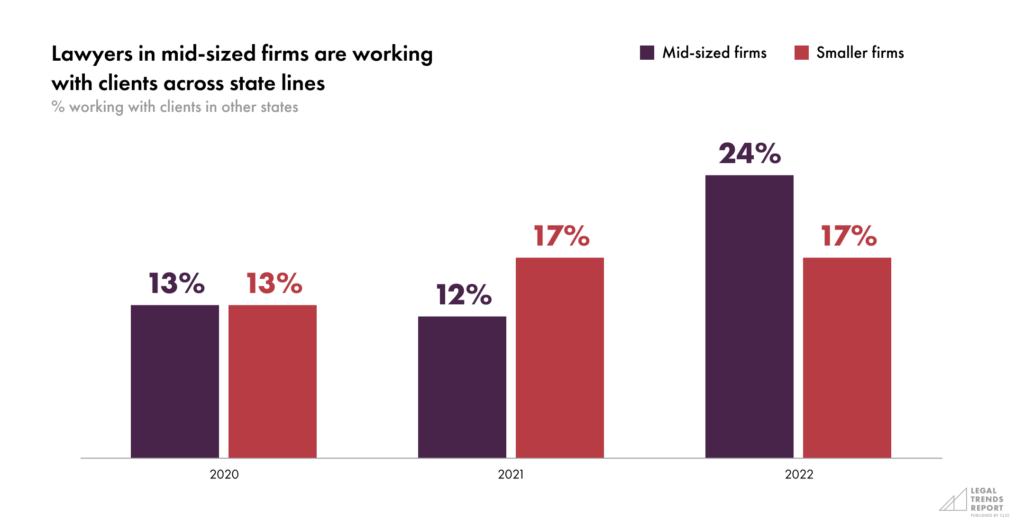

Another factor possibly impacting mid-sized firms’ higher billing and revenue? Their likelihood to work with clients in other states.

Between 2021 and 2022, the number of lawyers in mid-sized firms working with clients in other states doubled. Smaller firms have historically serviced clients in other states to a lesser extent, and the rate at which they have done so has remained stable over time.

It remains to be seen whether the jump in out-of-state work arose due to circumstances surrounding the COVID-19 pandemic or other factors. But, are the efforts to work with clients in other states paying off? Possibly.

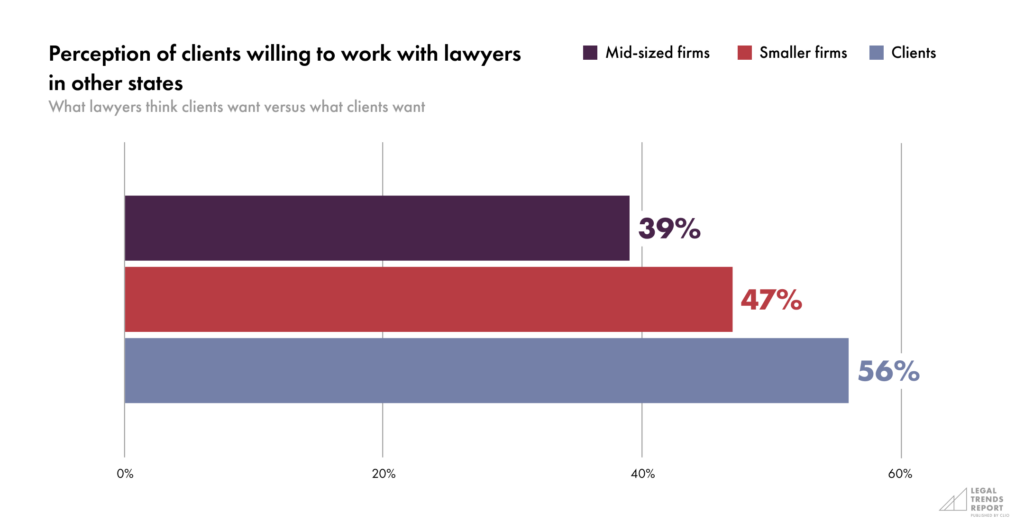

A lawyer’s location has an impact on a client’s willingness to hire them. In fact, nearly three in five members of the general public surveyed stated that they would only hire a lawyer who lives in the same state as them. While smaller firms seem to recognize this preference (47%) and are less likely to work with clients in other states, only 39% of lawyers in mid-sized firms answered the same. These perceptions may also be driving the rate at which lawyers among smaller firms and mid-sized firms choose to work with clients outside of their home state.

Between 2021 and 2022, the number of lawyers in mid-sized firms working with clients in other states doubled.

Key business metrics show lower performance among mid-sized firms

Mid-sized firms are outperforming smaller firms when it comes to billing and collection amounts. As a result, we would expect mid-sized firms to be more performance-oriented (having a mindset focused on measurable results and high levels of efficiency) than smaller firms (who often have fewer resources to invest in their business).

When we look at key business metrics, however, a different story emerges.

Key performance indicators

Key performance indicators (KPIs) provide insight into how a business is performing toward its goals. Law firms seeking to improve their revenue should pay attention to three KPIs in particular:

- Utilization rate is the number of hours put toward billable work as measured against an eight-hour workday.

- Realization rate is the proportion of billable work that gets billed to clients.

- Collection rate is the proportion of billed work that gets collected.

Each KPI significantly affects the next, and when looked at together, they show how well a business is performing in terms of its earning potential. For example, firms with a low utilization rate only put a small amount of their work hours towards billable work, which limits the number of hours that can eventually be billed and collected. Low realization and collection rates hinder a firm’s earning potential further.

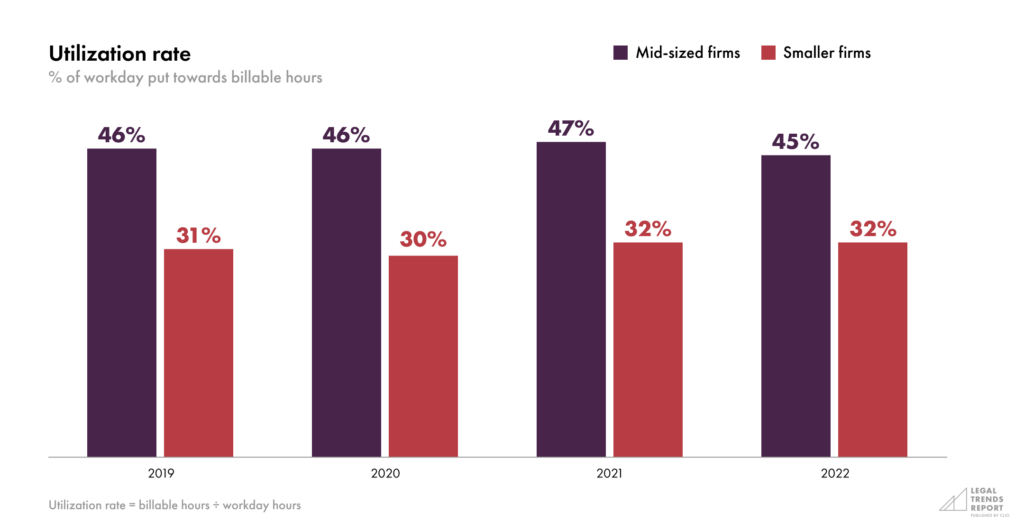

Utilization rates at mid-sized firms have dropped for the first time in years

While mid-sized firms’ utilization rates climbed slowly from 2019 to 2021, they experienced a dip (from 47% to 45%) in 2022. For comparison, smaller firms’ utilization rates remained steady at 32% between 2021 and 2022.

While the percentage differences may seem small, they can add up substantially. For example, the decrease from 47% to 46% utilization among lawyers in mid-sized firms equates to approximately five minutes per day. But, when extrapolated into annual rates, this difference amounts to 21.6 hours per year—or around $7,000 per lawyer (based on an hourly billing rate of $325). For a mid-sized firm with 21 or more lawyers, this could result in significant losses in annual law firm revenue.

While mid-sized firms still lead smaller firms in utilization rates, this drop (compared to the consistent growth in utilization rate amongst smaller firms) could mean one of two things:

- Lawyers in mid-sized firms are struggling to find time to put towards billable client work.

- Lawyers in mid-sized firms are failing to properly capture all of their billable time.

In this sense, lawyers in mid-sized firms may need to seek out improvements to productivity to ensure they are putting enough daily time towards billable work. Even minor improvements to productivity can have significant benefits over the medium-to-long term—and finding new efficiencies in a firm’s processes and workflows should open up time to focus on work that matters rather than creating more work overall.

Overall, lawyers at mid-sized firms are able to put significantly more time toward billable work, but if these shifts in utilization rates continue, this gap will only narrow further.

Even minor improvements to productivity can have significant benefits over the medium-to-long term.

