When it comes to paying for their legal fees, today’s clients want three things: convenience, security, and flexibility. Law firms with limited payment methods aren’t giving their customers what they want and expect—which ultimately hurts their bottom line.

The 2021 Legal Trends Report shows that 66% of consumers prefer online payment methods, including:

- Credit cards

- Debit cards

- Online payment systems

- Alternative payment options

The bottom line: Firms that offer a variety of payment methods (especially online payment methods) make their clients’ lives easier and get their bills paid faster.

In this post, we’ll cover the different payment methods your clients want—and how you can choose and implement them.

Is your firm allowed to accept online payments?

It’s clear that clients increasingly want to pay their legal fees by credit card or other online payment methods.

But are lawyers allowed to accept payments online?

The short answer is yes.

The long answer isn’t so straightforward because, as with many elements of practicing law, law firms must consider their ethical obligations.

The ethics of online payments

One of the most common ways to accept online payments is by credit card, using a payment processing solution for law firms.

Although lawyers have accepted credit card payments for legal fees since 1974 (ABA Formal Opinion 338, dated November 16, 1974), the ethics of doing so are very complex.

There are two main reasons for this:

- Accepting credit cards in person and online may require different ethical considerations.

- The rules can vary depending on a law firm’s location.

As our guide to the ethics of law firms accepting credit cards explains, some lawyers are hesitant to accept credit card payments for legal fees.

This is largely because people can use credit cards in so many different ways, like paying outstanding legal fees, putting funds into a firm’s trust account, or reimbursing a firm for expenses.

Meaning: Your clients can use credit cards flexibly, which different state ethics committees may address in different ways.

For example, four states expressly permit law firms to accept credit cards in all of the above hypotheticals; while eight states forbid passing credit card surcharges to clients.

To explore more payment resources, be sure to check out our payment hub page.

Four ethical considerations for law firms accepting credit cards

These are the four ethical questions surrounding the acceptance of credit cards by law firms.

- Can I accept payment for legal fees and expenses via a credit card?

- Can I accept advance payment of fees via a credit card?

- Can I pass a surcharge to my client to compensate for the processing fees charged by some credit card processors?

- Can I set up recurring charges to customers once they have stored a credit card on file with my law firm?

The ethics opinions on these considerations vary state by state.

Law firms also need to exercise care regarding how and in what instances they accept online payments via methods like PayPal or Apple Pay. Ethics opinions around other online payment methods are still evolving.

For instance, while collecting fee payments for completed legal services may be acceptable, taking retainers or holding unearned fees may not be possible with some payment methods.

When firms place funds directly in a trust account, services that transfer funds into other accounts or take processing fees may conflict with the rules.

The ABA’s Model Rules of Professional Conduct Rule 1.15: Safekeeping Property (c) notes, for example, that lawyers must deposit any legal fees and expenses paid in advance into a client trust account (until the fees are earned or expenses are incurred).

Lawyers must review and abide by specific rules for law firms on accepting credit credits and other online payment methods in their jurisdiction.

It’s also important to check regularly, as these rules continue to evolve. We have a list of resources you can follow to keep up with all the legal industry updates.

You may like these posts

What type of payment methods should you accept?

As a next step, you need to determine what payment methods to accept in your law firm.

Whether you’re a solo attorney or a new firm, the key questions to consider include:

- What lawyer payment methods do your clients want?

- What are the ethical rules and guidelines for payments in your jurisdiction?

- What forms of lawyer payment can your firm handle?

Your law firm can still accept payment methods like cash and checks. But you also need to look beyond these traditional methods and consider lawyer payment methods that deliver a stronger client experience—online payments.

It’s not only your clients who benefit, though. Online payment methods also tend to bring significant benefits to law firms, like faster payments, more revenue, and even more clients.

In fact, at Clio, we’ve seen that law firms that continually grow their revenue are the ones that harness the power of online payments. Specifically, the 2021 Legal Trends Report found that these firms are 37% more likely to use online payment solutions. This underscores the value that innovative payment methods can play in helping a law firm scale.

The 4 payment methods your clients want

Now that we’ve covered the basics, let’s discuss the types of lawyer payments your clients want you to offer.

When law firms offer a greater variety of payment methods—especially that make it easier and more convenient for clients—it can lead to faster payments (and more revenue). Specifically, the 2019 Legal Trends Report notes that 57% of online payments get paid within the day they’re billed, and 85% are paid within a week.

If your firm wants to get paid faster and improve your law firm cash flow, you should consider the following lawyer payment methods:

1. Credit Cards

As we’ve already outlined, credit card payments (specifically online credit card payments) can be an excellent payment method. That’s because:

- It’s familiar. For many clients, credit card payments are already their preferred payment method in their day-to-day life (be it big-ticket purchases, daily expenses, or utilities).

- It’s more convenient. Familiarity aside, online credit card payments allow clients to pay their legal bills quickly, easily, and more securely.

- It helps your firm get paid faster. When paying is effortless, clients tend to pay their legal bills sooner. Online credit card payments also reduce the time delay between the client making a payment and your firm receiving it.

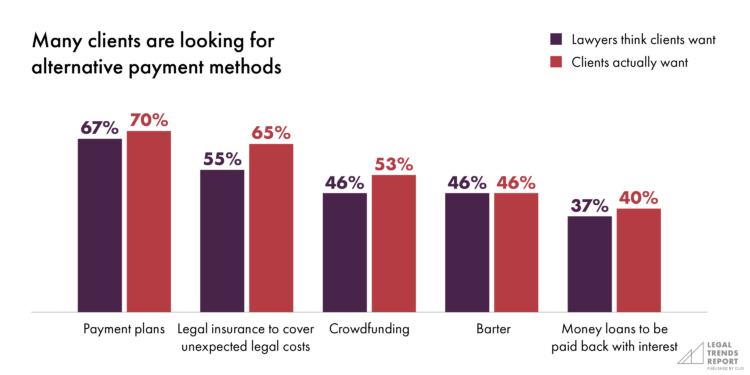

- It gives clients the flexibility they want. In cases where clients don’t have the cash on hand to pay a large legal bill, alternative fee arrangements may better serve them. Firms that use payment plans via credit card provide further payment flexibility for clients. As the 2022 Legal Trends Report found, it’s a wise move to do so: 70% of consumers want the option to pay a lawyer via a payment plan.

