Overview

At the time of writing, global cases of COVID-19 have surpassed 8.2 million globally and 2.2 million in the US. As the coronavirus pandemic continues to have far-reaching impacts on people and nations around the world, much of the initial shock has worn off and many are adjusting to the new normal.

As a result, many Americans—including legal professionals—are adapting their attitudes and behaviors to the challenges of everyday life, both personal and professional. Businesses are also adapting, but even as social restrictions ease in many regions, companies may face an abundance of consumer caution when it comes to resuming their consumption of goods and services.

As part of the ongoing industry analysis featured in the Legal Trends Report, this is the second briefing in a series of in-depth research initiatives undertaken by Clio to learn more about the challenges US legal professionals currently face due to the global pandemic, and how the industry can best adapt.

Included below is an update on key business metrics for law firms through April and May, which have also been published in a real-time data insights page that provides further details on individual states and practice areas. Additionally, as Americans continue to be affected by circumstances surrounding the pandemic, this briefing looks at key areas for law firms to focus on in adapting to the current needs of today’s legal consumers.

Detailed source information

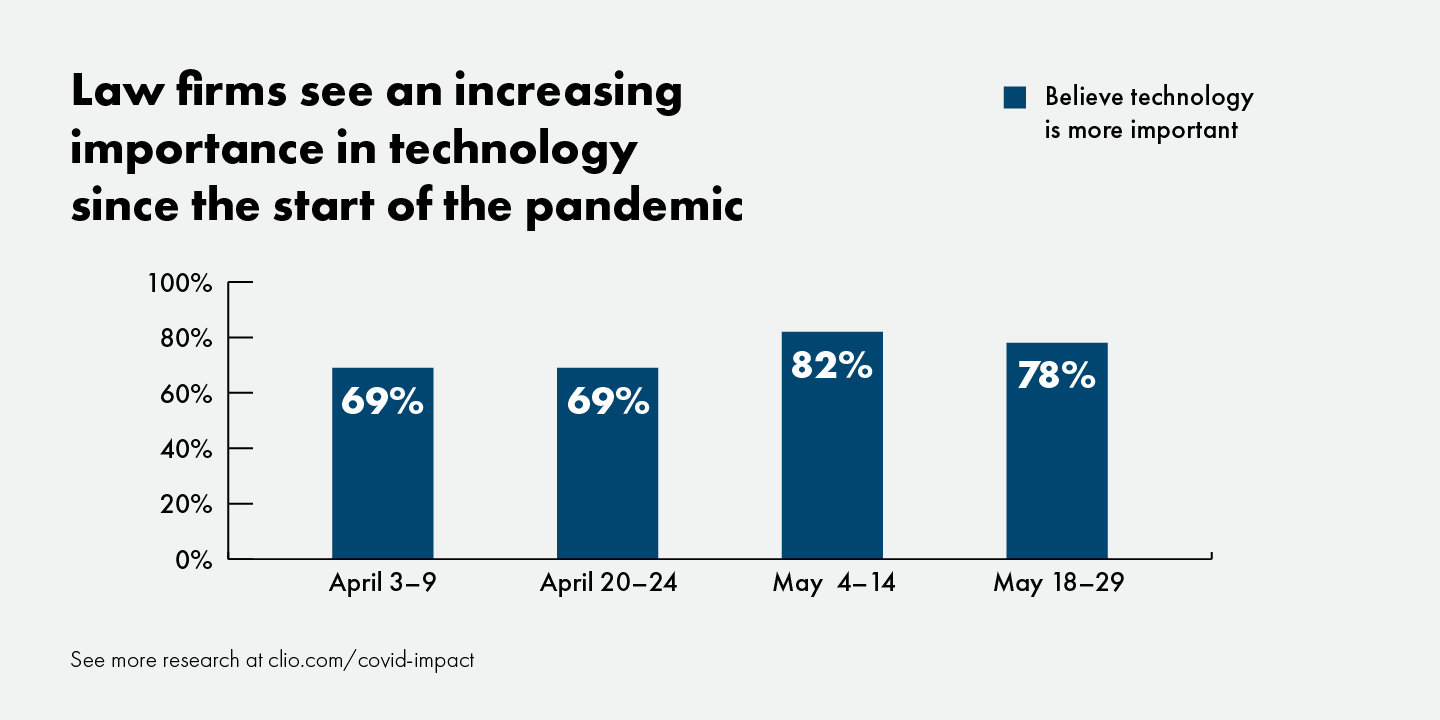

This briefing includes analysis from aggregated and anonymized data from tens of thousands of legal professionals using Clio’s legal practice management software. It also includes survey data collected between April 3 and May 29, 2020.

Clio’s app data

- Aggregated and anonymized data from tens of thousands of legal professionals

Surveys of US legal professionals

- April 3 to 9: 485 respondents

- April 20 to 24: 654 respondents

- May 4 to 14: 609 respondents

- May 18 to 29: 783 respondents

Surveys of US consumers (general population)

- April 14: 1,042 respondents

- May 4 and 5: 1,019 respondents

- May 18 and 19: 1,055 respondents

Research highlights

New casework recovers slowly, but billing volumes decline

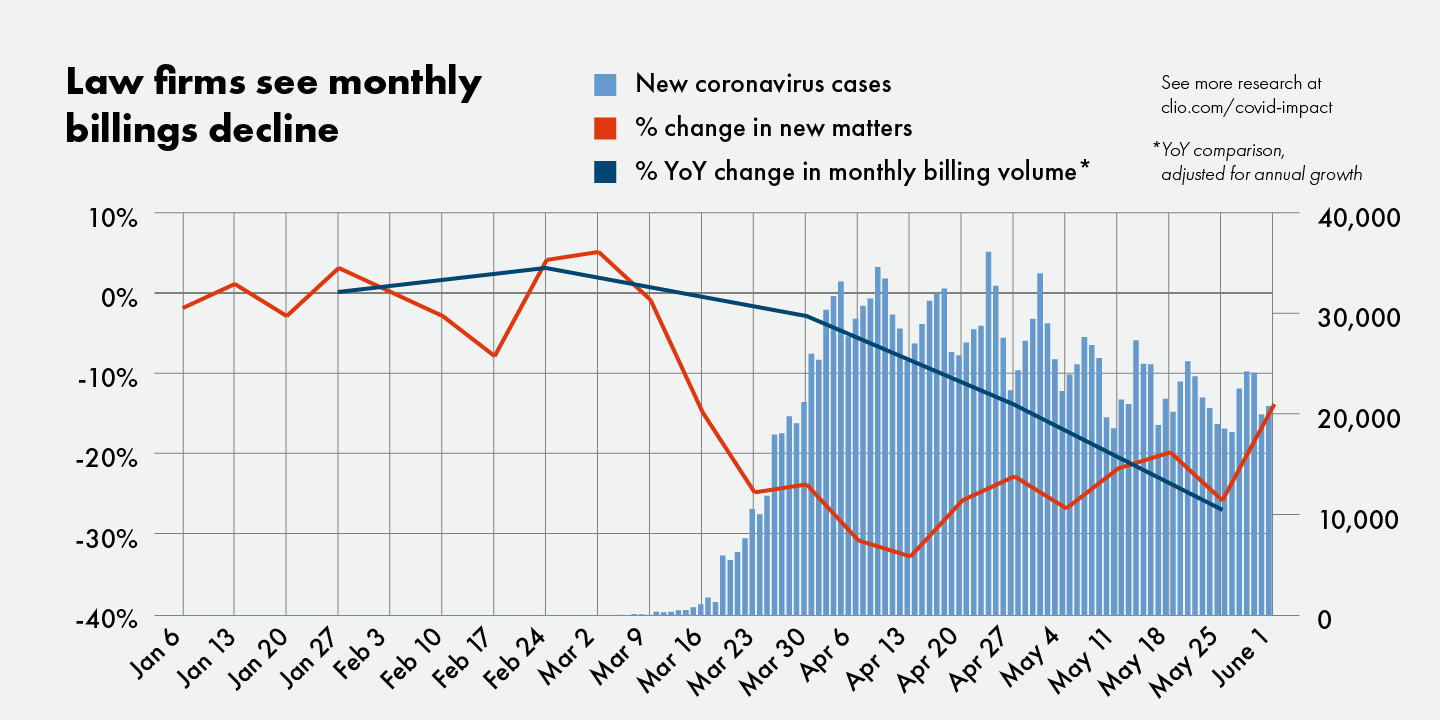

In Briefing #1, we reported that law firms were seeing a drastic reduction in the number of new matters being opened. This trend plateaued and showed signs of recovery through May. As of the first week of June, we saw a sharp spike in new matters, jumping from –26% to –14% compared to baseline, which is the largest increase we’ve seen since early March.

For April and May, the initial drop in matter volumes has had a corresponding downstream effect on billing volumes. The average law firm billed 14% less in April compared to the year prior. For May, firms billed 27% less compared to the year prior. (These values have been adjusted for year-over-year growth.) While law firms have been able to rely on work in progress from legal matters opened prior to March, it is clear that the shortfall of new casework in March and April has now also had an impact on monthly billings.