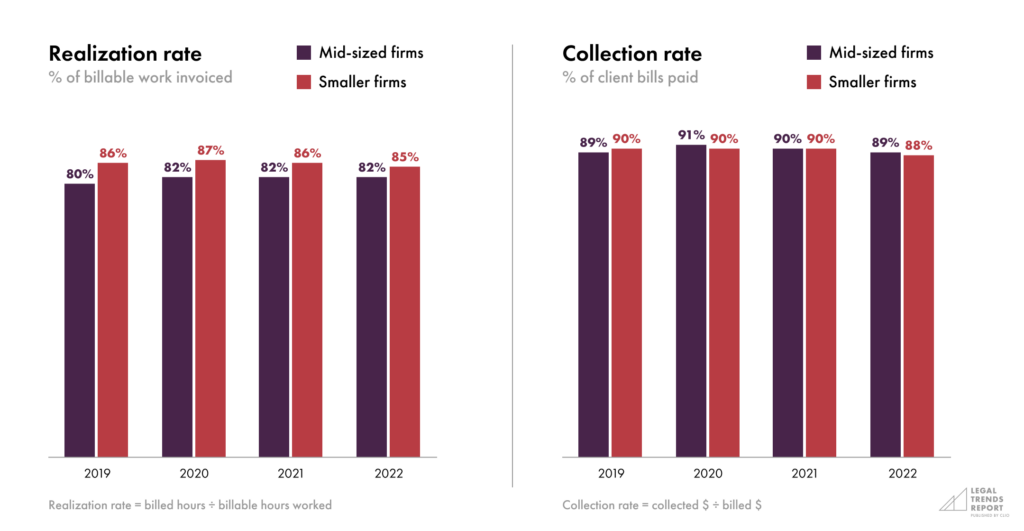

Mid-sized firms are falling behind on both realization and collection rates

Realization rates among mid-sized law firms have remained relatively high since 2019—however, they fell slightly in 2022. So, while firms were busier in terms of their average billables, they have not realized nor collected on that work as efficiently as in previous years.

Over the past four years, realization rates at mid-sized firms have trailed behind smaller firms by 4% to 6%. The good news for mid-sized firms is that this gap has narrowed over time, and mid-sized firms are getting closer to matching the realization rates enjoyed by smaller firms, which have remained relatively steady over time.

Mid-sized firms outpace smaller firms in collection rates—but not by much. Between 2019 and 2022, mid-sized firms and smaller firms have alternatively come out on top of one another with respect to the highest collection rates.

While many mid-sized firms have the advantage of dedicated staff who can focus more explicitly on billing tasks, it appears that lawyers in mid-sized firms are leaving money on the table. And, while these percentages are trending upward, lawyers in mid-sized firms may need to find more efficient ways to manage their billing and time tracking to make the most of their time and maximize their revenue.

While many mid-sized firms have the advantage of dedicated staff who can focus more explicitly on billing tasks, it appears that lawyers in mid-sized firms are leaving money on the table.

Clients want payment options, mid-sized firm clients want predictable pricing up front

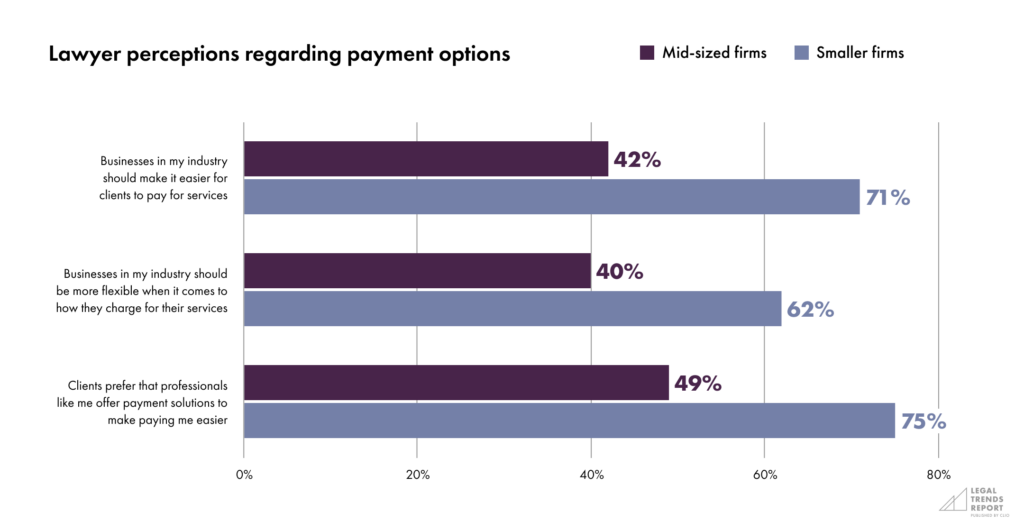

For years, legal scholars and experts have been advocating for new models of legal representation, from unbundled services to fixed fees. And, in fact, 79% of clients say they would prefer to hire a lawyer who offers payment solutions that make paying them easier.

Smaller firms are more likely to recognize this demand. While 71% of lawyers at smaller firms believe that businesses should make it easier for clients to pay for services, only 42% of lawyers in mid-sized firms agree. Lawyers at smaller firms are also more likely to believe that clients prefer that professionals offer payment solutions that make payment easier (75%, compared to 49% of lawyers in mid-sized firms).

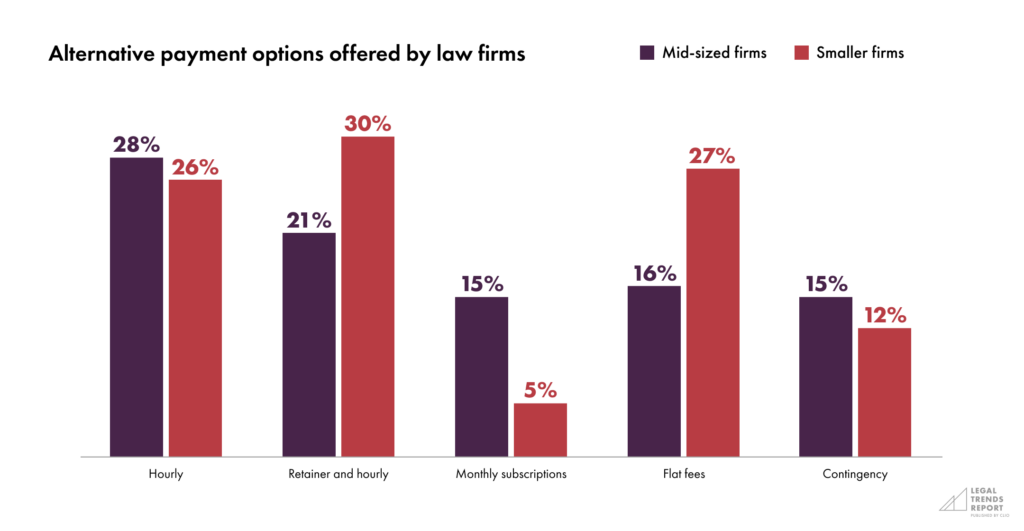

While both mid-sized and smaller firms tend to primarily offer hourly rates and retainer options, smaller firms are much more likely to offer alternative payment models such as flat fees (27%, compared to 16% of mid-sized firms), which provide an advantage in creating more ease and transparency for clients.

Interestingly, mid-sized firms are more likely than smaller firms (15%, compared to 5%) to offer monthly subscriptions for their services. Again, this could relate to the types of clients served by smaller firms versus mid-sized law firms. If mid-sized firms are often retained by businesses to provide ongoing legal guidance, they may be more likely to offer a subscription model for their services. However, by failing to provide the payment methods that general consumers want, mid-sized law firms may be missing out on opportunities to service their other clients.

Adopting payment technology can go a long way towards meeting clients’ expectations—and, beyond that, provide revenue advantages for law firms of any size.

For example, the 2022 Legal Trends Report identified that firms using cloud-based legal practice management (LPM) software were 11% more likely to report strong revenue streams than those without. Not only are these firms more likely to enjoy the profits of a successful business, but they also have more resources to invest in new capabilities and adaptations, furthering their competitiveness and innovation. As these firms continue to reap the rewards of running a successful business, they also provide a model for other firms to follow.

Software like Clio Payments makes it easy for law firms of any size to offer alternative payment methods, including payment plans and subscriptions. Further, users can create and send bills in bulk, send out automated bill reminders, manage and apply trust deposits to payments, and automate payment plans—all of which helps improve how lawyers bill and collect payments for their work while providing an exceptional client experience.

Adopting payment technology can go a long way towards meeting clients’ expectations—and, beyond that, provide revenue advantages for law firms of any size.

Aligning with client (and employee) expectations

Mid-sized law firms are performing comparatively well, especially when it comes to billing and collections. However, in the interests of continuing this success, we’ve also identified areas where mid-sized law firms would benefit from improvement—in particular, their declining utilization and collection rates.

The following sections will take a closer look at how lawyers in mid-sized firms prefer to work, how firms are set up to accommodate these preferences, and how these systems affect staff retention. These findings provide insight into the challenges lawyers in mid-sized firms face in charting their career paths and balancing priorities between work and their personal lives.

By better understanding these trends, owners and managers in mid-sized firms can better plan their operations in a way that better suits how today’s lawyers prefer to work.

[1] Clio 2018 Consumer Survey Demographics (unpublished).

2023

Legal Trends for Mid-Sized Law Firms

Part 2

Lawyers are making moves

- Introduction. What distinguishes mid-sized lawyers?

- Part 1. The shrinking performance gap

- Part 2. Lawyers are making moves

- Part 3. When work happens

- Part 4. The power of the cloud

- Appendix A. App data collection

- Appendix B. Survey design

Many lawyers in mid-sized firms report having started new roles within the 12 months prior to April and May 2022. While these shifts appear to be attributable to dissatisfaction with firms, managers, and coworkers, we also see that many lawyers have moved on to become firm partners and owners, suggesting that a lack of career advancement or partnership opportunities may be a driving factor for this movement.

Perhaps more concerningly, we also see that lawyers in mid-sized firms are faring worse than smaller firms on nearly all fronts relating to happiness in their personal and professional lives. To slow attrition in mid-sized law firms, owners and managers should consider steps for fostering a positive and inclusive environment and providing opportunities for career advancement to ensure they are retaining talented employees.

