Your clients are used to having experiences that put them first. In today’s marketplace, they can shop, consume content, and communicate with service providers via a wide variety of connected channels.

So when they need legal support, they come filled with high expectations for client-centered experiences. That’s true from client onboarding all the way to how easy it is to make a payment.

Simplifying the way clients pay you by expanding the online payment methods you accept can drastically improve the client experience, and differentiate your firm from the competition.

One way to do this is to accept ACH payments. Below, we’ll dive into ACH payments for lawyers, including how to accept ACH payments, what risks to pay attention to, and what rewards you can gain once you take the leap.

What is an ACH payment?

An ACH payment is a form of electronic or digital payment. ACH payments allow businesses including law firms, to: A) Accept payments wherever and whenever is most convenient for clients; B) Split a fee into installments—for example, in the case of a deposit or a retainer; and C) Automate your billing system, so that invoices get paid on time.

ACH stands for “automated clearing house,” and what it mostly clears is your time, your to-do list and the billing limitations that keep your law firm from taking its client-centered mindset to the next level. NACHA, the governing body for ACH, manages the ACH Network. This network safely and securely processes electronic financial transactions for everyday consumers and large and small businesses, as well government agencies, in partnership with ensures a safe and smart payment system that can partner with all US banks.

What is an example of an ACH payment?

NACHA offers a few examples of how ACH payments are already integrated into your life, including when you: A) See your paycheck appear in your bank account through direct deposit; B) Pay a bill online instead of in person; or C) Set bills to get paid automatically on a recurring basis.

In many cases, NACHA explains, you can simply set your billing system once, and it’ll make sure your billing is taken care of.

Why should my law firm accept ACH payments?

ACH payments create a better billing experience for clients, which increases their likelihood of choosing your firm and of paying their bills fully, on time. In addition, adding a new payment method to your processing can also improve your bottom line and improve employee well-being within your firm.

Benefits of ACH payments for lawyers

The following benefits of ACH payments for lawyers are proof that sometimes all you need is a small change to make a big impact.

- ACH payments are fast and easy.. Traditional checks mean clients have to visit the post office or your office. And your office has to process the physical check. With ACH payments, both parties are done with a few mouse clicks, giving you both time back in your busy days.

- ACH payments save money. Less time on administrative tasks means more time for revenue-generating activities (or taking an extra hour a week for employee happiness, which will ultimately lead to a more creative and profitable team). Plus, if your billing includes many transactions, you’ll end up saving on processing fees, as ACH fees are generally lower than other payment forms.

- ACH payments help you make money. Clio’s 2019 Legal Trends Report discovered that 14% of law firms’ billable hours don’t get paid. That can easily add up over the course of a year. Simplifying the process with ACH can help you collect more of your hard-earned money.

- ACH payments deliver a better customer experience. A better customer experience means more repeat business, better word of mouth and online reviews, and more referrals.

Benefits of ACH payments for clients

The main benefit of ACH payments for lawyers is that they’re great for clients.

- ACH payments are convenient. Clients can pay whenever and wherever they want, without wasting time in traffic just to bring over the payment or deposit it at the bank.

- ACH payments are secure. As ACH payments are governed by the NACHA Operating Rules, clients can feel more secure that their payment will arrive online and on time via ACH compared to snail mail.

- ACH payments are safe. With the COVID-19 pandemic still controlling many aspects of our lives, clients want contactless commerce that keeps them COVID-safe.

- ACH payments are environmentally friendly. According to an Edelman study, 60% of people want to buy from companies that take proactive action toward making the world a better place. Reducing paper usage while making their lives easier is a simple way to help clients connect with your brand emotionally.

Risks of ACH payments

No one can guarantee a 100% risk-free transaction, so it’s important to be aware of the risks—and verify that your payment provider is set to mitigate as much of that risk as possible.

- Although ACH payments are not governed by PCI compliance, as credit card payments are, the ACH Network does offer comparable internal controls and is considered safe. But as with any digital system, data breaches or data losses are possible.

- As Corporate Compliance Insights points out, payment fraud and ID theft could wreak havoc on your firm (but the risk is low with ACH).

- System downtime is rare, but can cause payment delays when it does happen.

Corporate Compliance Insights recommends verifying your provider has “a strategic plan to identify, analyze and oversee security risks,” pointing out that many companies automate this process with software to ensure continuity even during busier times.

Plus, often, you can request companies to show you any security certifications provided to them by industry authorities, though this can be a long process.

You may like these posts

How can my firm accept ACH payments?

Adding any new process to your firm can seem daunting, and adding an online payment method such as ACH is no exception. Fortunately, it’s easy to get up and running.

Here are the steps we recommend you follow:

- Ensure your customer base is right for ACH payments. Note that countries outside the US don’t work with ACH.

- Choose an ACH provider. You have several options when it comes to ACH payment providers, including familiar names such as PayPal and Stripe. We recommend choosing with a platform that specializes in law firm payment processing. A payments provider that works with law firms will understand industry requirements and have the checks and balances in place to ensure compliance with regulations such as trust accounting rules.

- Set up the back end. ACH payment setup is typically simple and all done online, so there’s no need to deal with hardware. Once onboarded you can add ACH payment instructions to your invoices and online payment options.

