-

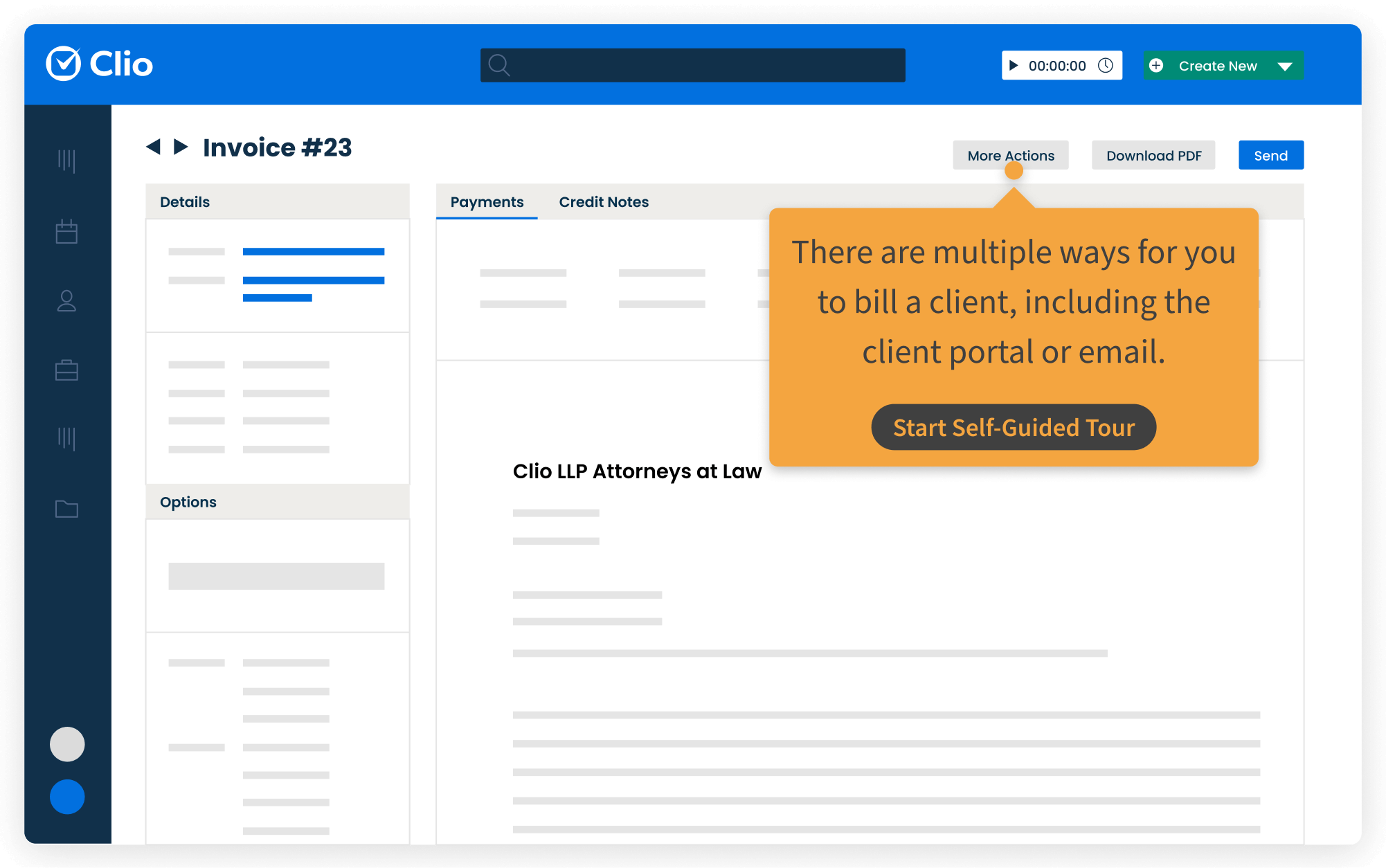

Quickly create beautiful, easy-to-pay bills

Speed up client billing with custom bills, built in minutes and delivered via email or secure client portal. Make them easy to pay using credit, debit, or eCheck (US only), or set up automated payment plans. See how in the Self-Guided Tour.

Make it easy for clients to pay and for you to get paid

-

Your to-do-list is long enough, and when it comes to processing online payments, you’re likely chasing down outstanding invoices or struggling to keep up with billing. But it doesn’t have to be this way.

Make the payment collection process fast, automated, and convenient for you and your clients, with Clio’s online credit card software built specifically for law firms. Law firm clients can also pay in-person with the tap to pay feature built in to Clio’s mobile app.

-

Accept online and in-person payments: Get paid faster, save more time, and provide a better client experience

-

Get paid sooner with convenient online and in-person payment options

Clio's online payment processing solution makes it easy for clients to pay legal bills online as soon as they receive them. Clients can pay bills or trust requests online through your website, client portal, text message, and more. Plus, our payment software allows you to accept in-person payments with tap to pay.

See it in Action -

Remove the stress of large, unexpected legal bills

Give your clients flexibility with automated payment plans. Break payments into manageable amounts and set a schedule that fits your client’s needs (and your firm’s cash flow).