Over one-third of lawyers in mid-sized firms switched jobs

The 2022 Legal Trends Report highlighted a significant trend wherein numerous legal professionals left or were contemplating leaving their positions with their current law firm that year. This trend aligned with the “Great Resignation,” a phrase used to describe the substantial number of workers who were either switching jobs or leaving the workforce during that period.

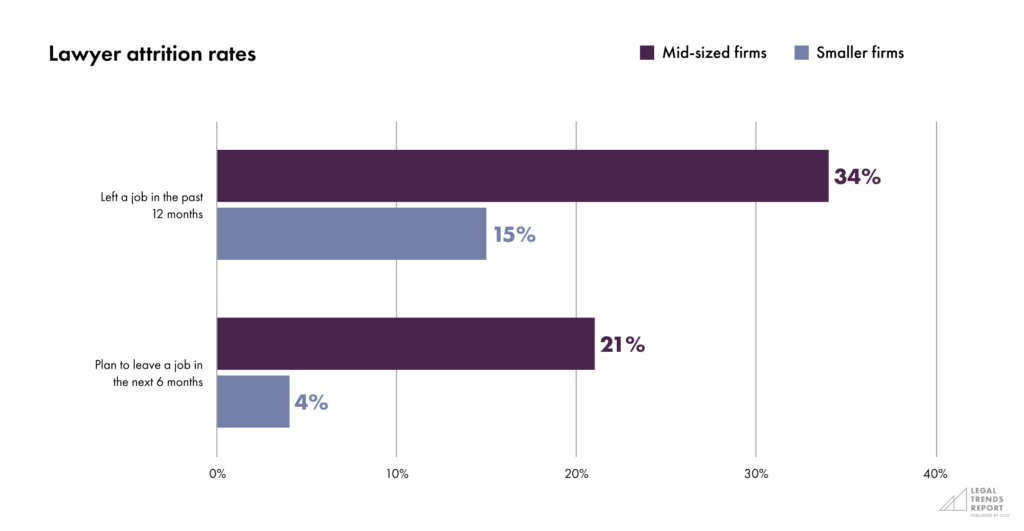

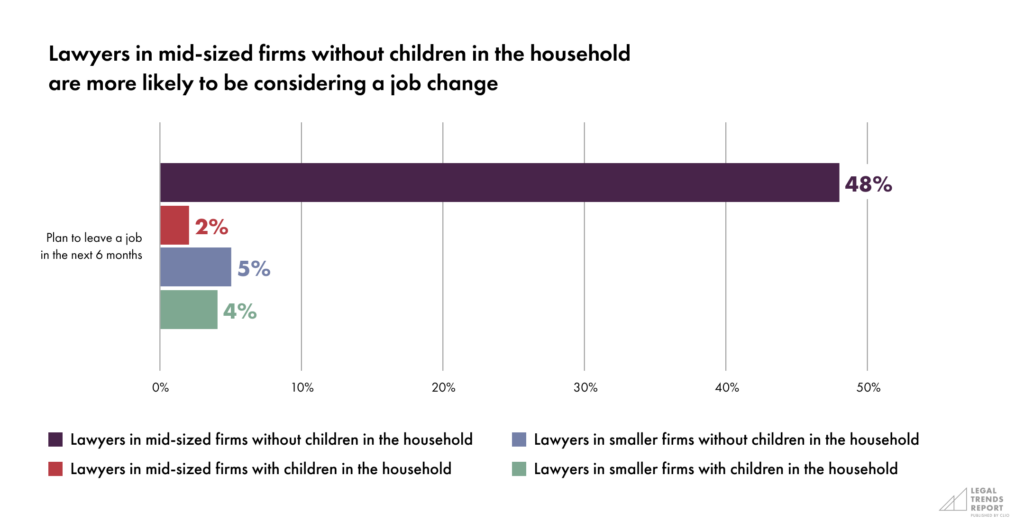

Mid-sized firms have been significantly affected by these trends. In fact, lawyers working in mid-sized law firms were more than twice as likely to have reported leaving a job in the 12 months leading up to April and May 2022 than lawyers in smaller firms. They were also over five times more likely to be planning to leave a job in the next six months.

Lawyers working in mid-sized law firms were more than twice as likely to have reported leaving a job in the 12 months leading up to April and May 2022 than lawyers in smaller firms.

Dissatisfaction with firms, managers, and colleagues drives movement among lawyers in mid-sized firms

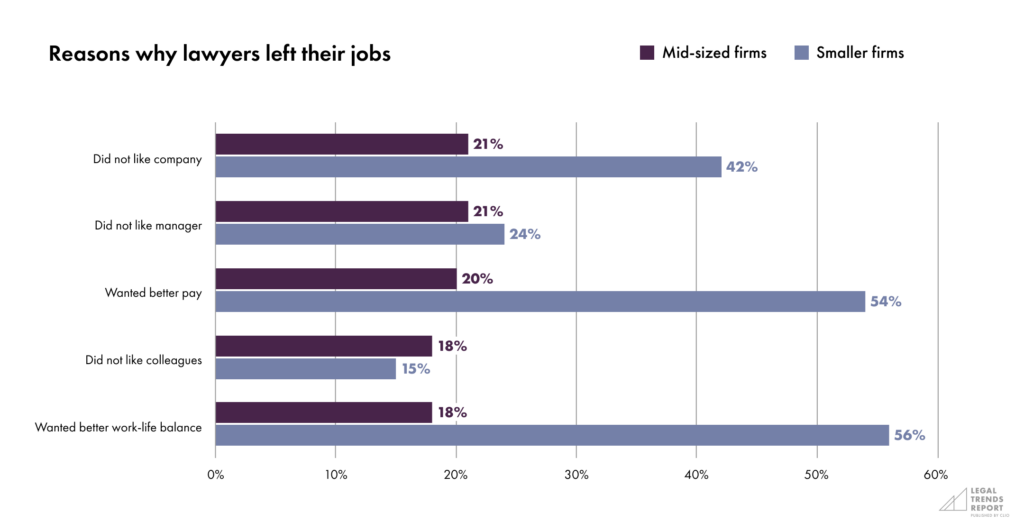

According to the 2022 Legal Trends Report, which examined data from lawyers working at firms of all sizes, better pay and work-life balance emerged as the primary factors motivating lawyers to either leave or consider leaving their roles.

However, lawyers in mid-sized firms report leaving their roles for slightly different reasons. Lawyers in this cohort quit their jobs because they disliked their firm or manager or disliked their colleagues. While this problem is not unique to lawyers in mid-sized firms, the issue is more prevalent among them than firms with fewer lawyers. On the other hand, lawyers in smaller firms are more likely to cite better pay and work-life balance as primary factors for leaving their roles, in addition to not liking the firm they worked for.

For lawyers in mid-sized firms, a disproportionate dislike of their firms, managers, or colleagues as primary reasons for leaving their positions isn’t necessarily surprising. As firm size increases, so too does the increase in interpersonal interactions and potential for conflict. Furthermore, larger firms may be more likely to have complex organizational structures, entrenched policies, and cumbersome procedures than smaller firms and less flexibility in their workday.

For mid-sized firms that are experiencing challenges in retaining employees, looking inward may help determine whether internal relationships and processes are affecting retention. For example, retention issues relating to dissatisfaction with firms, managers, or colleagues can arise when there are insufficient opportunities for professional growth, a lack of teamwork, or ineffective communication.

Fostering a positive and inclusive work environment, nurturing employee relationships, and providing opportunities for career advancement will be instrumental in addressing these concerns and retaining talented employees.

Lawyers in this cohort quit their jobs because they disliked their firm or manager or disliked their colleagues. While this problem is not unique to lawyers in mid-sized firms, the issue is more prevalent among them than firms with fewer lawyers.