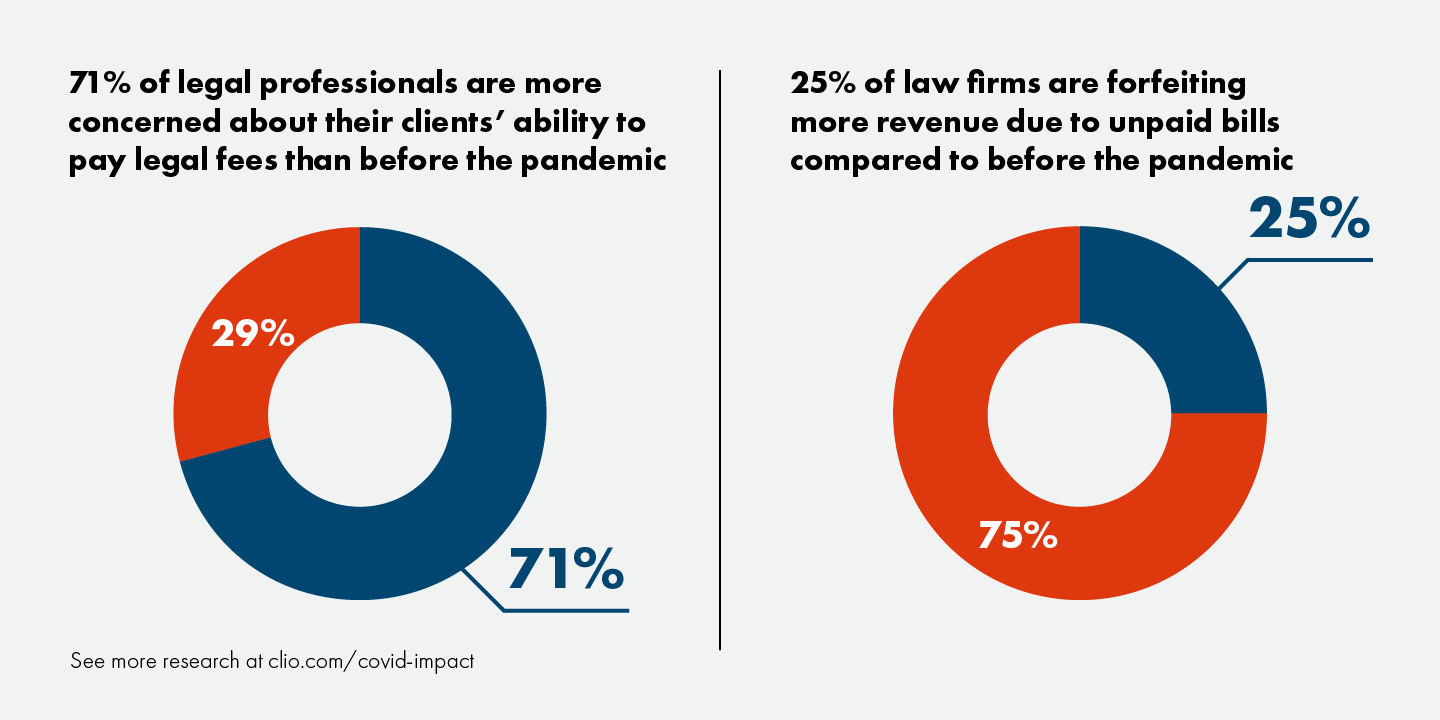

While the upward trend in new casework may result in a similar bounceback in billing volumes, firms may need to take into consideration their client’s ability to pay, as unemployment rates still remain high in the US. As of late April, 71% of legal professionals surveyed were concerned about their clients’ being able to pay their legal fees. As of late May, 25% of law firms report having to forfeit more revenue compared to before the pandemic due to their clients’ inability to pay their bills.

Despite the growing need for lawyers, law firms may see delayed recoveries

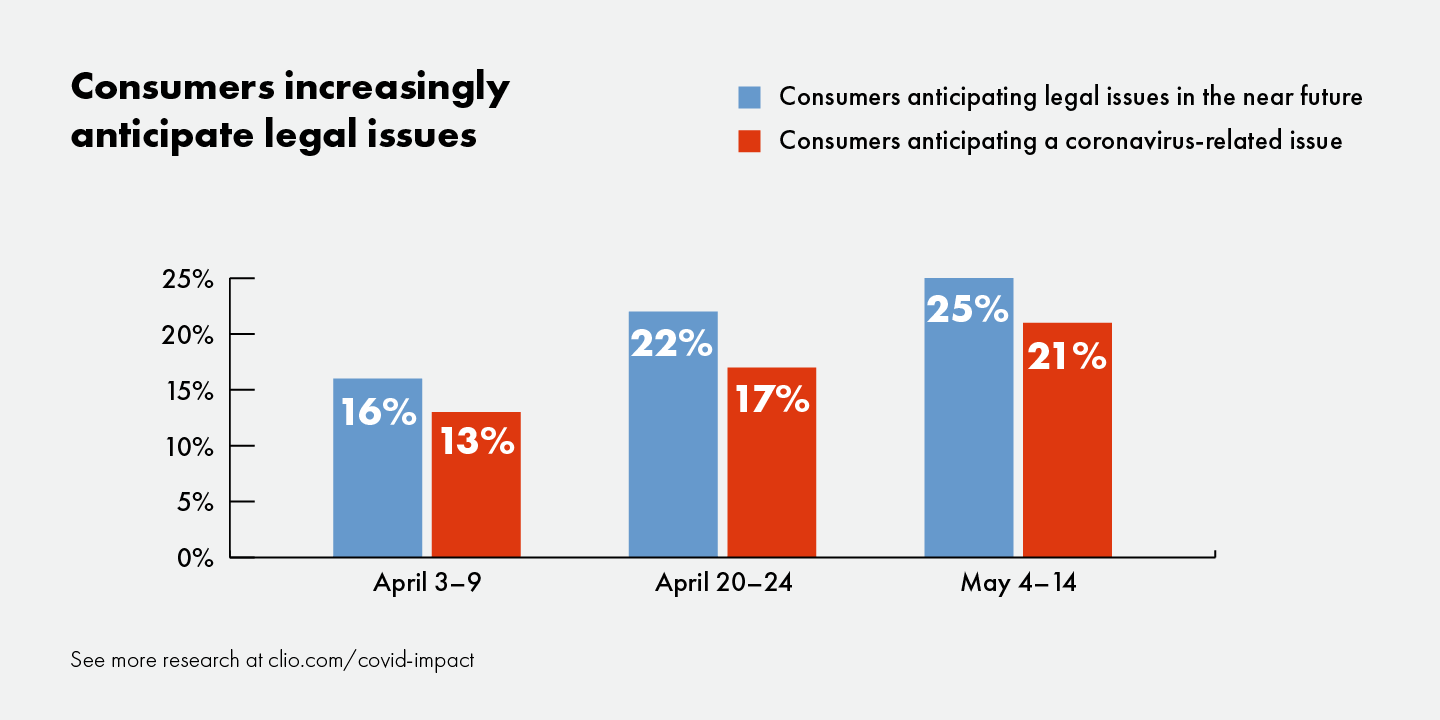

Survey data shows that the overall need for lawyers has not subsided. Through April and May, consumers consistently report anticipating having to deal with a legal issue, many of them related specifically to coronavirus.

Many in the legal industry have forecasted a flood of imminent demand, specifically around coronavirus-related employment issues, as clients begin to pursue legal matters they’ve put off since the start of the pandemic. However, similar to April, nearly half of consumers surveyed still say they would put off their legal issues until circumstances surrounding the pandemic return to normal. Recent analysis of other industries has shown that social distancing behaviors may continue to negatively affect businesses beyond the easing of restrictions.

