Billing is critical to the success of your law firm. And yet law firm billing, including billing clients and chasing down payments, can be one of the most repetitive, dreaded, and time-consuming parts of any lawyer’s day.

According to the 2022 Legal Trends Report, lawyers record only 2.6 billable hours per day on average, with the rest of their day going towards various non-billable tasks. These tasks often include billing-related activities like preparing and sending invoices, processing payments, and updating trust ledgers. While the amount of time dedicated to non-billable work is less than ideal, it also presents an opportunity: Law firms that can streamline their billing process can free up time to spend on helping clients and logging more billable hours.

From tips for creating effective legal billing guidelines to ways to improve billing productivity and get paid faster, read on for what you need to know about law firm billing. (You can also book a demo of Clio Manage, and ask how you can use it to streamline billing for your law firm).

The law firm billing process

In many cases, the law firm billing process looks something like this:

- The firm brings on a new client and opens its case.

- Billable time and disbursement fees/expenses are logged throughout the case.

- At the end of each month (or at the end of the case, if it’s a shorter case), bills and expenses for each client and case are put into a draft bill.

- Attorneys add notes and adjust costs as needed and approve the bill.

- A final version of the bill is created and sent to clients for payment.

- Clients pay via whatever payment methods are accepted at the firm.

- The accounting team sends follow-up reminders regarding late payments.

While it seems fairly straightforward, there’s plenty of room for bottlenecks and wasted costs. For example, attorneys taking too long to approve bills or adding too many edits can cause a delay in bills getting sent out.

Your law firm’s billing policy

To save your law firm valuable time and money, having a straightforward, standardized law firm billing policy in place is essential. It gives lawyers and staff something to refer to and keeps everyone in sync.

If you’re writing a policy for the first time, you’ll want to consider:

- How your firm bills clients.

- Where you see the most errors.

- Which stages of the process are causing the biggest bottlenecks.

With that in mind, follow these steps to write an effective billing policy:

1. Provide a template and guidelines for staff

Your standardized template and process should include:

- When to send invoices.

- How long legal billing descriptions should be.

- What expenses must be included on bills versus what should be written off.

- Any standard introductory communications on bills, if needed.

Investing early on in a transparent and accessible billing and expense process will save you time later on.

Managing expenses is a challenge in its own right. Learn more about law firm expenses.

2. Write out the flow of your law firm’s billing process

Become an expert in the lifecycle of your bills. You should be able to quickly answer the following questions about your firm’s billing process:

- Which attorneys on a case need to review a bill?

- In which order?

- Are bills mailed or sent electronically?

- Who should one inform when sending a bill out?

Write out your entire process from start to finish, so there’s no confusion—even if you’re a solo attorney. This understanding helps support your bottom line, and helps you better understand your clients—giving you momentum to invest in the client-centered experience.

3. Set requirements for invoice review

It’s helpful to ask lawyers to use a specific system, such as your legal practice management software, to conduct reviews electronically (you can easily keep track of this in Clio). This helps speed up the process and leaves less room for error—you can even use automation software. Be sure to check out our blog post on streamlining your law firm invoice process for further guidance.

4. Integrate the finance team with your billing process

Ensure your accountant or finance team knows when your firm is sending bills to clients, what still needs to be collected, and what’s being written off. Gaps in communication can cause confusion and delay the payment process.

5. Include a standard process for disputes and collections

Don’t leave unpaid bills languishing for months. The longer you wait, the less likely your clients will pay, so have a straightforward collections process. Identify who needs to follow up on unpaid bills and when. Have a standard but personalized reminder email or letter you can easily send to clients. It’s okay to repeat the same phrasing, but the tone and message should feel friendly, calm, and kind. Paying for legal services is stressful enough; it’s important to empathize with and reassure your clients.

If a client disputes a bill, know who will review the dispute and provide frameworks for resolving the issue.

6. Have a public billing policy for clients

Legal billing guidelines outline the rules that a law firm follows when invoicing clients. Establishing clear legal billing guidelines upfront gives clients a clear vision of what they can expect when they receive their legal bills.

Your clients should be well-acquainted with your billing policy, so they’re clear on:

- When and how often bills will arrive.

- The different payment methods available.

- How much time clients have to pay.

- The consequences for late payments.