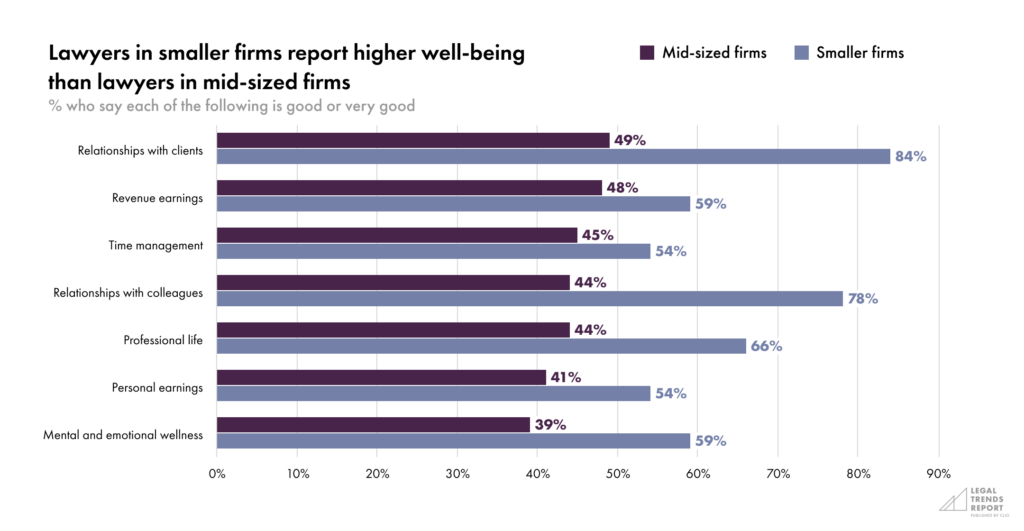

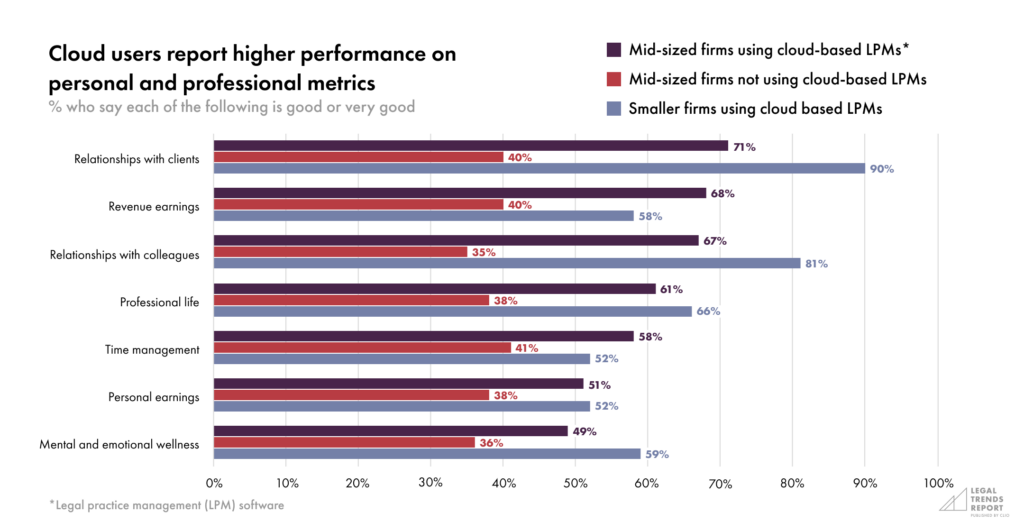

Smaller firms outpace mid-sized firms in well-being

When comparing how legal professionals feel about key areas of their personal and professional lives, we see a stark difference between mid-sized firms and smaller firms. Across all metrics, lawyers in smaller firms report higher states of well-being than those in mid-sized firms.

These differences become especially pronounced with respect to satisfaction in their professional lives and relationships with colleagues and clients. These trends also provide insight into the substantial attrition rates discussed above.

Lawyers in mid-sized firms are also less satisfied with their time management and revenue earnings for their company which, as we discussed in Part 1, could be driven by a lack of suitable technology to streamline tasks and bill effectively.

Lawyers in mid-sized firms are also less satisfied with their time management and revenue earnings for their company.

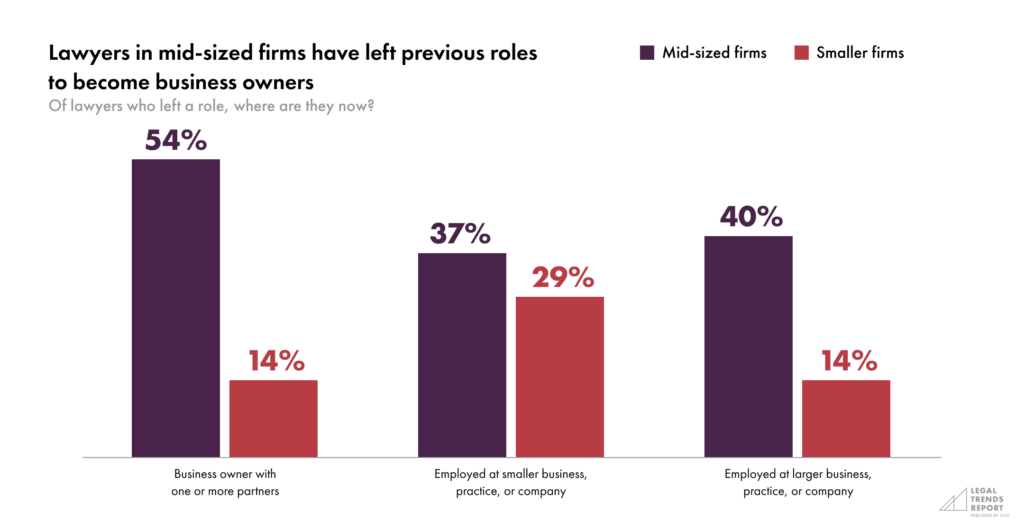

Lawyers from mid-sized firms are seeking ownership opportunities elsewhere

When compared to smaller firms, lawyers in mid-sized law firms reported that they were more likely to have left their previous firm to work at a larger firm or to become a business owner at a mid-sized firm. Lawyers in smaller firms, on the other hand, were much more likely to leave their positions to become a solo business owner.

Given that many lawyers are moving into ownership roles at mid-sized firms, frustrating hierarchies and the lack of partnership options may play a key role in lawyer attrition rates.

For example, lawyers in mid-sized firms may be dissatisfied with advancement options, such as their ability to “make partner” or the timing in which they will become eligible to join a partnership. Rather than waiting for their time to come, they may be leaving to join firms that offer them the ownership options they’re looking for.

Given that many lawyers are moving into ownership roles at mid-sized firms, frustrating hierarchies and the lack of partnership options may play a key role in lawyer attrition rates.

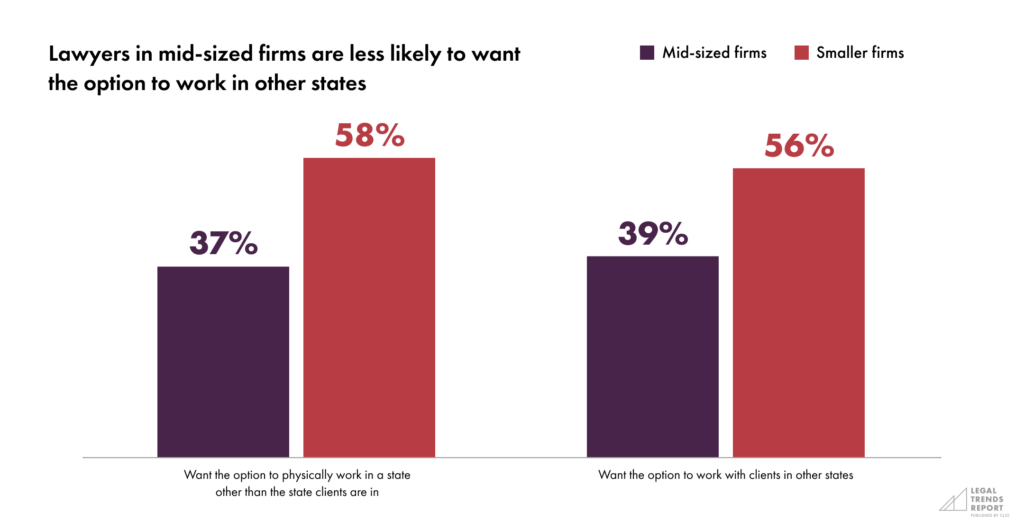

Lawyers in mid-sized firms aren’t moving (physically)

While lawyers in mid-sized firms report having switched jobs at a higher rate than those in smaller firms, they aren’t leaving their home state.

Historically, lawyers in mid-sized firms are more likely to stay within one state than those in smaller firms. Over the last 10 years, only 13% of lawyers in mid-sized firms moved to a new state, compared to 25% of lawyers in smaller firms.

These results align with lawyers in mid-sized firms’ preferences on how they work. Only 37% of lawyers in mid-sized firms want the option to physically work in a state other than the one their clients are in (compared to 58% in smaller firms), while 39% want the option to work with clients who have needs in states other than the one the lawyer is licensed in (compared to 56% in smaller firms).

These results could be due to a number of factors, including firm or client expectations, connections to personal networks, or personal circumstances. However, the ability to work in another state by virtue of technology adoption is another factor that cannot be overlooked.

As we’ll discuss further in Part 4, mid-sized law firms have fallen far behind smaller firms in their technology. So, for lawyers in mid-sized firms, their ability to move to another state may not be impacted so much by preference as by limitations.

Legal work has gone virtual, and cloud-based technology has both enabled and influenced the ability to work remotely from more than one location—while also opening opportunities to work outside of one’s immediate market. Being able to work remotely with clients also allows lawyers the freedom to move or travel while maintaining continuity with clients.

Being able to work remotely with clients also allows lawyers the freedom to move or travel while maintaining continuity with clients.