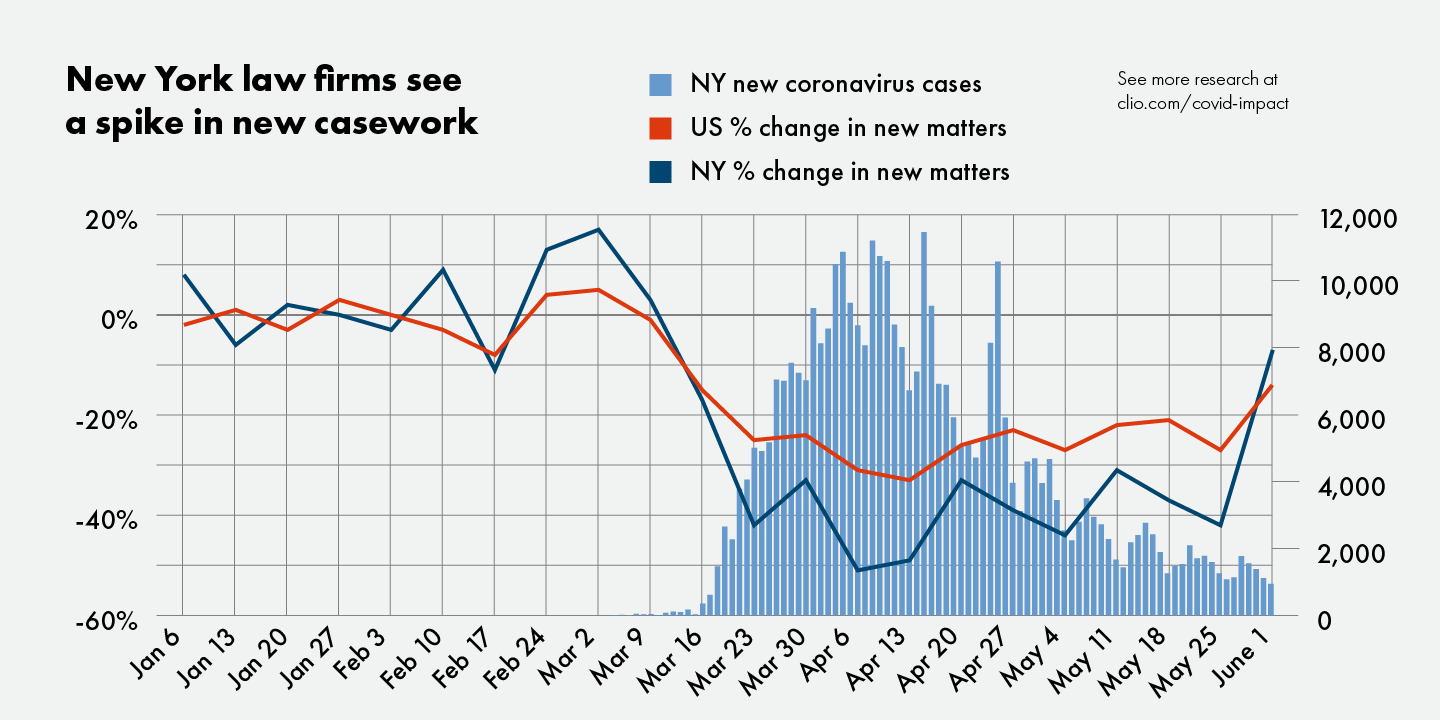

New York state provides an example of how law firms can be affected by a dramatic surge in local coronavirus cases, as the state was hit especially hard through March and April, seeing over 10,000 new coronavirus cases daily. During this time, new matter creation among law firms in New York fell dramatically lower than the national average, falling to approximately –50% relative to baseline for the weeks of April 6 and 13. (For data on matter volumes for individual states, see Clio’s live tracking data.)

Even as coronavirus cases dropped significantly in the following weeks, new casework for law firms continued to fall as low as –40% compared to baseline in New York. In the first week of June, however, New York law firms saw a 34% surge in new casework, exceeding the national average. This jump preceded the first stage of economic reopening of New York City by one week, putting as many as 400,000 people back to work.