Write this out clearly and provide it to all new clients, preferably right after their initial consultation. New clients might feel overwhelmed by new information and potential strife and uncertainty about their case. Having your attorney billing guidelines in writing will ensure clients can go back and review it at their convenience.

You may like these posts

Invoice requirements

If you’re working with a larger company, there may be strict invoice requirements regarding everything from how you need to send bills to how you must format bills. However, even if you’re not working with big businesses, you should still stick to a standard set of invoice requirements. This will ensure consistency for your clients and keep the billing process running smoothly.

Legal billing description examples

Clear communication is key. Clients want to know what they’re paying for, which makes legal billing descriptions a key part of your invoice. But how much detail should go into each entry on a legal bill?

As our legal billing template shows, the framework can be straightforward and set up as an itemized list. Then, each line should have a concise, clear description of the service provided. Legal billing entries should neither be too long or too short. They should provide the right amount of context and information to leave the client satisfied that they’ve received the value they’re paying for. Clear billing descriptions lead to fewer disputes later on in a case.

If we consider billing descriptions from the perspective of the client, this becomes more clear.

Poor sample attorney billing descriptions that would not provide clients with enough information could look like:

- “Met with client.”

- “Did legal research.”

- “Facts of case.”

Instead, more effective legal billing entry examples could look like:

- “Met with client to review wills and answer questions.”

- “Legal research to strengthen arguments for next month’s hearing.”

- “Spoke about and recorded the facts of the case with the client.”

Law firm billing codes

Separate from descriptions, billing codes convey—at a high level—which activities or expenses a client is being billed for.

Example codes might look like:

- Meeting

- Draft/revisions

- Research

These codes should, at the very least, be consistent within your firm. Another way of doing this is to use standard billing codes as outlined below.

LEDES billing

If your law firm works with larger clients, your billing process may include an extra step: Formatting your bills to use LEDES billing codes for time and expense entries.

LEDES stands for Legal Electronic Data Exchange Standard. LEDES billing is a standard format for electronic legal billing that uses specific format guidelines. It makes it easier for large organizations to handle large amounts of files and data, and assess invoices, as they will all be coded in the same format.

Unless your client specifically asks for it, you probably won’t need to provide LEDES-formatted bills. However, it’s worth checking if you’re working with a business or a larger client.

You can also use UTBMS codes (Uniform Task-Based Management System Codes) to give further detail on a LEDES bill.

Creating a billing template

If you’re not sure where to start with standard invoice requirements, plenty of billing templates are available. Software suites like FreshBooks provide an excellent law firm billing template. You can also create customized bill templates by using bill themes in Clio.

Top tips to improve billing productivity

1. Set expectations with clients up-front about your firm’s billing process and policies

Good attorney billing comes down to clear communication with clients. A bill isn’t just an invoice: It’s a tool for communicating the value you provide to your legal clients.

Depending on your practice area, hiring a lawyer may be one of the most expensive things your client ever does. Spare them from unexpected bills: Set clear expectations as to what clients can expect to see on invoices, when they’ll receive them, and how they’ll be able to pay.

2. Track your time as you work for more accurate billing

If you’ve ever sat down at the end of a workday and tried to remember exactly where your time went, you know just how difficult it is to get everything recorded on a bill. Use a timekeeper to track your time as you work, and take notes to ensure the client is crystal clear on the value you’ve provided. This is the best way to ensure nothing gets missed and that every time entry is accurate.

Legal timekeeping and expense tracking software can help you meet your billable targets, bill clients in real time, and increase cash flow. Learn more about timekeeping and expense tracking and check out our reviews of the best time and billing software.

3. Use clear descriptions

Your invoices to clients should be easy to understand, but that doesn’t mean they should lack detail. Clearly articulate everything you’ve done for your client: An item for a 15-minute call to review the case with no context might leave a client feeling confused or anxious about the charge.

Consider: Katy Young of Ad Astra Law Group prioritizes adding clarity and detail to billing descriptions because she believes it creates trust—which makes her clients more willing to pay.

4. Bill frequently, and consistently

With the right system, you can send out bills and reminders quickly, so there’s no reason to put off billing your clients. Sending out smaller bills consistently can lower the shock of a large unexpected bill. Plus, there’s the added benefit of encouraging a smoother cash flow for your firm.

5. Automate, automate, automate

There are plenty of solutions available to help automate routine tasks, so you can spend your time and energy on things that can’t be automated, like answering difficult questions or giving your clients peace of mind.

