Manage your trust accounts in accordance with industry rules

-

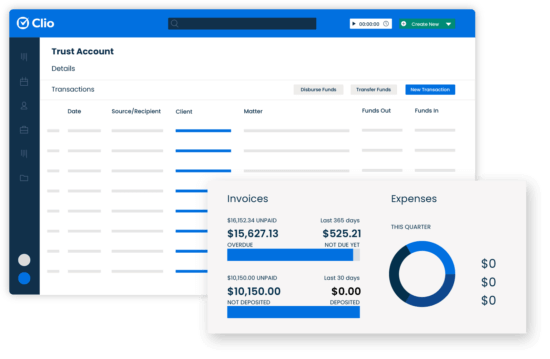

Set up separate ledgers for trust and operating accounts

Use Clio’s trust account management software to track trust and operating accounts as required by legal industry regulators. See all transactions connected to a matter or client and whether they impact your trust or operating accounts.

-

Keep it simple and reconcile directly in Clio

With several reconciliation options, choose to manage your firm’s trust accounts from the same place you already bill and collect payments—right in Clio. Simply match trust transactions to your bank account statement directly from the Accounts tab.

-

Stay trust accounting complaint with reports

Run built-in legal trust account reports required for trust accounting compliance. Clio keeps detailed records of your client’s operating and trust funds. You can view all accounts and transactions associated with a client, generate statements of account, and access up to ten years of reconciliation reports.

Manage your trust accounts with confidence

Properly manage the request, deposit, transfer, disbursement, and refund of trust funds at every step knowing client funds are always properly logged across your ledgers.

-

Generate requests and accept deposits from clients with ease

Enjoy the speed and convenience of requesting and depositing funds into trust according to legal industry rules. You can send trust requests through email or accept trust deposits through click-to-pay links, QR codes, or the secure client portal.

-

Create client-friendly invoices that comply with regulations

Clearly present line items on your legal invoices that detail the movement of funds held in trust along with remaining trust balances.

-

Stay on top of your trust account balances

Use evergreen trust management to stay on top of retainers in Clio’s trust account management software to set an alert when available funds drop below a certain threshold.

-

Comfortably move funds in and out of trust

Create automated logs for all trust transactions as you apply funds to invoices, transfer funds to operating accounts, and issue disbursements or refunds.

-

Accounting for your firm's needs

Whether it’s Clio Accounting, or our best-in-class accounting integrations with QuickBooks Online or Xero, Clio helps you efficiently manage your firm’s accounting so you can avoid data-entry errors and remain compliant, no matter how you work.

Frequently Asked Questions

How do I keep my trust accounts full of funds?

Our trust account management software offers an evergreen management feature that sends you a notification when trust accounts reach a minimum dollar amount.

You can also create a credit card payment plan that will automatically charge a client on a monthly or weekly basis, and deposit the specified amount into their trust account.

Does Clio have the specific report required for trust accounting compliance in my jurisdiction?

Clio’s trust account management software allows you to either reconcile directly in Clio or make use of built-in reports that help meet general trust accounting guidelines, in addition to several reports made for specific jurisdictions. Our trust account management software also allows you to export transactions to Excel.

Can I use QuickBooks Online or Xero without integrating to Clio?

Using an accounting solution built for the nuances of the legal industry is important to maintain compliance. Clio offers trust account management software for attorneys through several different options depending on your accounting preferences, all with the goal of helping you reconcile and maintain compliance with ease.

What information syncs with QuickBooks Online?

Clio’s trust account management software syncs your contacts, bills, time entries, expenses, Clio Payments transactions, and trust transactions to QuickBooks Online automatically. Additionally, you can sync hard costs using the Hard Cost Importer feature. Learn more here.

What information syncs with Xero?

Clio’s best-in-class integration with Xero syncs your Clio contacts, time and expense activities, bills, credit notes, interest, and Clio Payments transactions for accounting purposes.

For more information, visit the help center.

Customer testimonials

Hear what other law firms have to say about Clio’s legal accounting software.

Accounting resources for law firms

More Clio Manage features

-

Case Management

Stay organized, and access the information you need—from anywhere, at any time.

-

Document Management

Edit, store, and organize your legal documents securely, from anywhere.

-

Billing

Create custom bill plans based on fee structure and reduce manual data entry. Bill via email or our secure client portal.

-

Client Management

Easily organize contact details, documents, and communication logs from intake to invoice.

-

Accounting

Manage, record, and analyze every financial transaction in one system of record.

-

Calendaring

Stay on top of deadlines, with legal-specific features like Court Rules.

-

Task Management

Assign and track tasks. Report on task progress, identify roadblocks, and better manage productivity.

-

Online Payments

Get paid faster and make it easier for client to pay with online payments.

-

Time & Expense Tracking

Make billing easy and accurate with features like Timekeeper and enhanced expense tracking.

-

Law Firm Reporting

See how many hours your firm has captured, billed, and collected in one dashboard.

-

Client Portal

A desktop and mobile app for clients to communicate and collaborate with their lawyer.

-

Law firm communications

Manage client and firm communication all on one platform.

-

Personal Injury Case Management Software

Clio’s personal injury case management software helps personal injury firms organize every case detail, close cases close faster, and deliver the best outcomes for clients.

Book a Live Demo

Book a live demo to see how Clio can help your law firm maximize efficiency and increase revenue

Try Clio for Free

Try Clio’s legal software free for 7 days with no obligation. Easy setup. No credit card required. Cancel anytime