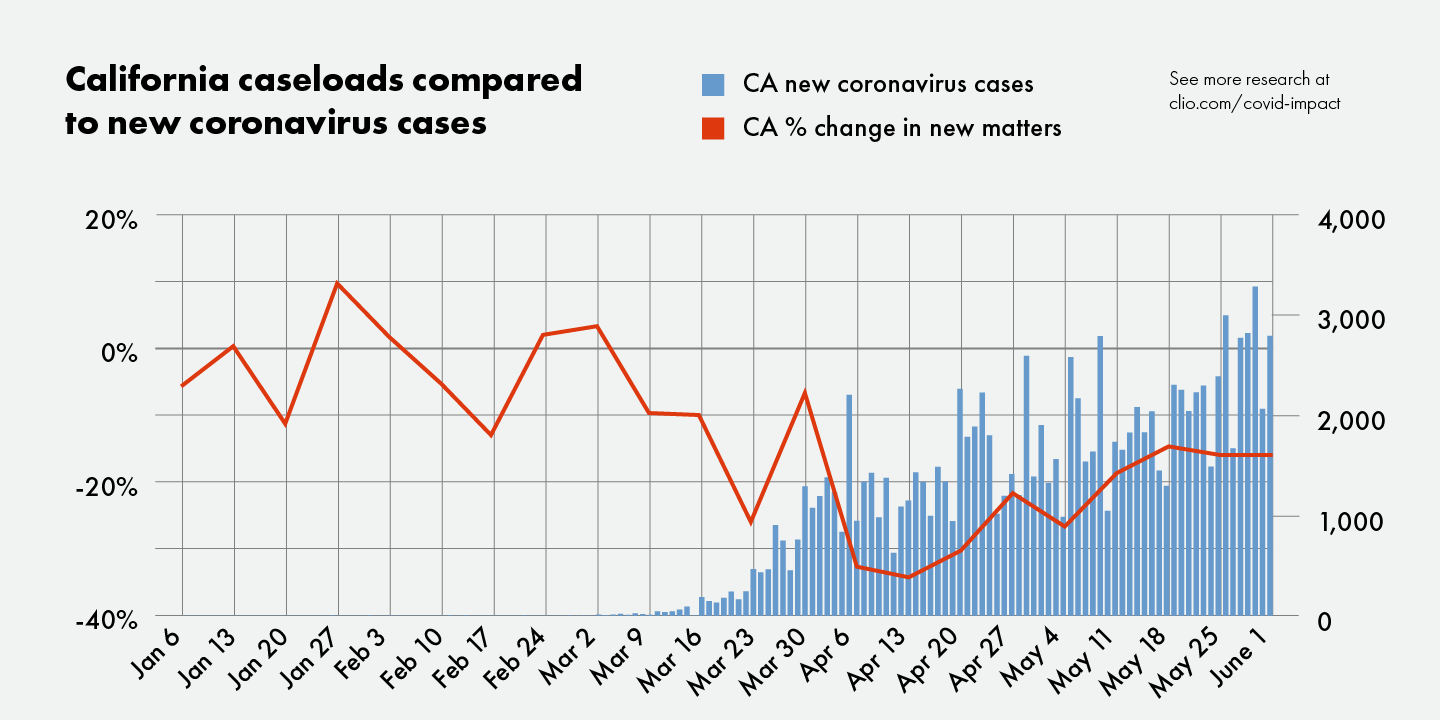

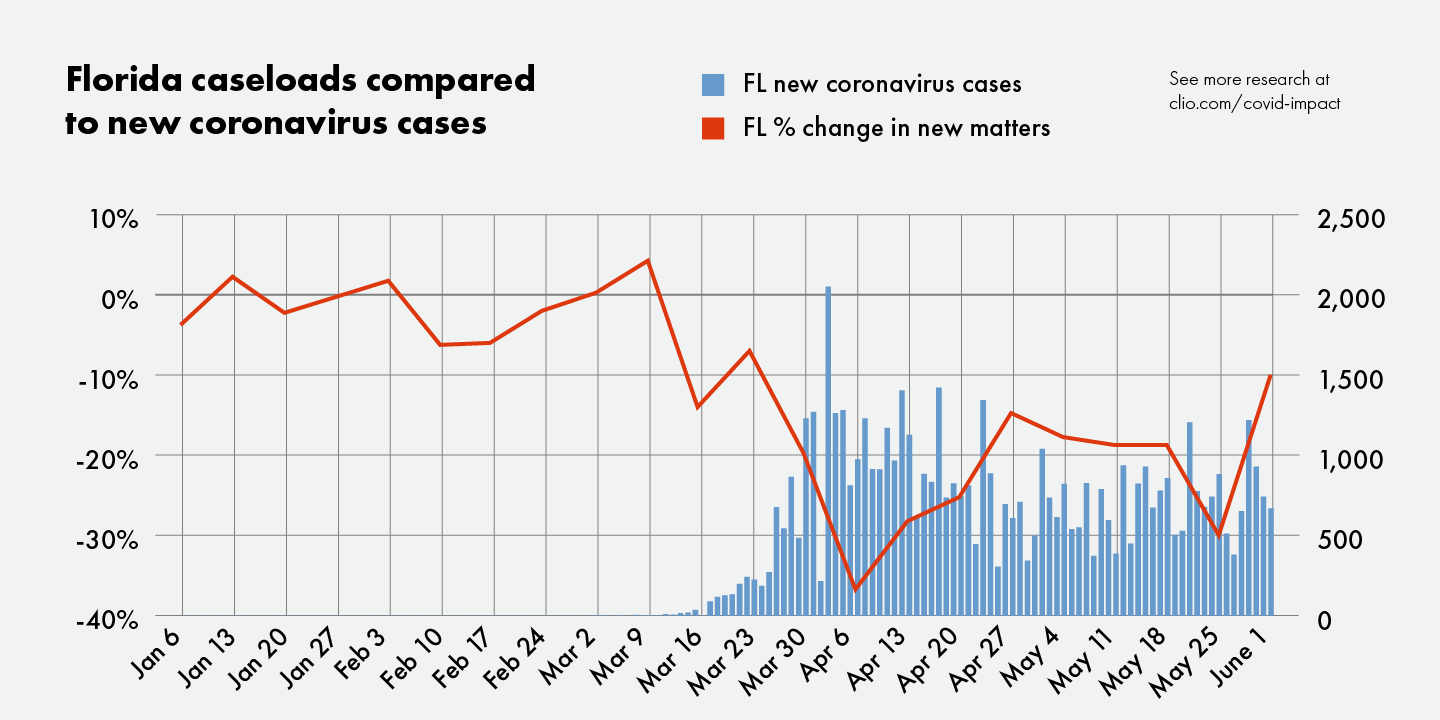

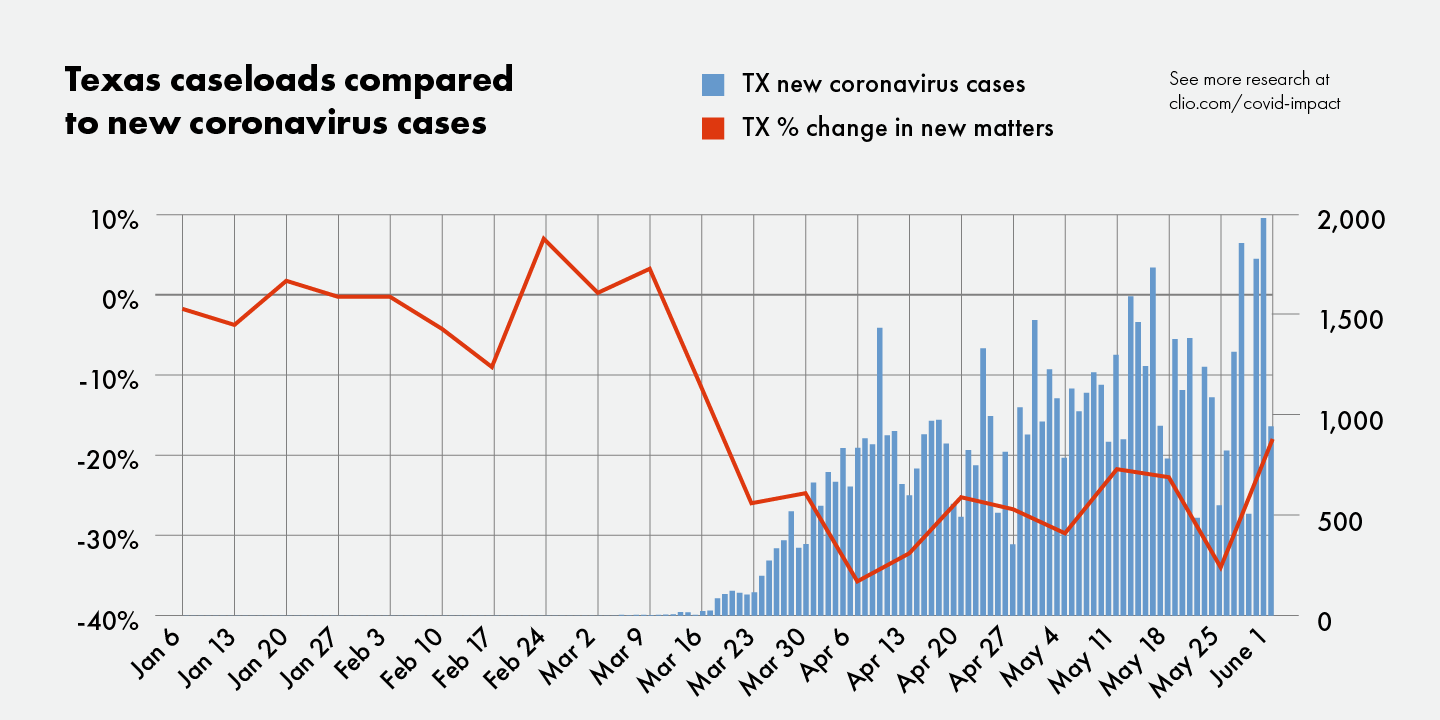

In states such as California, Florida, and Texas, where coronavirus cases have been on the rise—reaching between 1,000 and 2,000 daily new cases in each state—new casework has steadily increased for the past several weeks. However, as localized surges and a more widespread second wave of COVID-19 remains an ongoing possibility across the US, the events of the past months—and in New York in particular—should provide an indication of the types of challenges law firms could still face in 2020 and beyond.

Business-related practice areas have been less affected than others

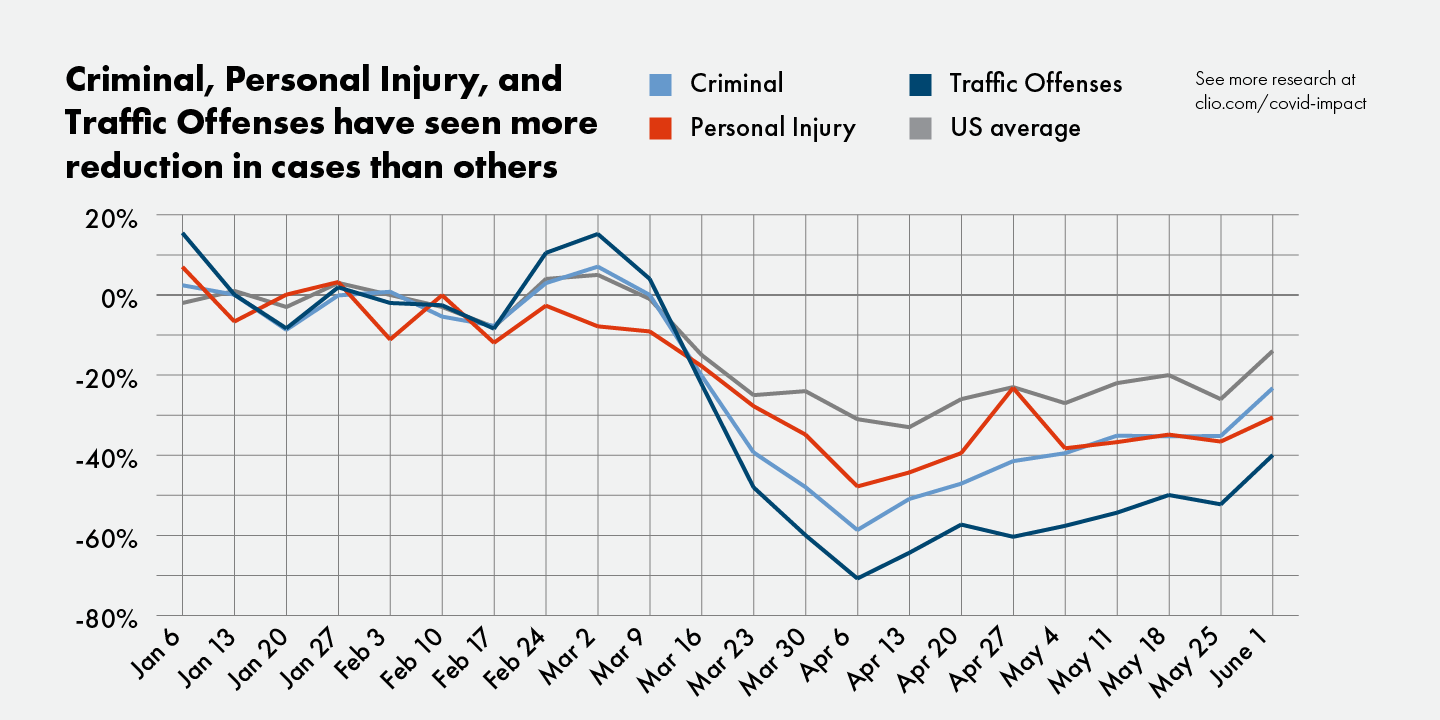

While most practice areas have seen a significant decline in new matters, some have been more affected than others. Traffic, criminal, and personal injury are among the practice areas most affected by the pandemic. This is likely due to many court systems operating at reduced capacity during social distancing restrictions, and the fact that people are driving less.

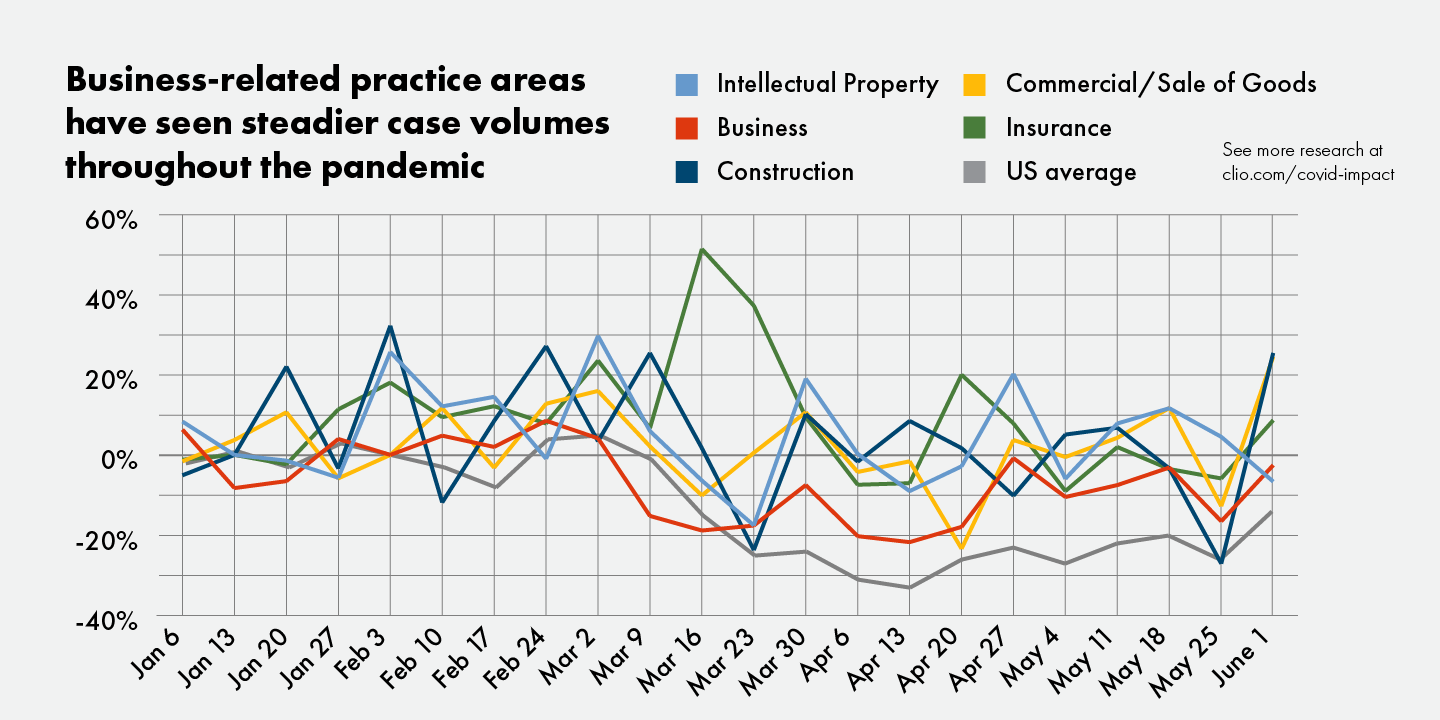

Business-related services are among the practice areas that have been less affected or have recovered significantly since the start of the pandemic. These include intellectual property, insurance, and commercial sale of goods, among others. This may be due to the fact that many businesses are in a better financial position to pursue legal matters and may be dealing with new legal challenges as a result of the pandemic—and many businesses may not have the option of putting off their legal proceedings.