Before implementing any software, know that process should come before technology. Understand the kinks in your billing processes, then look for tools that can help improve them.

Some examples include:

- Using software like Clio Manage to generate draft bills in minutes.

- Using Automated Bill Reminders in Clio Manage to automatically send Outstanding Balances to your clients and bill recipients based on a schedule you can customize.

- Accepting online or credit card payments to get paid faster. Learn how to pick the best credit card processor for your firm here.

- Leveraging Clio’s billing integration partners to make the payment process quicker and easier for clients.

Setting the right rates for your firm

To start calculating your firm’s billing rates, read this article on how to calculate your hourly rate based on your cost of doing business. It will also help you factor in the number of billable hours you expect to record in a year (if your firm bills hourly instead of via flat fee or contingency).

Then, check how closely your chosen rate tracks against market rates.

With the 2022 Legal Trends Report, you can benchmark your law firm’s rates against other firms in your state or practice area, including actual rates and rates adjusted for cost of living in each state.

Some interesting statistics:

- The highest average hourly billing rate by state was $424 per hour in Washington, DC.

- The lowest average hourly billing rate by state was $168 per hour in West Virginia.

- The highest average hourly billing rate by practice area was for bankruptcy law at $377 per hour.

- The lowest average hourly billing rate by practice area was for juvenile law at $103 per hour.

Subscribe to the blog

If you’re low compared to your state’s average firm billing rates, consider raising your rates. If your rates are higher, think carefully about how you’re providing extra value to your clients to make that rate make sense.

Remember that the rate you charge is, to some extent, up to you. If you’d like to charge a little less to keep legal services affordable for others in your community, that’s completely fine.

Determine if your rates are competitive by viewing industry averages from others in your practice area. Compare your rates now.

Goodbye billable hours: alternative billing arrangements

What are billable hours? This has long been subject to debate amongst law firms. The practice is alive and well, but plenty of lawyers advocate that this isn’t the best way to charge for legal services—at least not for every practice area.

Here are some alternative billing arrangements:

Subscription-based law firm

With a subscription-based firm, you provide clients with legal services on an as-needed basis for a set monthly subscription fee. This setup works well for small business clients who may need regular help with trademark applications, proactive IP protection measures, transactions, and more.

This leads to a more predictable income for your firm and smoother working relationships. It can be a challenge to get clients to buy into the idea if they’re used to the billable hour, but it’s worth it. Learn more about running a subscription-based law firm here.

Sliding scale fees

If you work with clients with lower incomes, sliding scale fees may be appropriate. Clients pay fees based on their household income rather than a standard rate. This approach can help your firm access more clients by making your services more affordable.

Unbundled services

The idea of “unbundled” legal services refers to limited scope representation. The limited scope attorney and the client agree to define the attorney’s involvement in their case. Unbundled legal services can vary greatly, depending upon the agreed-upon task(s), in both litigation and transactional matters.

Examples of unbundled legal services might include:

- Evaluating a case or transaction.

- Providing limited litigation or transactional guidance.

- Suggesting court documents or transactional documents to prepare.

Flat fees

If you’re able to accurately scope the amount of work required for certain types of cases, flat fees can be an excellent approach to billing. They create clarity on costs up front, and are a form of value-based billing—meaning that you bill based on the value you provide to your client, rather than commodifying your time.

Of course, there’s some risk of underestimating the work required for a case and setting fees too low. But with diligent case scoping, flat fees can provide an excellent alternative to the billable hour.

Contingency fees

There’s potential to help clients who can’t afford a lawyer with contingency fees. These allow you to receive payment based on a percentage of the money paid out to the client if the case is successful. Depending on the case, this amount can be pretty substantial.

Of course, there’s also the risk that you won’t get paid for your work. But, if you can stomach the risk, billing on a contingency basis is a great way to build a profitable practice and serve those who otherwise might not be able to afford your services. Read these five tips for determining your contingency fees.

Note: Contingency fees are prohibited for certain types of cases, so double-check your state’s ethics rules before deciding to bill on contingency.

Evergreen retainers

Evergreen retainers simplify the process of getting paid on time. Here’s how it works: Your client provides an original retainer held in trust against which legal services are billed—and when their trust account hits a predetermined minimum balance, they replenish the funds.