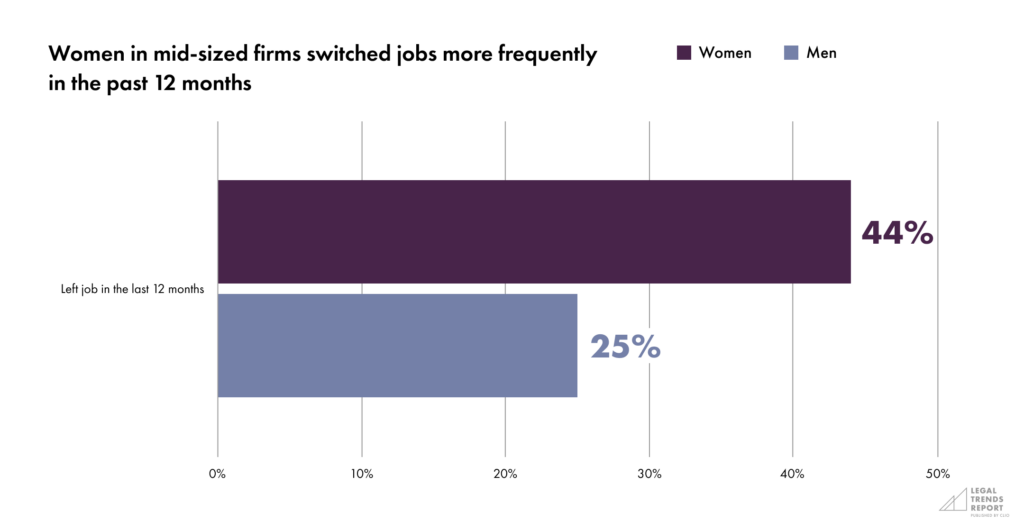

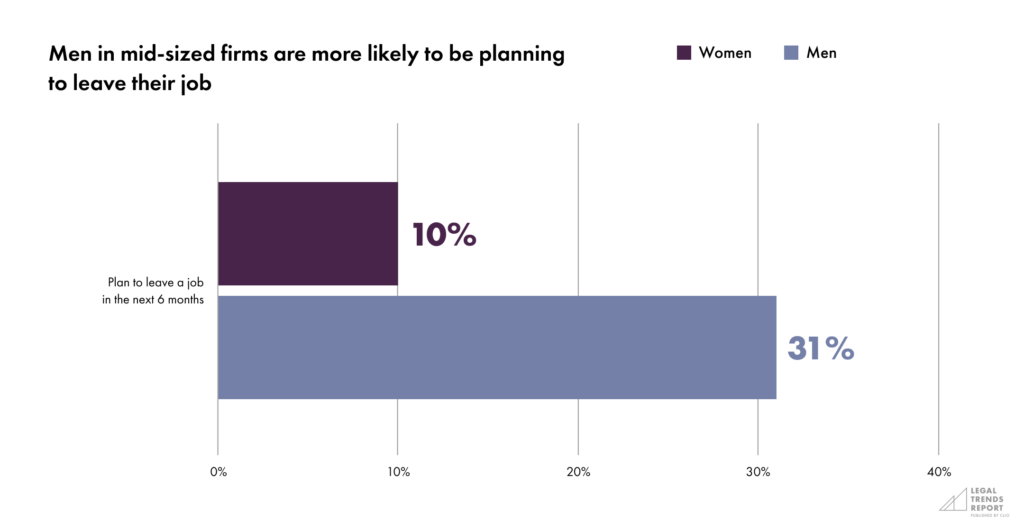

Female lawyers switched jobs more frequently in the past 12 months

Our research also uncovered an interesting pattern: among lawyers in mid-sized firms, women were significantly more likely to have left a job in the past year than their male counterparts (44% as opposed to 25% of men).

For female lawyers in particular, limited advancement opportunities may be a key motivating factor for leaving their employers. As noted by McKinsey & Company’s 2022 Women in the Workplace survey2, women left companies at unprecedented rates in 2022, likely due to headwinds against advancement coupled with lack of recognition for their work.

While women were more likely to have left a job in the past year, they were less likely to report planning a career move in the next six months than their male counterparts. Only 10% of female lawyers surveyed plan to leave their job in the next six months, while 31% of male lawyers are planning to leave their job in the next six months.

However, among women and men in mid-sized law firms, the presence of children in the household impacted whether they were thinking about leaving a job. Almost half of all lawyers in mid-sized firms who did not have children have considered leaving their jobs. In comparison, no more than 5% of lawyers with kids and those at smaller firms have considered leaving their firms.

Within smaller firms, the presence of children in the home did not have a significant impact on whether they were planning to leave their jobs. This difference may relate to the flexibility enjoyed by those working in smaller firms, which we’ll explore more in-depth in the next section.

Women left companies at unprecedented rates in 2022, likely due to headwinds against advancement coupled with lack of recognition for their work.

[2] McKinsey & Company and LeanIn.org, “Women in the Workplace | 2022.” Women in the Workplace. 2022. https://womenintheworkplace.com

2023

Legal Trends for Mid-Sized Law Firms

Part 3

When work happens

- Introduction. What distinguishes mid-sized lawyers?

- Part 1. The shrinking performance gap

- Part 2. Lawyers are making moves

- Part 3. When work happens

- Part 4. The power of the cloud

- Appendix A. App data collection

- Appendix B. Survey design

In Part 1, we saw that lawyers in mid-sized firms have enjoyed increased billable amounts and collected revenue when compared to 2019—but they have also underperformed in several other key areas. We’ve also seen that lawyers in mid-sized firms reported leaving their previous jobs at an alarming rate due to dissatisfaction with their firms, managers, and colleagues (possibly driven by a lack of advancement opportunities) in Part 2.

As we’ll explore in this section, lawyers in mid-sized firms are finding better work-life balance than those in smaller firms in terms of their total number of hours worked—but they aren’t necessarily working during the time of day that they want to be. We also see some resistance to remote work and flexible schedules among lawyers in mid-sized firms—but whether this resistance is due to disinterest or an inability to work remotely or flexibly remains to be seen. Whatever the reason, this resistance to remote or flexible work is at odds with modern client expectations.

Lawyers in mid-sized firms are working less than smaller firms (but not when they want to be)

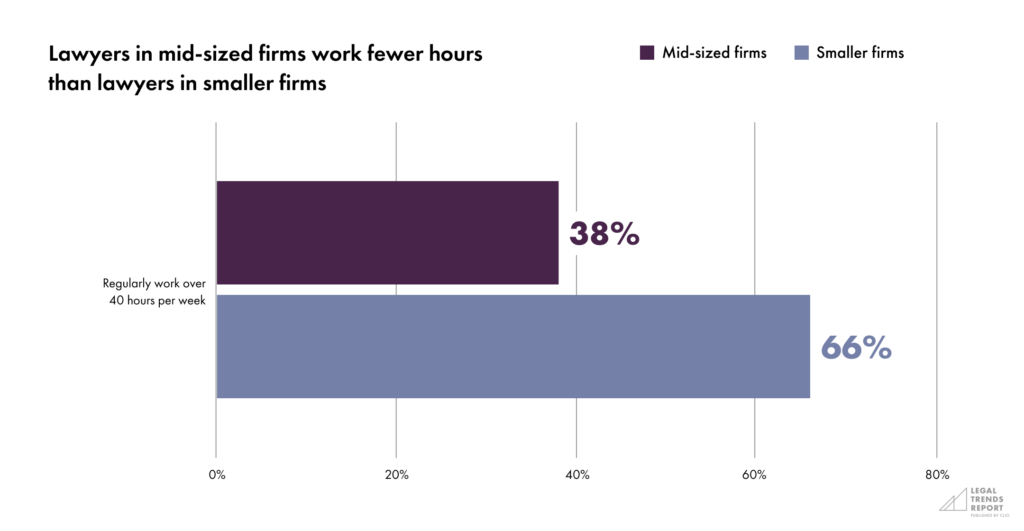

Lawyers in mid-sized firms tend to work less than lawyers at smaller firms. Only 38% of lawyers in mid-sized firms reported regularly working over 40 hours per week, compared to 66% of lawyers at smaller firms.

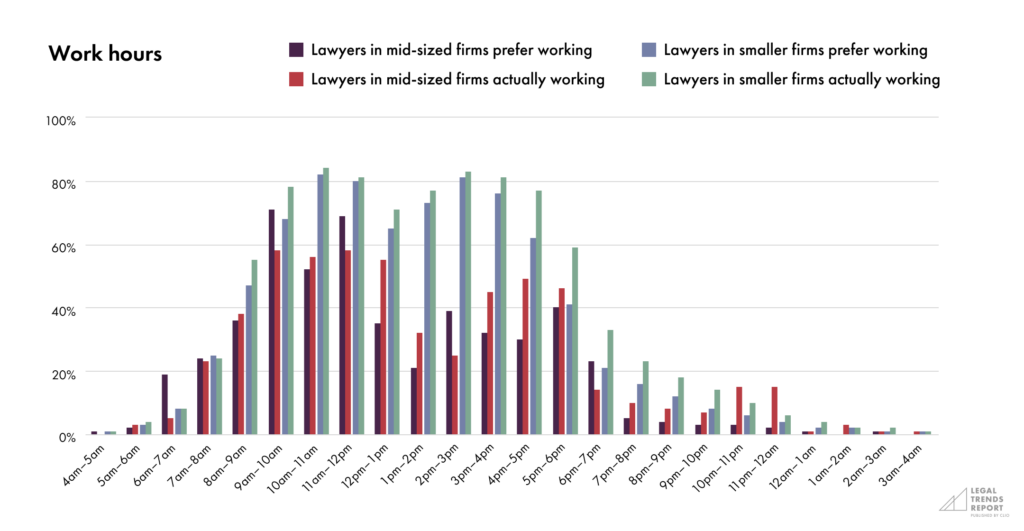

But despite working fewer hours, lawyers in mid-sized firms aren’t working when they want to be. Overall, lawyers in mid-sized firms prefer to work between the hours of 9am and 5pm. However, the data suggests that many lawyers in mid-sized firms are working beyond 5pm—and through their lunch breaks. Specifically, more lawyers in mid-sized firms are working between 12pm and 1pm and between 4pm and 5pm more than they would prefer.

Unfortunately, 15% of lawyers in mid-sized firms reported that they work late into the night—between 10pm and 12am—despite the fact that virtually no one wants to work these hours. And, while lawyers in smaller firms are working between 9am to 5pm and beyond, they also reported working late into the night less frequently.