Legal professionals are adapting to their new normal

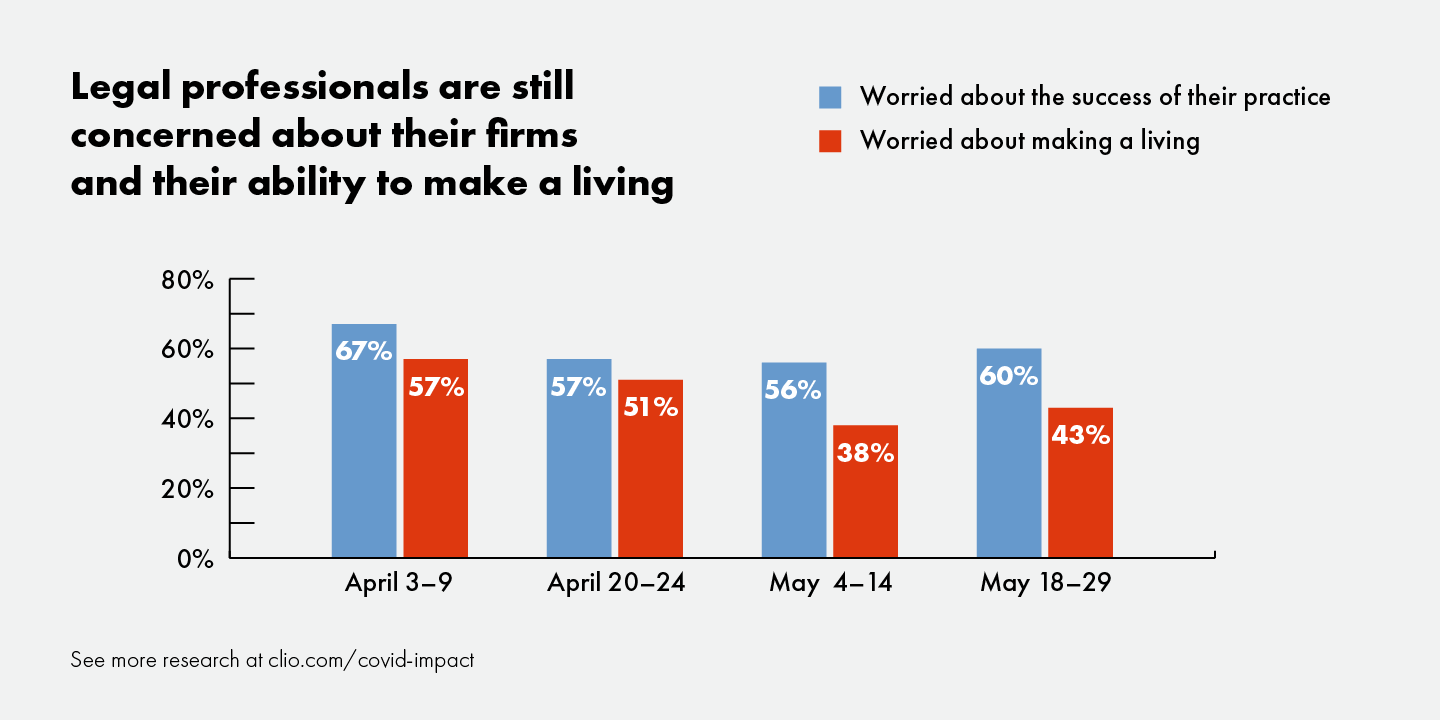

Since April, many legal professionals have been concerned about the success of their practice and their ability to make a living. And while government support for small businesses and those whose income has been affected by the pandemic may have been a lifeline for law firms and their clients, the lifespan of these programs is uncertain. Between May 18 to 29, 35% of those surveyed said that some form of government support was essential to the survival of their business, and 27% said they believed that this aid was readily available to them.

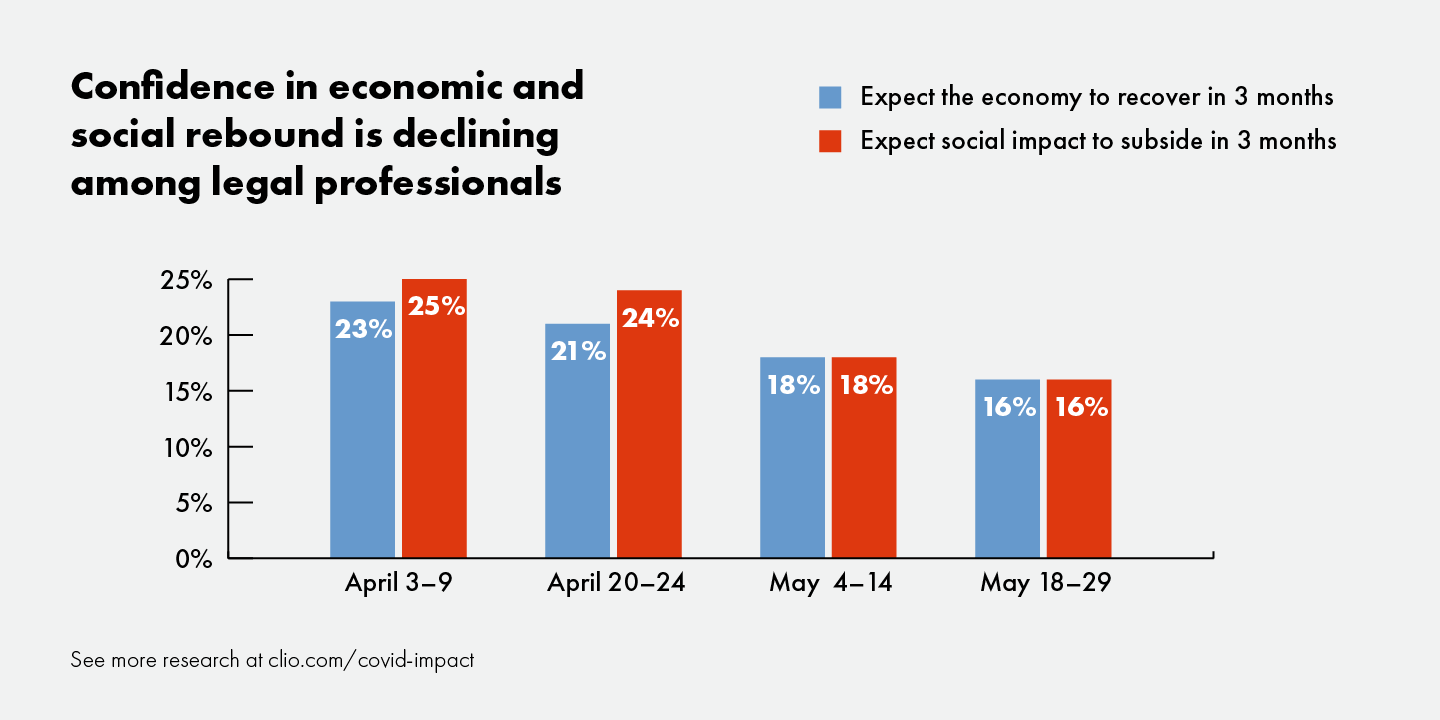

As the pandemic persists, more legal professionals see potentially longer-term implications. Fewer legal professionals expect the economy to bounce back in the next three months, and fewer expect the social impact of the pandemic to subside over the same timeframe. As many as 75% of law firms predict that circumstances around the coronavirus will have longer-term impacts on their businesses even after the pandemic comes to a close.