-

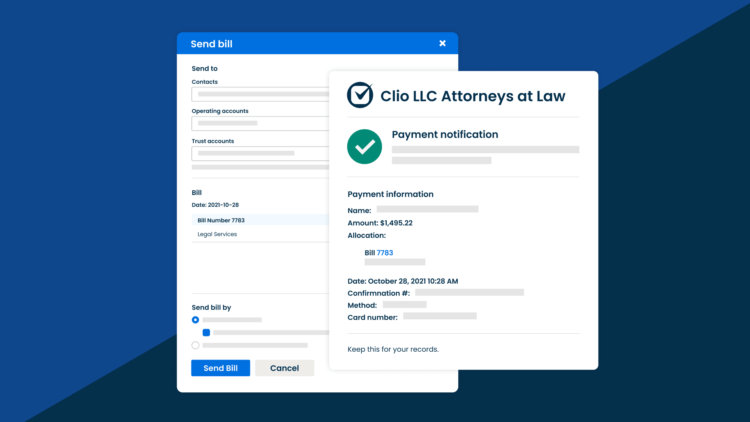

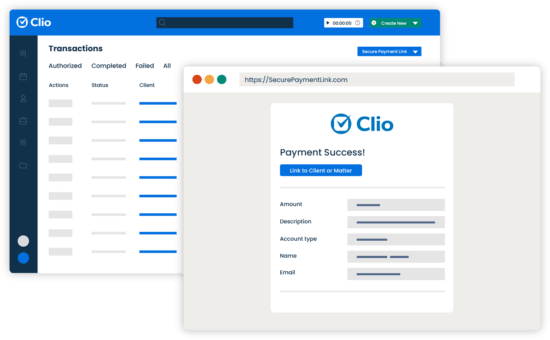

Handle client billing and payments—all in one go

Manage online payments through a fully-integrated collections process. Payments are automatically associated with client bills and synced to your accounting platform, leading to fewer manual data errors—and more time back in your day.

Learn More

A legal payments solution your law firm can trust

-

Real time insights into your finances

Stay on top of all your transactions with financial reports and instant payment notifications to get a real-time view of any outstanding balances. Set automated payment reminders for any bills that need additional follow-up.

Learn More -

The simple solution to complex trust accounting

Clio handles all trust-related transactions, including refunds, in compliance with trust accounting and IOLTA regulations. With earned and unearned funds kept separate, funds in your trust account are protected from all third-party debiting, including processing fees and chargebacks.

-

Operate in accordance with PCI legislation

Clio uses the payment industry's most advanced security measures—with bank-grade protection of client data and proactive fraud detection—so you can safely accept online payments.Clients can also store card details for future transactions.

-

Simple and transparent pricing

Online payments are included in all Clio Manage subscriptions. Unlike other providers, you can accept payments at fixed rates so that you always know what you're paying—no extra or variable card network fees.

See how it works

Thousands of legal professionals get paid with Clio

Explore more features

-

Case Management

Stay organized, and access the information you need—from anywhere, at any time.

-

Document Management

Edit, store, and organize your legal documents securely, from anywhere.

-

Billing

Create custom bill plans based on fee structure and reduce manual data entry. Bill via email or our secure client portal.

-

Client Management

Easily organize contact details, documents, and communication logs from intake to invoice.

-

Accounting

Manage, record, and analyze every financial transaction in one system of record.

-

Calendaring

Meet every deadline, with legal-specific features like automatic court date scheduling.

-

Task Management

Manage firm productivity by assigning and tracking task completion.

-

Time & Expense Tracking

Seamlessly track time and expenses to make billing simple and accurate.

-

Law Firm Reporting

See how many hours your firm has recorded, billed, and collected from a single dashboard.

-

Client Portal

Enable clients to securely communicate and collaborate with their lawyer from desktop or mobile.

-

Law Firm Communications

Manage client and firm communication all on one platform.

-

Personal Injury

Close cases faster by organizing medical liens, damages, and settlements alongside your case files.

Book a Live Demo

Book a live demo to see how Clio can help your law firm maximize efficiency and increase revenue

Try Clio for Free

Try Clio’s legal software free for 7 days with no obligation. Easy setup. No credit card required. Cancel anytime

Law firm payment processing FAQs

What is Clio Payments?

Built within the powerful Clio Manage infrastructure, it offers a faster, more transparent collections experience and real-time view of transactions. Payments get recorded automatically in Clio and are synced to your accounting platform—saving time and effort. And you can send trust payment requests and maintain evergreen retainers knowing Clio keeps you compliant with trust accounting rules.

Is Clio Payments PCI Compliant?

Clio Payments is built to ensure all payments are PCI compliant. The processing, transmission, and storage of card data is handled in a way that meets the highest level of certification available in the payments industry.

Where is Clio Payments available?

Clio Payments is available to customers in the U.S., Canada, the UK, and Ireland.

What is Clio’s chargeback guarantee?

Credit card disputes happen, and if and when they do, Clio has you covered. Chargebacks are fees charged by banks when a client disputes a charge, but rest assured that funds will never be taken from your trust account. If a chargeback occurs, you will be alerted and our team will walk you through the dispute process step by step.

Can clients pay by eCheck?

How do I accept online payments with Clio?

Current Clio Manage customers can set up Clio Payments right from within Clio Manage by going to the Online payments tab. From there, select the Access more features subtab and click Activate today. You’ll be asked to enter details about your business and financial institutions. Once done, activation takes as little as one minute.

What information is required to set up payments in Clio Manage?

Clio Manage requires the following information about your firm to activate online payments: business type; business name; employer identification number (if applicable); business email, phone number, and address.

In addition, the following personal information is required for all firm owners with at least 25% ownership: name; date of birth; social security number; email; phone number; address; and bank account and routing numbers for any accounts you want to connect to Clio Payments. Learn more.

How does Clio's law firm payment processing work?

With Clio Payments, law firms can securely accept payments online and in-person and stay in compliance with trust accounting rules. With Clio’s instantly payable invoices, law firms reduce administrative burden, get paid faster, and make reconciliation a breeze.