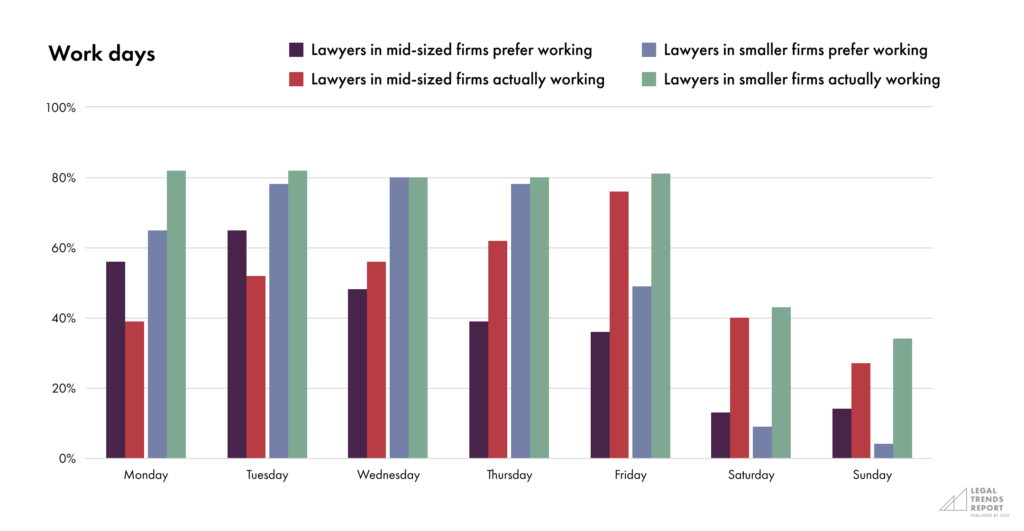

Lawyers in mid-sized firms are also more likely than those in smaller firms to prefer working Monday to Friday, with a greater preference to work earlier in the workweek than later in the week.

The reality, however, is that the vast majority of lawyers in mid-sized firms work Fridays, and many end up working Saturdays and Sundays. However, only 39% actually work Mondays, perhaps to make up for having to work through the weekend.

Lawyers in mid-sized firms aren’t working when they want to be.

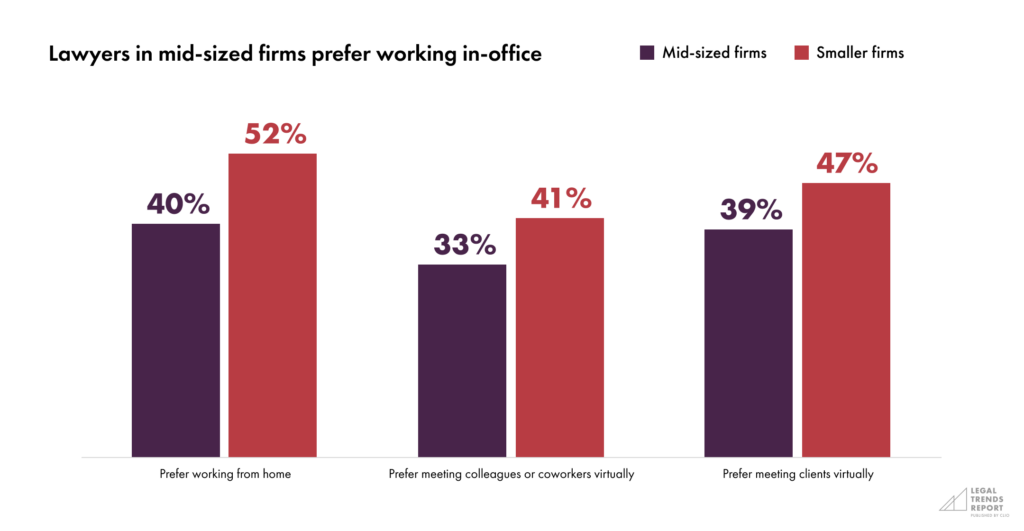

Lawyers in mid-sized firms want to work in-office

A key finding in the 2022 Legal Trends Report is that office use has declined among legal professionals. On average, they spend fewer days in the office, and fewer lawyers work exclusively from one. Despite this decline in office use, lawyers in mid-sized firms appear to still prefer working in the office.

On all fronts, lawyers in mid-sized firms are less likely to prefer remote work than those in smaller firms. Specifically, lawyers in mid-sized firms are less likely to prefer working at home, meeting with colleagues or coworkers virtually, or meeting with clients virtually.

While working in an office may be a personal preference for some, for others—especially among those in mid-sized law firms—it could be necessary for practical reasons. For example, an office may serve as a central location for workers in mid-sized firms to collaborate or socialize. Mid-sized firms that have invested heavily in their office space and infrastructure may also be seeking a return on their investment. Junior lawyers in the firm may also be keen to make a good impression and to be seen by more senior partners, since their advancement may be influenced by in-person interactions as well as individual performance.

Whether lawyers in mid-sized firms are resisting remote work due to personal preferences or expectations in their workplace, it’s important not to lose sight of the importance of flexibility. Even if the majority of lawyers in mid-sized firms don’t prefer remote work, having the ability to adapt work schedules has many benefits, especially when accounting for personal conflicts or unforeseen circumstances that can take lawyers away from their work during the day.

Lawyers in mid-sized firms are less likely to prefer working at home, meeting with colleagues or coworkers virtually, or meeting with clients virtually.

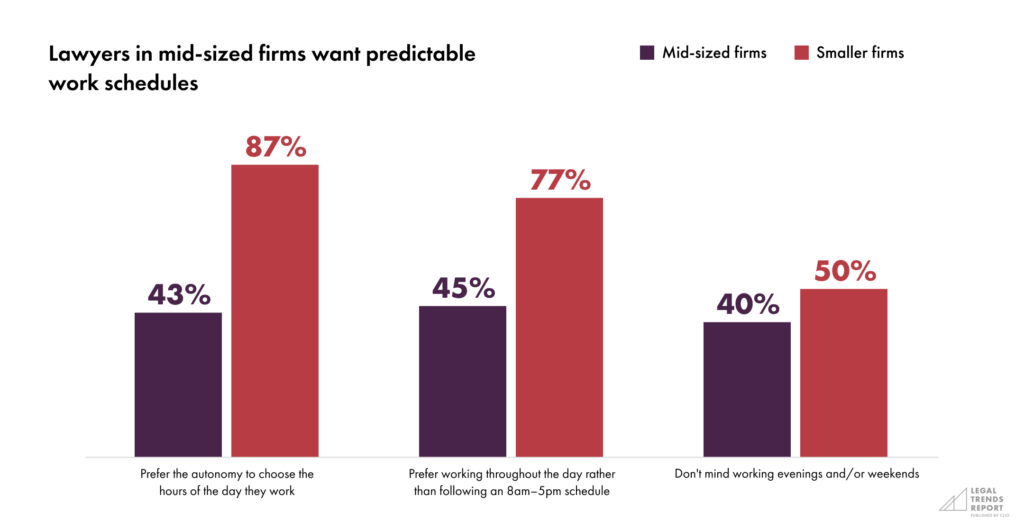

Lawyers in mid-sized firms want predictable work schedules

As noted above, lawyers in mid-sized firms prefer to work between 9am and 5pm. They are also less likely to want the autonomy to choose their own work schedule, and they are less likely to prefer to work whenever they want. They also show no preference for working evenings and weekends.

It may seem surprising that lawyers in mid-sized firms aren’t seeking autonomy to choose their own hours. However, the data suggests that they aren’t prioritizing autonomy and, instead, prefer routine and predictability (as in, they would prefer to work within a set period of time during the day—and those being traditional office hours).

These preferences may align with the experience of working in mid-sized law firms, which in many cases may be more established within their communities or practice areas and come with less motivation to “wow” clients by providing flexible meeting options.

Furthermore, some mid-sized firms may be more likely to work with business clients or handle complex matters involving multiple stakeholders, where flexible meeting options may not necessarily be a selling point. For smaller firms that service individual clients, on the other hand, offering to meet outside of traditional office hours can help set their practices apart while providing a client-centered experience.

Regardless of why lawyers in mid-sized firms prioritize routine and predictability, at the end of the day, understanding client preferences can go a long way in both attracting new clients and retaining existing ones.

The data suggests that lawyers in mid-sized firms aren’t prioritizing autonomy and instead prefer routine and predictability (as in, they would prefer to work within a set period of time during the day—traditional office hours).

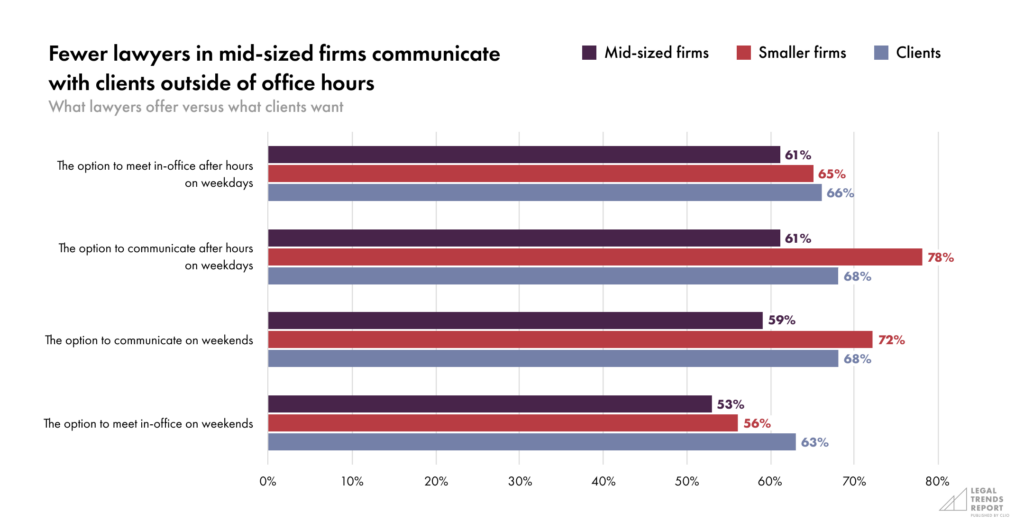

What do clients want?