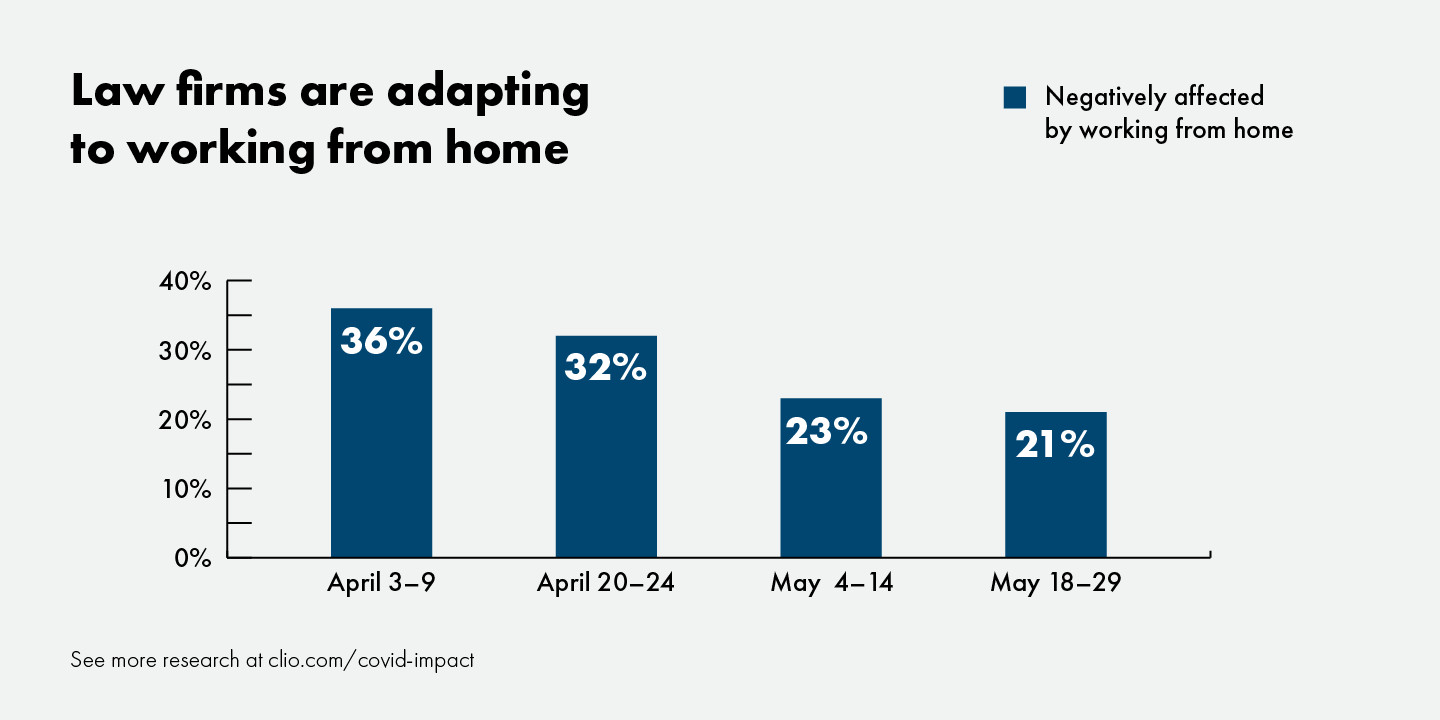

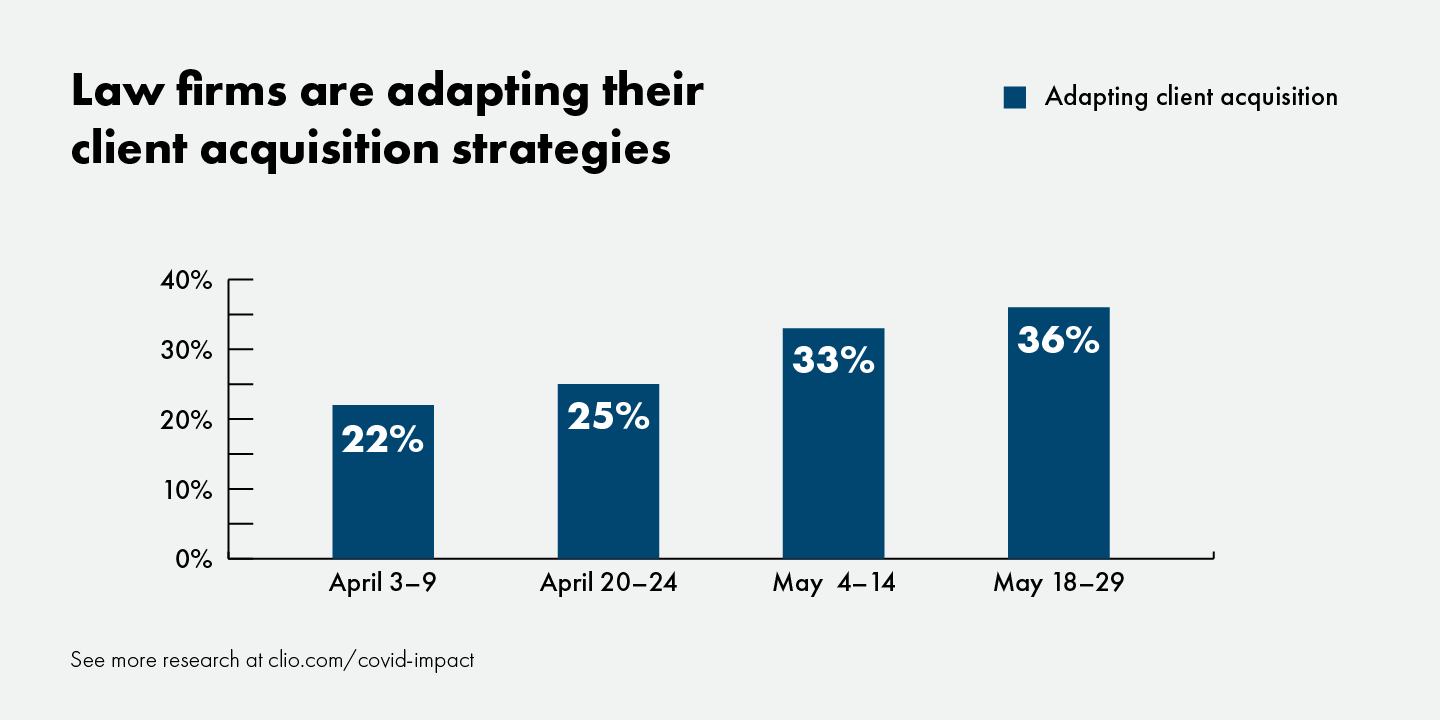

Many law firms are also adapting to the new normal. For example, legal professionals are adjusting to the challenges of working remotely, as fewer of those working from home report having difficulties. More firms have also adapted their client acquisition strategies.

For law firms adapting their client acquisition strategies, past research into what clients look for when hiring a lawyer says that responsiveness and access to information are key deciding factors when deciding on a lawyer to hire. Additionally, research shows that consumers seek face-to-face interaction when initially consulting with a lawyer on the details of their case.

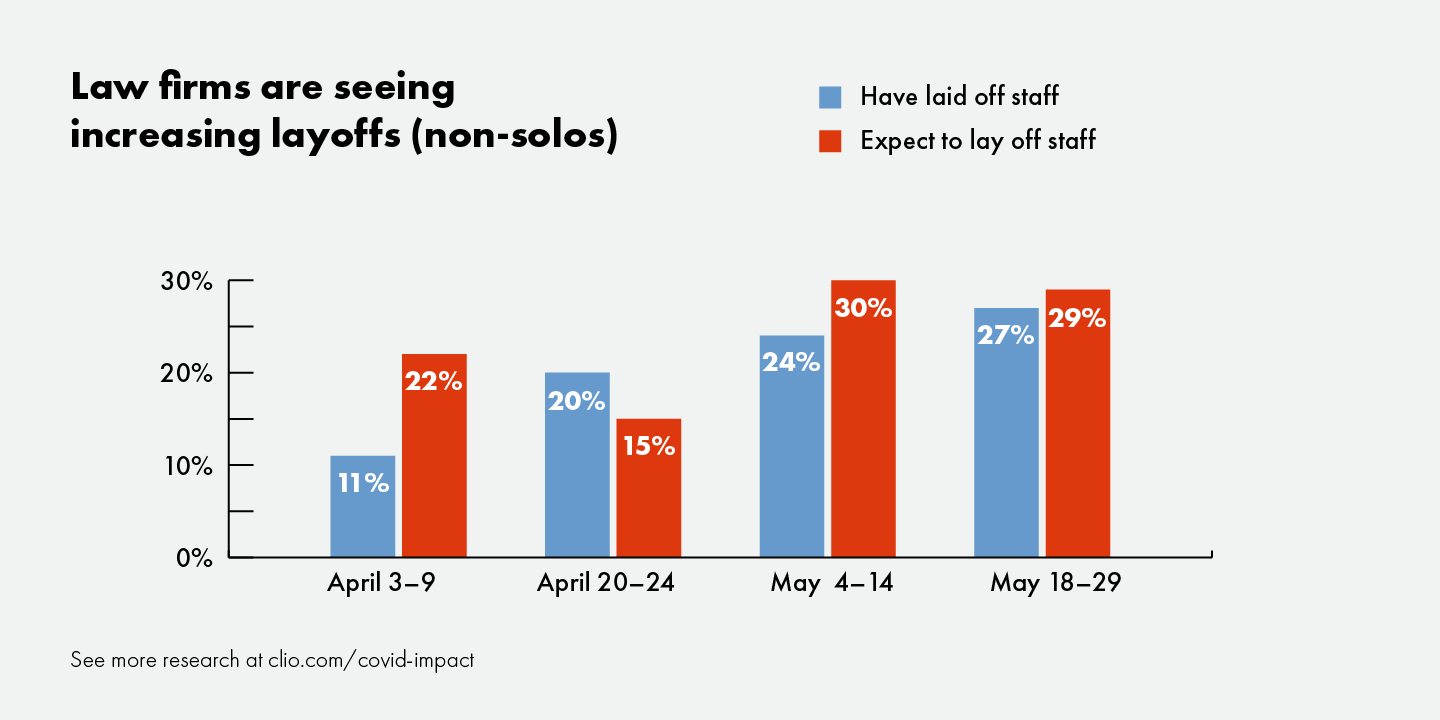

As firms cut costs, the number of staff layoffs increased among survey respondents in April and May. April saw 20.5 million jobs lost in the US, bringing the unemployment rate to 14.7%. The legal industry saw its share of layoffs, shedding 64,000 jobs in the same month. The unemployment rate improved to 13.3% in May, resulting in 3,200 jobs for the legal sector, which along with the rise in new casework, is hopefully a positive sign of recovery.