The key to success is notifying clients when trust funds are at or below the minimum balance required. In this case, technology can help by automating notifications when a client’s trust drops below the minimum balance. Learn more by reading our guide to evergreen retainers.

Payment plans

According to the 2022 Legal Trends Report, 70% of consumers want the option of paying a lawyer via a payment plan. Offering payment plans can be a big help for ensuring your firm gets paid.

Before you start, create clear guidelines for when to offer payment plans and draft an agreement template to determine how you will collect payments, what payment methods you’ll accept, and what happens when a payment is late.

Then, set up a system for billing clients and collecting funds to help automate the repetitive work.

Reasonable fees and price transparency

When it comes to ethics and attorney billing, clarity is key. Rule 1.5 of the ABA Model Rules of Professional Conduct states that a lawyer may not collect an “unreasonable fee” or an “unreasonable amount for expenses.” The ABA provides eight factors to consider when determining whether a fee is reasonable, including fees charged for similar legal services, the reputation of the lawyer, and any time constraints.

As a best practice, make your bills as clear and accurate as possible. If you’re billing by the hour, provide clear, detailed notes on work performed. But if you’re billing via fixed fee or contingency, ensure you’ve got fair rationale to prove your fees are reasonable.

You’ll also need to keep track of payments to avoid the unethical practice of double billing.

Also, if you’re in the UK, you’ll need to be mindful of the SRA’s price transparency rules, which state that price information must be provided in a clear and easy-to-understand format. Other requirements include providing a total cost, explaining the basis of your charges, and communicating what is and isn’t included in your services.

Billing, reporting, and monitoring

To keep your billing process on track, you should keep a close eye on outstanding balances, payments, and revenues. The following reports can help you monitor your law firm’s financial health and keep your billing process running smoothly:

Accounts Receivable Report

The Accounts Receivable Report helps firms determine amounts outstanding on all open and past due invoices on a per-user, per-client, and per-matter basis. The report details amounts due on approved unpaid invoices, partial payments made towards those amounts, and credit notes applied to invoices.

Accounts Receivable Aging Report

The Accounts Receivable Aging Report helps firms track unpaid bills. It divides overdue accounts receivable into aging categories (e.g., unpaid bills 1-30 days old, 31-60 days old, 61-90 days old). This enables you to get paid faster by efficiently following up with clients whose bills are overdue.

Billing History Report

The Billing History Report provides a detailed view of open receivables, past-due receivables, and paid invoices. This provides a complete history of your clients’ invoicing.

Matter Balance Summary Report

The Matter Balance Summary Report gives your law firm a snapshot of outstanding receivables, as well as how much is work in progress, and expenses in progress, on a per-matter or per-client basis. It allows your firm to look at what future revenue remains to be collected for each matter.

Invoice Payments Report

The Invoice Payments Report gives firms a detailed view of payments on invoices for individual matters made towards individual service and expense items. It also details the users responsible for those line items.

Revenue Report

The Revenue Report helps your firm visualize and quantify key performance metrics on a per-user, per-client, and per-matter basis. The report details hours, expenses, and taxes in terms of unbilled, billed, and collected amounts.

How to get paid faster

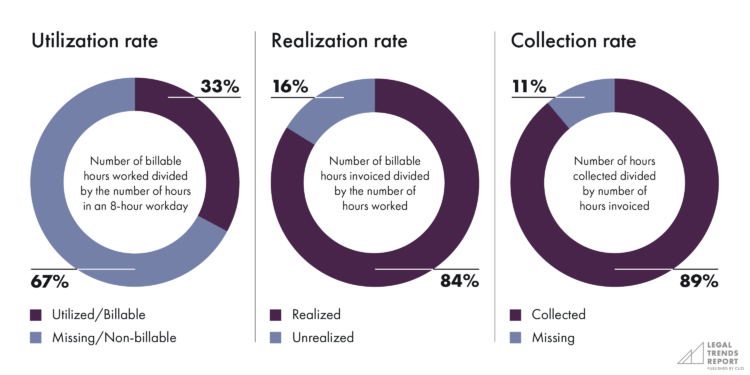

Law firms often find that it takes too long to get paid. The 2022 Legal Trends Report found that of all hours invoiced to clients, 11% are never paid.