Interestingly, even though lawyers in mid-sized firms are less likely to prefer virtual meetings with clients, they are more likely to know that clients prefer working with lawyers virtually (41% of lawyers at mid-sized firms compared to 34% of those in smaller firms).

The problem? Many lawyers in mid-sized firms aren’t providing the experience their clients expect. According to the 2022 Legal Trends Report, 25% more clients (35% compared to 28%) prefer virtual meetings over in-person meetings—and the rest indicated no strong preference either way, meaning they’re adaptable.

There may be many reasons why lawyers in mid-sized firms are less likely to want to meet with clients virtually. For one, in larger organizations with many moving parts, some workers may be more comfortable or productive in a face-to-face environment, especially when it comes to working in conjunction with different team members or departments.

Another reason may stem from the fact that mid-sized law firms are much less likely to use cloud-based LPM software than their smaller firm counterparts, and thus lack the flexibility of working seamlessly from anywhere and at any time. This begs the question of whether lawyers in mid-sized firms’ hesitance to work remotely stems from a lack of suitable resources for remote work.

Lawyers in mid-sized firms who use cloud-based LPM software are more likely to prefer working from home and are more likely to want the option to physically work in a different state than their clients. They’re also more open to meeting remotely with clients—suggesting that cloud technology adoption may help mid-sized firms provide the experience their clients have come to expect.

There are also benefits to using cloud-based LPM software when it comes to offering alternative payment models. Programs like Clio Payments, for example, allow firms to easily set up automatic payments and offer alternative payment models to better meet modern clients’ expectations and help firms get paid faster.

Many lawyers in mid-sized firms aren’t providing the experience their clients expect.

Balancing firm expectations and lawyer satisfaction

Clearly, there is work to be done in mid-sized law firms. With lower performance in key business indicators and greater personal and professional dissatisfaction among their lawyers, mid-sized firms need to identify effective ways to balance their infrastructure and expectations with the needs of their employees.

As the following section demonstrates, cloud-based technologies offer efficiencies and automations that improve firm performance—and lawyer satisfaction rates.

2023

Legal Trends for Mid-Sized Law Firms

Part 4

The power of the cloud

- Introduction. What distinguishes mid-sized lawyers?

- Part 1. The shrinking performance gap

- Part 2. Lawyers are making moves

- Part 3. When work happens

- Part 4. The power of the cloud

- Appendix A. App data collection

- Appendix B. Survey design

Technology is evolving quickly, and many mid-sized firms have fallen behind—missing out on opportunities to not only serve clients better but increase employee satisfaction. As smaller firms continue to embrace legal technology, and are perhaps in a better position to adopt it, mid-sized law firms will need to find opportunities to adopt cloud technology and navigate change management within their organizations.

Mid-sized firms are falling behind on cloud technology adoption

Mid-sized firms are falling behind in cloud technology adoption: only 27% reported using cloud-based LPM software compared to 73% of smaller firms. They are also less likely to use online solutions for video conferencing, electronic payments, e-signatures, and cloud-based data storage.

Adopting new technologies can help mid-sized firms provide their clients with the types of services—such as alternative payment methods and remote or flexible communication options—they’ve come to expect, while helping lawyers in mid-sized firms manage their time more effectively.

As discussed in Part 1, 79% of law firm clients want options that make payments easier, yet only 21% of mid-sized law firms use online or electronic payments tools. Here, we see a substantial opportunity for mid-sized law firms to bolster their abilities and remain competitive. Dedicated legal payments software, like Clio Payments, helps firms increase their capacity to not only offer alternative payment arrangements for their clients but also improve their collections rates and efficiency.

Clio Payments, a feature of Clio Manage, allows firms to speed up billing with custom bills that can be created in minutes and makes it easy for clients to pay using various payment methods, including credit, debit, eCheck, or automated payment plans.

These capabilities not only provide mid-sized law firm clients with the payment options they’ve come to expect but also help firms manage billing and payment collection seamlessly, which can contribute to stronger realization and collection rates.

Additionally, harnessing the power of cloud-based LPM software helps lawyers save time on routine tasks, allowing them to focus on work that truly matters. Whether focusing on complex legal matters or finding efficiencies that help them to bill more, practice management solutions like Clio Manage help organize firm information and processes to increase efficiency while enabling the ability to work from anywhere, at any time.

Adopting new technologies can help mid-sized firms provide their clients with the options they’ve come to expect, such as alternative payment methods, and remote or flexible communication options while helping lawyers in mid-sized firms manage their time more effectively.

Cloud lawyers are happier lawyers

As discussed above, lawyers in smaller firms are generally happier with their professional life, emotional wellness, and relationships than lawyers in mid-sized firms. However, not all is lost. In fact, among mid-sized firms, lawyers using cloud-based LPM software report significantly higher performance on all professional and personal metrics that match the satisfaction levels of lawyers in smaller firms.

This data is especially important when taking into consideration the scope of the job movement discussed in Part 2. With so many lawyers leaving their previous roles because they didn’t enjoy the firms, nor the people they worked with, cloud technology stands to substantially improve their work conditions, giving legal professionals less reason to leave their jobs.

For example, 67% of lawyers in mid-sized firms using cloud-based LPM software reported that their relationships with colleagues were good or very good (compared to 35% of lawyers in mid-sized firms not using cloud-based LPM software). Meanwhile, 71% of lawyers in mid-sized firms using cloud-based LPM software reported that their relationships with clients were good or very good (compared to 40% of those not using cloud-based LPM software).

Among mid-sized firms, lawyers using cloud-based LPM software report significantly higher performance on all professional and personal metrics that match the satisfaction levels of lawyers in smaller firms.

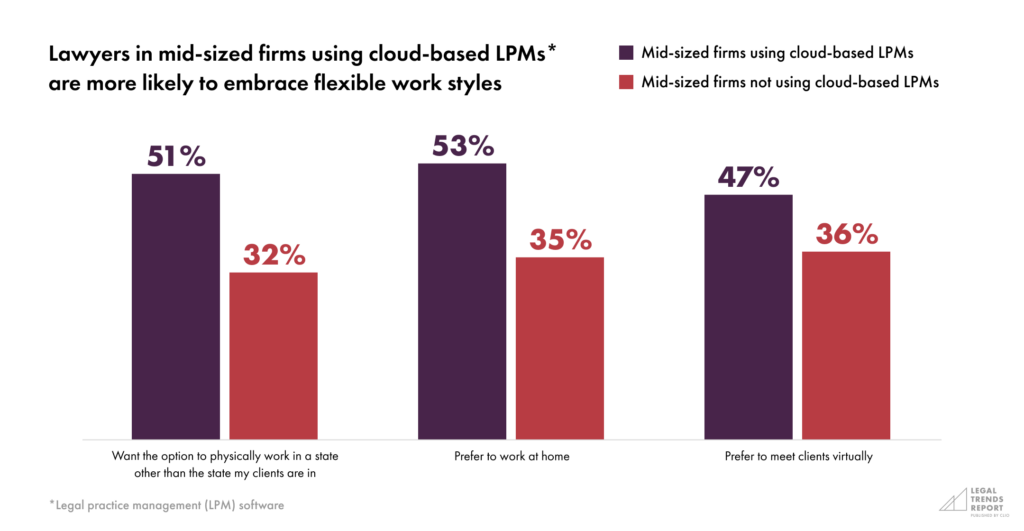

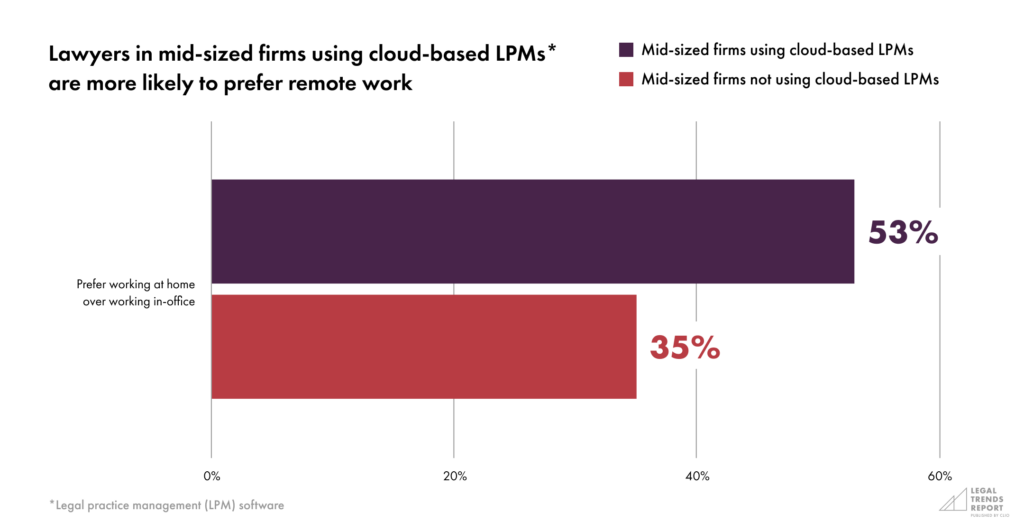

Lawyers in mid-sized firms using cloud technology prefer remote work more than those without

When it comes to where lawyers in mid-sized firms prefer to work, we see that 53% of lawyers in mid-sized firms who use cloud-based LPM software prefer working at home over going into the office (compared to 35% of lawyers in mid-sized firms who do not use cloud-based LPM software).