Legal clients face perceived barriers when seeking legal help

Whether consumers continue to put off their legal problems or begin pursuing them in the near future, law firms may face longstanding challenges as clients continue to be affected by circumstances related to the pandemic, and any potential surges in the virus in the coming months. For legal professionals, this should also be a cause to motivate new innovations to meet the current and future needs of clients who may be forming new expectations working with professional service providers.

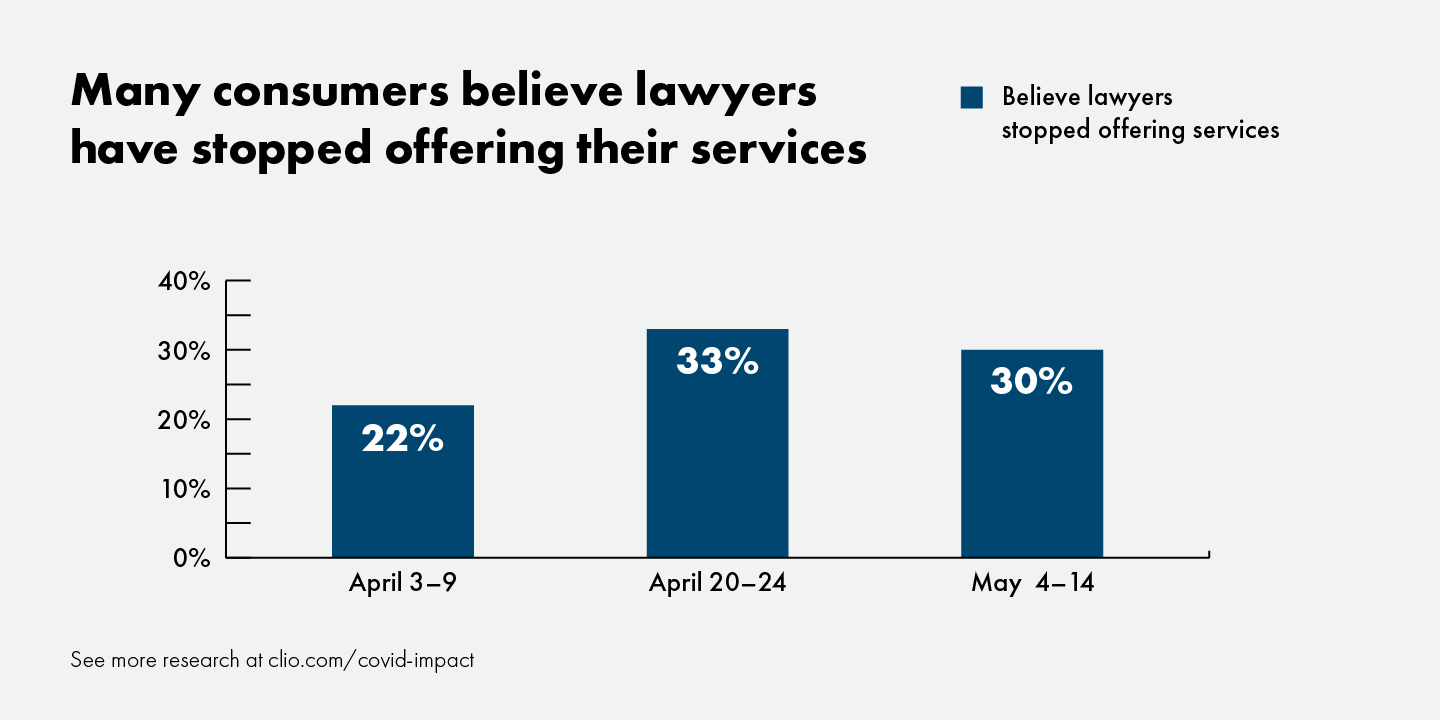

Law firms may be hindered by the fact that potential clients don’t know lawyers have been offering their services throughout the pandemic. As many as 33% of consumers continue to believe that lawyers have stopped offering their services through April and May. Of the legal professionals surveyed, only 2% identified that their firm had stopped offering their services. Firms may need to manage the perception of availability and the range of services offered during any social restrictions within their respective markets.

With unemployment rates reaching new heights across the US, there is ongoing concern that consumers won’t be able to afford the cost of dealing with a legal issue. As of late May, 15% of consumers surveyed had lost their primary source of income due to circumstances related to the pandemic, and 25% had experienced a significant decrease in income.

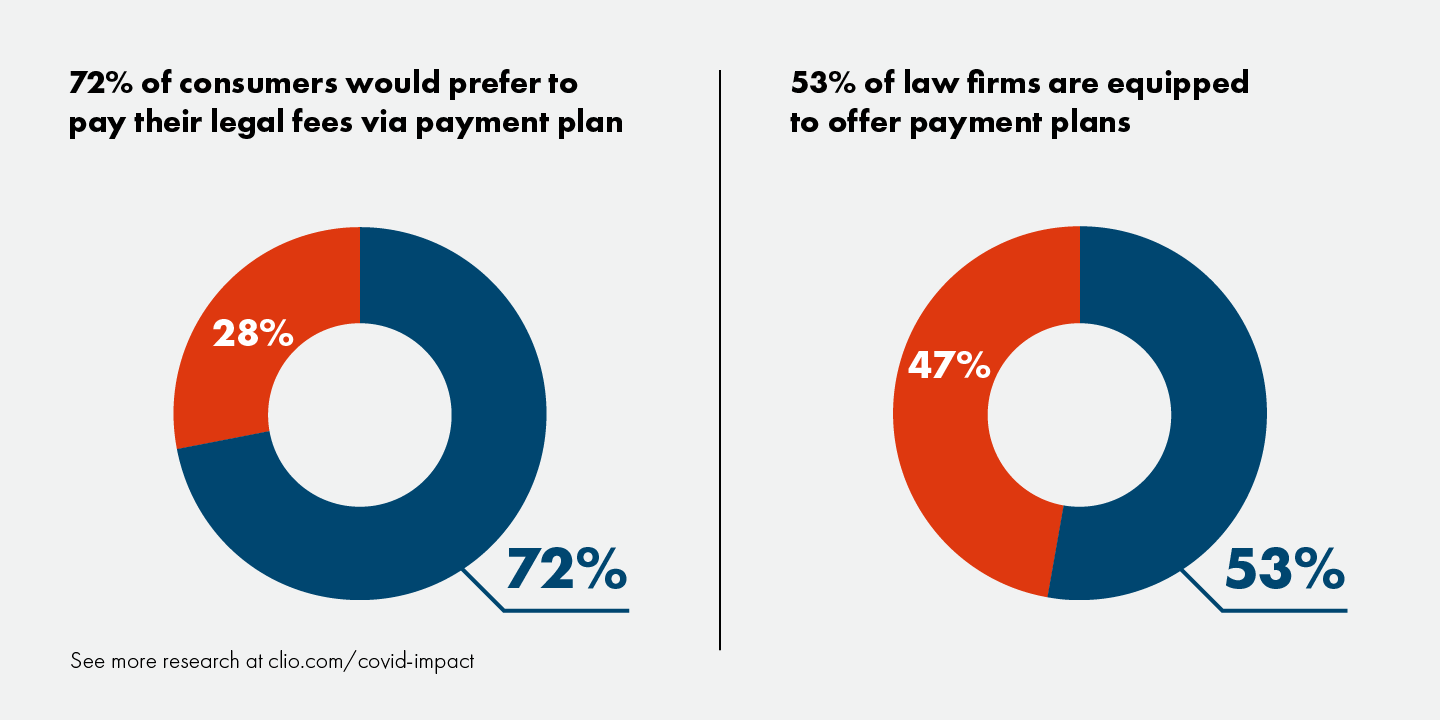

Firms struggling to bring in business may need to look at options to accommodate those who can’t afford legal fees. This could be through temporarily reduced rates, discounted services, or payment plans to ease the financial burden on clients. Among consumers, 72% say they would prefer to pay their legal fees on some sort of payment plan, while only 53% of law firms say they are equipped to offer payment plans. Sixty-three percent of consumers also believe businesses should be more forgiving of people who can’t afford to pay for essential goods and services.