Choosing a credit card processing solution

It’s important to choose a credit card processing solution carefully. As our guide to picking the best credit card processing service for lawyers explains, the right credit card processors for lawyers should be legal-specific. It should offer firms solutions that:

- Integrate with their processes. Legal credit card processors should integrate with your firm’s billing, accounting, and practice management software. When your firm’s tools work together, you can save time, reduce redundant data entry, and lower the chance of human error.

- Offer competitive pricing. Take into account the processors’ monthly and per-transaction fees.

- Ensure trust accounting compliance. The ability to ensure trust accounting compliance is essential when accepting credit card payments online—and the right credit card processor can help. A law-specific credit card processor like Clio Payments helps your firm stay compliant by charging credit card processing fees and account fees to your operating account.

Learn more about how to accept credit cards at your law firm.

2. Debit

Credit card payments deliver scores of benefits to lawyers and clients, but they aren’t the only lawyer payment option to consider. Like credit cards, debit payment options also provide the convenience, efficiency, and familiarity that clients want and expect.

In fact, the 2019 Legal Trends Report noted that 40% of clients would never hire a lawyer who didn’t take credit or debit cards.

Online debit payments allow clients to easily make legal payments without having to worry about interest payments. As with all online payment options, it’s important for law firms to consider their ethical responsibilities when accepting online debit payments.

By accepting multiple online payment options, law firms make it easier for clients to pay, which can help grow their practice.

Providing various convenient lawyer payment methods is just one way to prioritize the client-centered experience.

To learn more about why the client experience matters, listen to this episode of Clio’s Matters podcast.

3. Accept ACH payments

ACH or “automated clearing house” is a commonly used term for eChecks (electronic checks). This is another lawyer payment method that you should consider to make payments faster and more convenient.

An eCheck serves as a digital version of a traditional paper check. eChecks use the ACH network to transfer funds electronically from a client’s checking account, so they can pay their bills directly from their online bank account, opposed to writing a check.

eChecks function similarly to paper checks—but with a lower cost than credit cards.

To accept eChecks, law firms need to use an online payment solution that includes eChecks as a payment method. A legal-specific eCheck processor allows law firms to accept eChecks as a lawyer payment method securely.

Attorneys should be aware and careful to follow ethical guidelines when accepting payments via eCheck, just as they would with any lawyer payment method. However, using legal-specific processors can make this easier.

4. PayPal

Law firms can also consider online payment systems like PayPal when looking for lawyer payment methods that clients want.

PayPal offers a convenient, easy-to-use payment option that appeals especially to certain generations of clients, such as millennials.

However, platforms like PayPal do come with different considerations than other lawyer payment methods. In particular:

- PayPal takes a cut of payments—which can impact revenue.

- Law firms must ensure payments accepted via platforms like PayPal follow all ethical and compliance rules.

As mentioned earlier, the nature of PayPal could make it difficult to ensure compliance when accepting payment for retainers or funds for a trust account.

In a 2018 opinion, the South Carolina bar allowed lawyers to accept payments via PayPal, as long as certain restrictions—like not commingling client funds with their own—are followed.

Be sure to check your state’s rules about accepting legal payments via PayPal to ensure you’re able to stay compliant.

Streamline your billing and payments with an all-in-one solution

If you’re looking to update your payment methods, an all-in-one billing payment solution is the best place to start.

By connecting your billing process and payments, you can create smooth, streamlined workflows. This ultimately allows you to save time and money on your billing and collections process.

The right solution can also help you avoid potential compliance issues while still accepting the online payments that clients want.

Take Clio Payments, for instance.

Clio’s built-in credit card processing system lets you automate your billing workflows and securely collect legal credit card payments. This gives clients the convenient, client-centered experience they want.

Clio Payments also helps your firm stay compliant while accepting online credit card payments. It does this by allocating fees (earned and unearned) to operating and trust accounts according to professional and state bar trust accounting guidelines, and by protecting IOLTA accounts from chargebacks should there be a dispute.

In addition, Clio Payments also provides payment flexibility to clients, with not only online payments, but automated payment reminders, bulk billing, and split billing functionality to allow for multiple payers.

Final notes on payment methods

Payment is an integral part of a successful law firm’s billing process. And savvy law firms are making it a top priority to give legal clients what they want when it comes to payments.

That being said: While today’s technology makes a variety of potential payment methods available, not all options are suitable for law firms. You should look for an all-in-one solution that integrates with other firm tools (such as practice management software) and allows them to accept multiple payment methods.

For example, Clio Payments makes online payment processing for law firms simple. You can also use our all-in-one solution to set up recurring credit card payment plans for clients. And, because online payments in Clio Manage is a component of legal practice management software, it works seamlessly with your billing workflows to save you time and help your firm get paid faster.

Moving beyond traditional payment methods can reveal many benefits for law firms, such as increased revenue. But the core advantage centers around clients. Client-centered law firms put their clients’ experience first—and today’s clients want more options and convenience when it comes to payment.

The information in this article applies only to US practices. This post is provided for informational purposes only. It does not constitute legal, business, or accounting advice.

We published this blog post in October 2021. Last updated: .

Categorized in: Business, Technology