- Gain authorization from clients and suppliers to start charging and paying them via ACH. With a good platform, it’s just a matter of a few short steps that can be done online.

How to accept ACH payments securely

Client confidentiality and regulatory compliance are critical for your law firm. Any payment method you offer, and the platform you choose to power that method, must be secure and must meet compliance requirements. Thankfully, ACH payments are low-risk on both fronts.

Still, to ensure peace of mind when accepting ACH payments, it’s a good idea to confirm that the platform you choose is one that is PCI compliant. Although, as previously noted, ACH payments don’t need to follow PCI-compliant standards, if your payment provider also processes credit card payments and complies with the PCI standard, it’s a good indication of their commitment to security.

How do ACH payments compare to other payment methods?

To fully understand the benefits and risks of ACH payments for lawyers, let’s compare this system to more traditional payment methods.

ACH payments vs. credit cards

ACH payments take the credit card convenience of remote, cashless payments, to the next level. But there are two main differences in ACH payments vs. credit cards:

- ACH offers lower fees. We’ll expand more about it in the next section.

- Credit cards inform you right away, at the moment of transaction, whether the payer has enough funds to cover the deal. With ACH, that’s something you’ll only discover within one to three days.

ACH payments vs. wire transfers

When it comes to ACH payments vs. wire transfers, they both offer benefits:

- Wire transfers allow you to operate globally, whereas you can only use ACH in the US.

- ACH offers lower fees than wire transfers.

- Wire transfers get payments processed immediately. ACH takes one to three days, although there’s an increasing amount of instant ACH options these days.

- ACH allows you to cancel transactions much simpler than wire transfers.

- They’re both secure payment options, but ACH is more regulated, so there’s some added level of security.

ACH payments vs. checks

Paper checks might be the billing method to win the ACH payments vs. checks debate when it comes to transaction fees, but there are additional considerations.

- ACH is more convenient, since it can be done from anywhere.

- This convenience saves money, and we’re not just referring to post office costs if you snail mail the check. The time it takes for the payer to go to the post office, wait in line, then wait for the check to arrive—and for the receiver to go to the bank, wait in line, wait for the check to be accepted. That’s equivalent to a lot of money. Even if you commute to give or receive a check in person, you’re still wasting time.

- If the payer doesn’t have enough money in her or his account to complete the transaction via check, the payer might be charged a fine. This doesn’t happen with ACH.

- As mentioned above, the ACH system is highly regulated and, therefore, far more secure.

- Paper checks are bad for the environment. Using ACH helps save trees and the planet, which need all the help we can give them right now. Plus, as mentioned above, transitioning to a digital billing system provides your clients with an opportunity to make a difference simply by choosing your law firm over others.

How much do ACH payments cost?

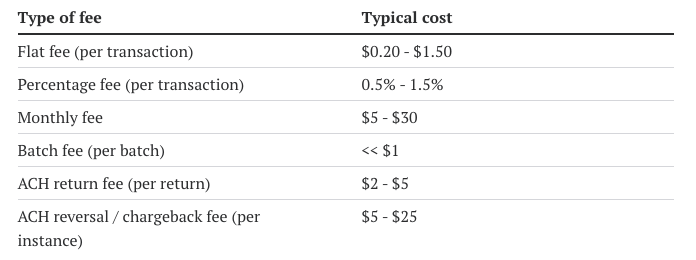

A big part of figuring out how to accept ACH payments is understanding how much this new system will cost your law firm.According to Merchant Maverick, you can expect a flat $0.20-$1.50 fee per transaction, a 0.5-1.5% fee per transaction, or a combination of the two.

“However, in contrast to credit card transactions, many providers place a cap on ACH fees. This tends to fall somewhere around $5,” adds Merchant Maverick, making ACH payments very cost effective for lawyers.

That said, there are additional fees you need to take into consideration:

Source: Merchant Maverick via GoCardless

So, after all this, is it time ACH payments for lawyers become the go-to option?

ACH payments for lawyers: Really the best option?

ACH payments for lawyers are growing in popularity because they’re cost effective, convenient, and client-centered. Plus, with so many great tools out in the market, the daunting task of figuring out how to accept ACH payments becomes an easy one (At the risk of a shameless plug, platforms like Clio specialize in the legal industry, so you can collect more payments, get paid faster, and still remain ethical and compliant).

You don’t need to throw all other payment methods out the window. Many clients still use credit cards, wire transfers, and even checks. But when you expand your digital billing options, you reduce their effort in doing business with you, while helping them easily contribute to a more sustainable world.

What does ACH stand for?

ACH stands for “automated clearing house”. ACH is a U.S. financial network for electronic payments and money transfers. Sometimes referred to as direct payments, ACH payments are a way to transfer money from one bank account to another without using paper checks, credit card networks, cash, or wire transfers.

What is an ACH payment?

An ACH payment is an electronic or digital payment. ACH payments allow businesses, including law firms, to accept payments wherever and whenever is most convenient for clients. In addition, businesses can split fees into installments and automate billing systems.

We published this blog post in April 2022. Last updated: .

Categorized in: Business, Technology