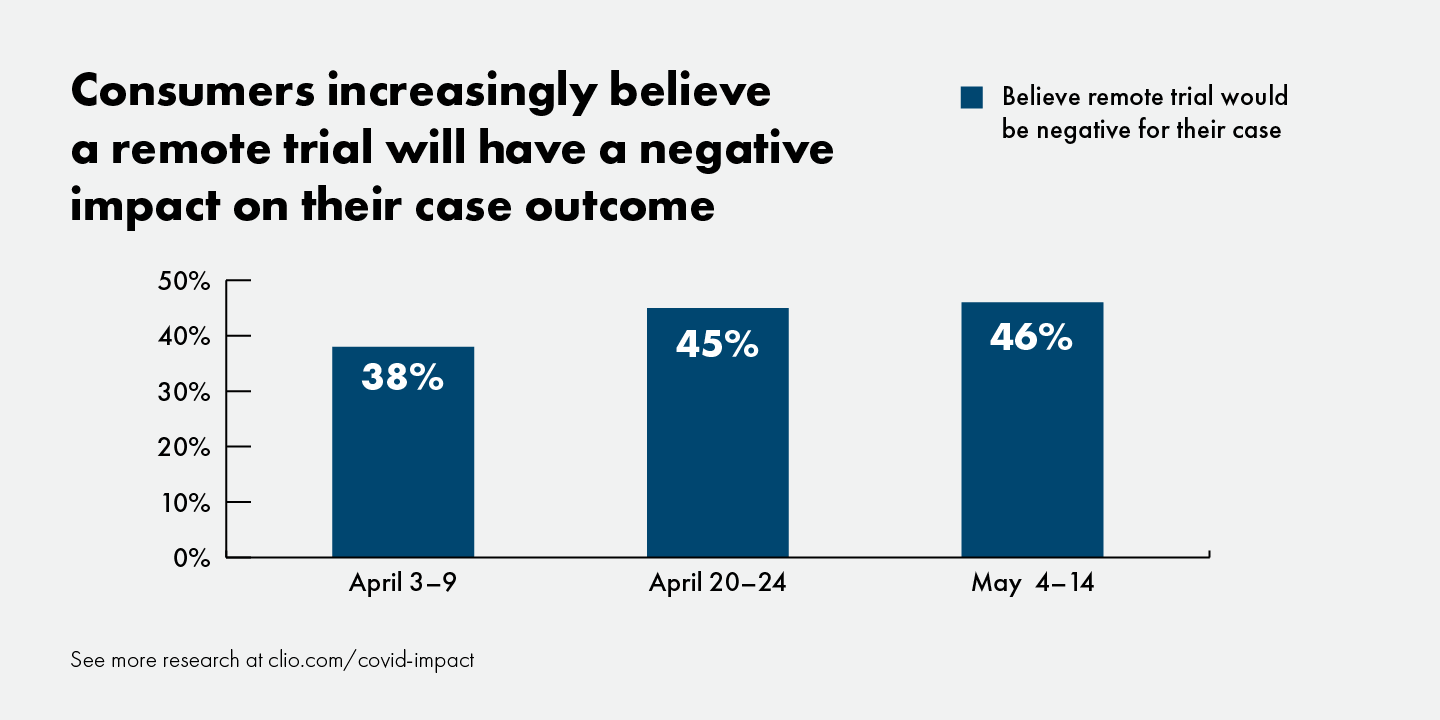

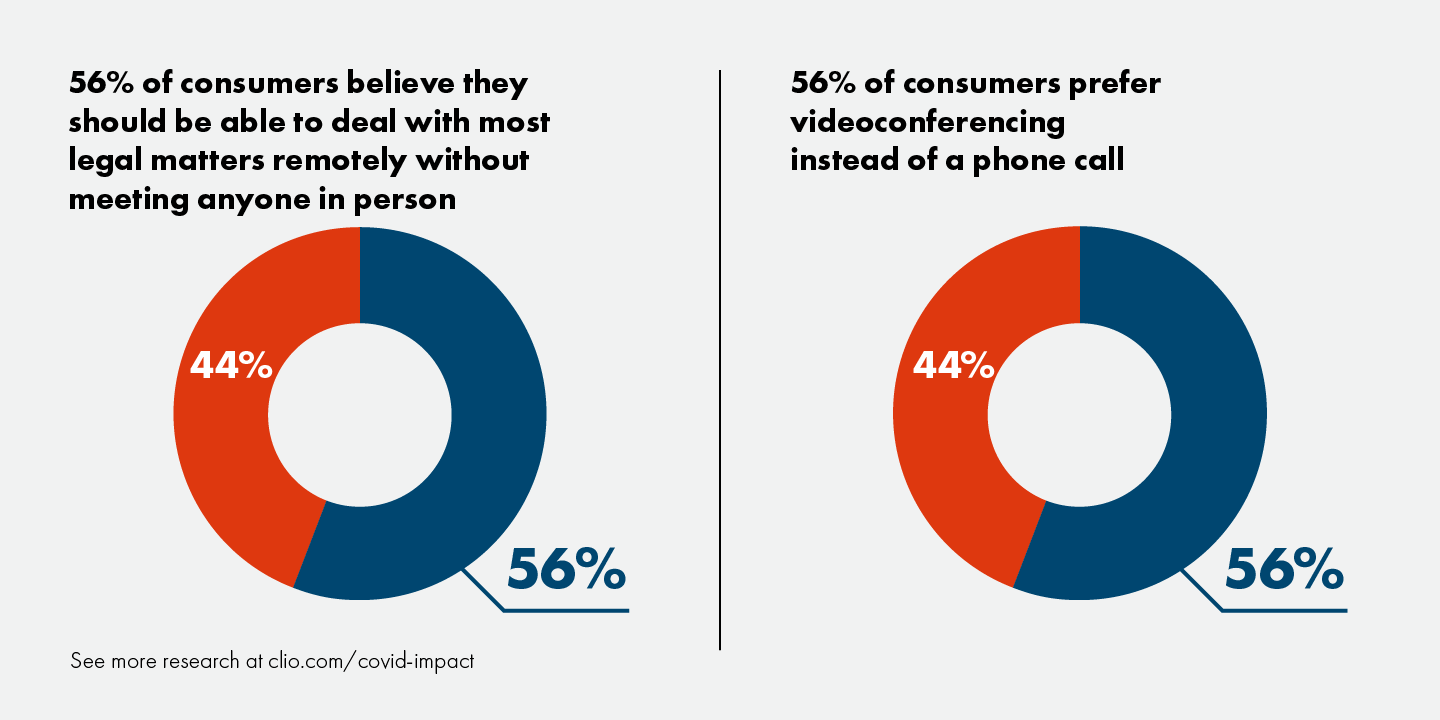

Consumers perceive technical challenges in having to deal with their legal issues during the pandemic. Fifty-six percent of consumers believe they should be able to deal with most types of legal matters remotely without having to interact with someone in person, yet increasingly more see a remote trial having a negative impact on their case outcome.

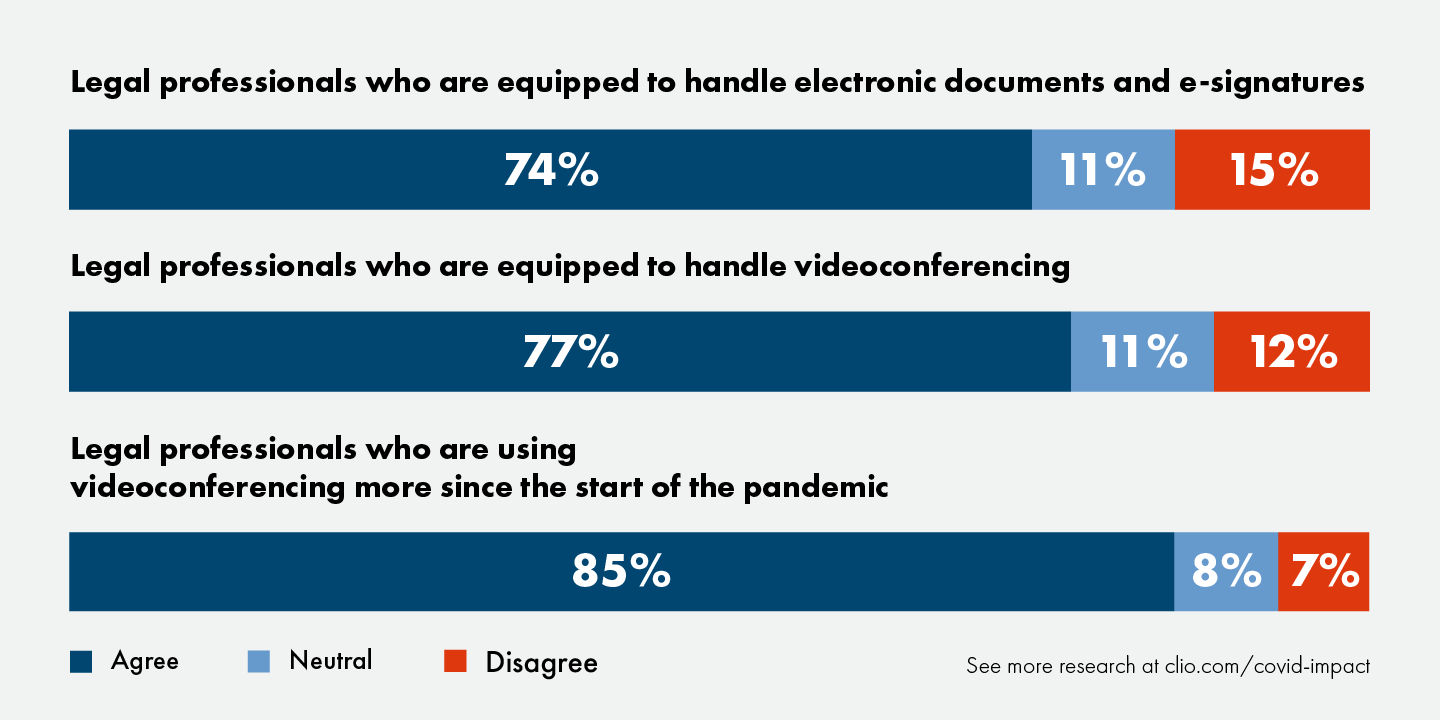

More law firms have already adapted their services to the needs of their clients

Of those surveyed, many law firms have already adopted technologies necessary in meeting the needs of clients and to enable remote work, and a larger number see technology as being more important to them since the start of the pandemic. This is especially clear with electronic document sharing and e-signature technologies, as well as videoconferencing software. Videoconferencing in particular has become a preference for over half of consumers over phone calls, and 85% of legal professionals say they’ve been doing video calls much more than before the pandemic.