Here are four tips to improve collections at your law firm:

1. Improve your timekeeping

One of the most important ways to improve cash flow is to implement diligent timekeeping and recordkeeping habits. How can you collect on time billed if you haven’t tracked it? Take notes on what you’re doing, review outgoing calls and emails, and, as mentioned above, track time as you go.

2. Bill consistently

Think for a minute about the way you handle bills in your personal life. When these bills come at a predictable time, you can budget accordingly and pay them on time. When bills are unpredictable and inconsistent, it’s harder to stay on top of things.

Getting bills out on time, at the same time each month, will help your firm collect faster.

3. Send regular reminders

Don’t let forgotten law firm bills slide under the radar. Make it a habit to send regular reminders to clients who haven’t paid. Automating this process will help save time and money. Again, you can easily send automated bill reminders with Clio Manage.

4. Accept credit card payments

If you’re still asking your clients to pay by check, you may be asking them to use a payment method they haven’t used in years (or one they’ve never used). In the digital era, clients expect convenient online payment options. As a lawyer, you can give them this option with online credit card payments.

All it takes is a bit of due diligence to ensure you’re accepting credit card payments following ethics rules.

Legal firms need a credit card processor that does not allow chargebacks on trust accounts and that does not take fees from trust accounts. So, if a client disputes a charge that results in a chargeback, and the credit card company withdraws money from a pooled trust account, this may cause an ethics violation.

Usually, this means using a credit card processor tailored specifically towards lawyers, such as Clio Payments.

Beyond credit cards, offering other convenient online payment methods—Clio Payments can help you accept payments via debit or eCheck, for example—gives your clients more options, which can help you get paid faster.

Law firm billing software

Investing in billing software for law firms makes a significant difference in how you spend your time—and mitigates the risk of error.

Clio Manage lets you easily create branded invoices and customized billing plans, and accept payment by credit card, debit, or eCheck. It manages trust accounting features and also integrates with your favorite accounting programs including QuickBooks Online, Xero, and Klyant—so you can keep all of your financial information in sync.

Investing in legal billing software to help your process run more smoothly can be invaluable for your firm: Chris Trebatoski of Treblaw LLC gets all his bills out each month in about 15 minutes with Clio—a task that used to take him much longer at a larger firm.

“I spend less time doing my time entries and sending out my bills using Clio than I spent being the Chair of Billing and Collection at a large law firm calling other lawyers saying, ‘Could you get your bill out?’” he says.

Again, it’s crucial to think about your process before technology. Don’t be afraid of a learning curve. Software like Clio Manage is intuitive, and a small investment in learning how it works can yield a lifetime of simplified billing practices for your law firm. Book a demo today to see how it can work for your law firm.

Note: The information in this article applies only to US practices. This post is provided for informational purposes only. It does not constitute legal, business, or accounting advice.

What is legal billing?

Legal billing is the process of invoicing clients for legal services rendered. Law firms bill hourly, or may charge flat fees or contingency fees for their services.

What are billable hours in a law firm?

Billable hours in a law firm are hours logged by attorneys and other legal professionals for work directly related to client matters. Attorneys should track their time as they work while also setting clear expectations with clients about the billing process.

What percentage of a law firm's time should be billable?

A high percentage of a law firm’s time should be billable, since billable hours are the lifeblood of many practices. This can be accomplished with accurate and efficient tracking and collection of billable time, often with the assistance of legal technology.

What is the rule of thirds billing?

The rule of thirds billing is a traditional approach to lawyer compensation and billing. Using the theory of the rule of thirds, one-third of the revenue an attorney bills for should go towards firm overhead, one-third should go to partner profits, and one-third should go towards the attorney’s salary. So, using this model, an attorney should aim to be bringing in roughly three times their salary to the firm via billing.

What are the functions of a successful legal billing system?

A successful legal billing system saves lawyers time by streamlining billing and invoicing workflows, which means they spend less time on tedious non-billable tasks (like manually preparing invoices, tracking time, sending bills, and processing payments) while freeing up more time to work for clients—all while getting paid faster. A secure and successful legal billing system also helps law firms keep detailed records.

What are legal billing guidelines?

Legal billing guidelines outline the rules that a law firm follows when invoicing clients. Establishing clear legal billing guidelines upfront gives clients a clear vision of what they can expect when they receive their legal bills.

We published this blog post in March 2019. Last updated: .

Categorized in: Accounting