In this sense, cloud-based LPM software could be a key factor influencing lawyer preferences relating to remote work. As suggested in Part 2, it may be that lawyers in mid-sized firms aren’t necessarily eschewing remote work due to personal preference. Instead, their capacity to embrace remote work may be influenced by the technology available within their firms.

Cloud-based LPM software could be a key factor influencing lawyer preferences relating to remote work.

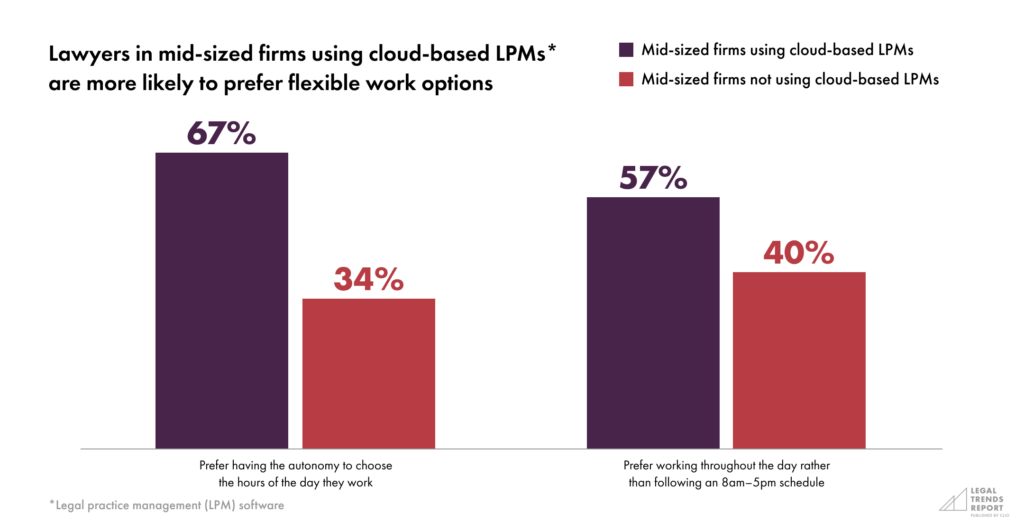

The cloud enables more flexible work styles

Among lawyers at mid-sized firms, 67% of those using cloud-based LPM software want the autonomy to choose their hours (compared to 34% of those not using cloud-based LPM software), and 57% prefer to work throughout the day (not just between 8am and 5pm), compared to 40% of those not using cloud-based LPM software.

Again, we see a stark difference between the working preferences of lawyers in mid-sized firms using cloud technology and those going without (discussed in Part 2), suggesting that the availability of technology that allows for remote work could be a driving factor for lawyer preferences.

Promoting flexibility in remote work and working arrangements through technology adoption not only provides mid-sized firms and their employees with balance in both their personal and professional lives—it may also encourage lawyers in mid-sized firms to adopt working styles that fall closer in line with the expectations of modern clients. By providing tools to work more flexibly, firms can encourage lawyers to adopt more distributed approaches to their practice, increase their willingness to meet with clients remotely (or after hours), and, ultimately, provide more competitive client experiences.

We see a stark difference between the working preferences of lawyers in mid-sized firms using cloud technology and those going without.

Future innovation of mid-sized practice

So, what does the future of innovation for mid-sized firms look like?

Three focus areas for mid-sized law firms include:

- Prioritizing employee satisfaction. While lawyers in mid-sized law firms report that they are generally happier with their compensation and work-life balance, dissatisfaction with their firm, managers, and colleagues has driven some to leave firms for better opportunities. Lack of advancement or ownership options appears to be a relevant factor in these decisions. For mid-sized firms that struggle to retain talent, assessing internal relationships and structures is critical for identifying causes of dissatisfaction.

- Aligning with client preferences. Many mid-sized firms don’t offer experiences that align with client preferences, particularly with respect to lawyer availability and payment options. To remain competitive, mid-sized firms (especially those who serve the general public) must identify and implement the capabilities that are more attuned to what clients want. A critical element here is leveraging technology that provides online payment processing options and alternative payment models (such as Clio Payments) and making themselves available to meet clients where they’re at (whether virtually, outside of traditional office hours, or both).

- Upgrading practice management systems. Investing in cloud technologies can help realize significant short-term gains that will only pay off exponentially over the longer term. For any mid-sized law firms not using cloud-based technology, solutions like Clio Manage (and, within Clio Manage, Clio Payments’ online payments features) will help improve client payment experiences and organize firm information and processes—leading to increased efficiency, performance, and satisfaction among lawyers.

Change management opportunities for mid-sized firms

Moving to the cloud has obvious benefits for mid-sized law firms—and, with one in four mid-sized firms already using cloud-based LPM software, adopting this technology is no longer a new frontier.

To successfully navigate change in a larger organization, mid-sized firms should pay attention to several factors:

- Prioritization: As mid-sized firms tend to have larger, more complex organizational structures than smaller firms (often including multiple practice areas, departments, and offices spread across different locations or states), conduct a thorough assessment of existing systems to distinguish essential upgrades from the “nice to haves” and prioritize accordingly. In some cases, it may be appropriate to implement change management in a multi-stage approach to create a more gradual transition.

- Embracing change: Given the range of stakeholders working together in most mid-sized law firms, it’s natural to expect some level of resistance to change. Some may be apprehensive of the unknowns or have concerns about disrupting existing work processes and client relationships. Overcoming this resistance necessitates a thoughtful and inclusive approach. Consider forming a “technology committee” with representation from different roles and departments. This will help surface hesitations early on and help others champion change when it comes time to roll out new software. Embracing change is much easier when you aren’t going at it alone.

- Modernizing legacy systems: Mid-sized law firms often operate with complex infrastructure and well-established IT systems, which can impede the adoption of new technologies and upgrades. Integrating new solutions and evolving existing systems can require time and effort. The good news? You’re not the first firm to make the switch! Tap your network of friends, bar associations, and consultants to learn how they’ve addressed similar changes. Software providers also have expertise that should not be ignored, as they’ve helped numerous firms move away from legacy systems. Use these insights to build a roadmap that works for everyone at your firm.

By addressing these challenges with proactive strategies and fostering a positive mindset, mid-sized firms can navigate the change management process successfully and unlock new opportunities for growth and efficiency.

With one in four mid-sized firms already using cloud-based LPM software, adopting this technology is no longer a new frontier.

Redefining the mid-sized law firm experience

Mid-sized law firms are billing and collecting more than ever, and have undergone tremendous growth over the past two years. At the same time, some may be struggling to bolster lawyer satisfaction and meet the needs of modern clients. Technology offers a powerful path forward for mid-sized firms seeking to overcome these challenges. By making the space to welcome innovation in their firms, they will continue to see expansive growth and shape the practice of law in ways that benefit themselves, their profession, and their clients.

2023

Legal Trends for Mid-Sized Law Firms

Appendix A

App data collection

- Introduction. What distinguishes mid-sized lawyers?

- Part 1. The shrinking performance gap

- Part 2. Lawyers are making moves

- Part 3. When work happens

- Part 4. The power of the cloud

- Appendix A. App data collection

- Appendix B. Survey design

The Legal Trends for Mid-Sized Law Firms report uses aggregated and anonymized data collected from the Clio platform between April 2019 and April 2023. By synthesizing usage data, we’re able to identify trends that would be otherwise invisible to most firms.

These customers were included in our data set using the following criteria:

- They were paid Clio subscribers. Customers evaluating the product via a free trial or using Clio as part of our Academic Access Program were not included.

- They were located in the contiguous United States, including the District of Columbia but excluding Hawaii and Alaska. Customers in other countries were not included.

- Any data from customers who opted out of aggregate reporting were excluded.

- Outlier detection measures were implemented to systematically remove statistical anomalies.

Data use and privacy

The security and privacy of customer data is our top priority at Clio. In preparing the Legal Trends for Mid-sized Law Firms report, Clio’s data operations team observed the highest data collection and reporting standards.

Data collection

- All data insights were obtained in strict accordance with Clio’s Terms of Service (section 2.12).

- All extracted data was aggregated and anonymized.

- No personally-identifiable information was used.

- No data belonging to any law firm’s clients was used.

Reporting

Aggregate data has been generalized where necessary to avoid instances where individual firm data could be identified. For example, to avoid reporting data on a small town with only one law firm, which would attribute all of this town’s data to this firm, we only report at country, state, and metropolitan levels.

Additionally, raw data sets will never be shared externally. Clio is effectively a tally counter for user interactions—much like stadiums use turnstiles to count visitors without collecting any personally-identifiable information from their customers. Similarly, as users interact with the Clio platform, they trigger usage signals that we can count and aggregate into data sets. We can identify trends without collecting information that reveals anything specific about individual customers.

2023

Legal Trends for Mid-Sized Law Firms

Appendix B

Survey design

- Introduction. What distinguishes mid-sized lawyers?

- Part 1. The shrinking performance gap

- Part 2. Lawyers are making moves

- Part 3. When work happens

- Part 4. The power of the cloud

- Appendix A. App data collection

- Appendix B. Survey design

The Legal Trends for Mid-Sized Law Firms report includes survey data collected during April and May 2022.

Survey of US legal professionals

1,134 respondents

Survey of US consumers (general population)

1,168 respondents

Survey respondents were representative of the US population by age, gender, region, income, and race/ethnicity, according to US census statistics.