The problem with billing is that it’s time-consuming and takes lawyers away from doing actual legal work. The good news? According to Clio’s most recent Legal Trends Report, lawyers are capturing more billable time for every case they take.

With the right workflows in place, billing your clients is quick and easy. One of those workflows includes using a legal billing template. In fact, standardizing your process with a legal billing template will help cut down on non-billable hours. Also, clients will find it easier to know what to expect when processing your invoices.

(And, to easily create other types of templates for your practice, use Clio Draft to convert your Word docs into dynamic legal templates and cut time spent on routine legal drafting by 80%! Request a demo to see how it works.)

Read on to understand how to set up an effective billing process. We’ve included a free legal billing template for you to reference.

What goes into a law firm invoice?

Billing processes may look a little different depending on the client and practice area. But all law firm invoices should address the following general elements:

- Law firm details: Your identifying details—including firm name, phone number, email address, and physical address.

- Client details: This will vary depending on your client. Typically an invoice is addressed to your point of contact, but some clients may give you a billing contact.

- Date of issue: The date you are sending the invoice.

- Itemized list of service(s): The breakdown of service(s) you provided to your client.

- Billing rate for each service: How much you are charging for the service line item(s) according to the rate communicated.

- Total due for each service(s): The total amount your client owes based on the itemized list and billing rate for each service(s) you provided.

- Subtotal for all services, plus taxes: The total amount your client owes for each service(s) added up, including the corresponding percentage of services tax.

- Payment due date and late payment consequences: The deadline for payment and repercussions if the client pays late.

If you choose to charge your clients a late fee based on a percentage of the total sum, check your local jurisdiction for potential restrictions. For example, Iowa will not allow you to charge more than 5% of the outstanding balance on a delinquent bill.

Free legal billing template

Use this legal billing template to help you get started. We’ve also included step-by-step instructions below on how to use and personalize the template to your needs.

| INVOICE #X | |||

| Date of issue: mm/dd/yy | |||

| Payment due by: mm/dd/yy | |||

| Billed to: | Service Provider: | ||

|

Client Name Street address City, State, Country, zip code Phone number Email address |

Law firm name / Your name (if solo) Street address City, State, Country, zip code Phone number Email address |

||

| Description of service(s) | Hours | Rate | Amount |

| Service 1 | XX | $X.XX | $X.XX |

| Service 2 | XX | $X.XX | $X.XX |

| Service 3 | XX | $X.XX | $X.XX |

| Service 4 | XX | $X.XX | $X.XX |

| Service 5 | XX | $X.XX | $X.XX |

| Subtotal | XX | $X.XX | $X.XX |

| Charges | Amount | ||

| Subtotal | $X.XX | ||

| Discount | $X.XX | ||

| Tax Rate | XX.XX% | ||

| Tax Amount | $X.XX | ||

| Total Balance | $X.XX | ||

| Legal disclaimer: | |||

How to use the legal billing template

The legal billing template above is actually very straightforward to use. Here’s how to use this template:

- Step 1: Number your invoices. Numbered invoices help you track how many invoices you sent out and which ones your clients have paid.

- Step 2: Change the issue date to the date you’re sending the invoice.

- Step 3: Change the payment due date to the deadline you’d like to set.

- Step 4: Fill out the “Billed to” portion with your client details.

- Step 5: Fill out the “Service provider” portion with your details.

- Step 6: Add a detailed description of the services you provided to the client. You can add or delete rows as needed.

- Step 7: Add how many hours you spent on each service(s).

- Step 8: Add your rate for each service(s).

- Step 9: Total up each row into the Amount column.

- Step 10: Fill out the subtotal row under the Hours column with the total number of hours you worked.

- Step 11: Fill out the subtotal row under the Rate column with your rate. If your rates vary across the services you provide, leave this blank to avoid confusion.

- Step 12: Fill out the subtotal row under the Amount column by adding all the numbers in the Amount column.

- Step 13: Fill in the Subtotal row under Charges with the number you calculated in Step 12.

- Step 14: Fill in the Discount row with any discount(s) you’re giving the client (if applicable)

- Step 15: Fill in the Tax Rate row with the appropriate tax rate.

- Step 16: Fill in the Tax Amount row with your Subtotal amount in Step 13 multiplied by your tax rate in Step 15.

- Step 17: Add up all the rows and fill in the Total Balance.

- Step 18: Add legal disclaimers like late payment consequences.

If you don’t already have a billing policy in place, check out our guide on developing a billing procedure for your law firm.

Benefits of using a legal billing template

Even if you have established a billing process from memory, using a template can reduce redundancies and human error. Here are a few other benefits:

- Create custom invoices for different clients: Depending on the case, billing structure, and client, your invoices may vary. Having a template will ensure your invoices always contain your standard information but are still flexible to customize as needed.

- Sending detailed and accurate invoices becomes easy: Standardizing your billing process means you won’t be scrambling to gather the information you need.

- Save time on non-billable hours: With a legal billing template, you’ll always have a starting point to build on. This way, you’ll save time and send out invoices faster.

- Get paid faster: Unexpected invoices can lead to unnecessary back-and-forths with a client, which wastes your time. Billing consistently ensures clients know when to expect your invoices and helps you get paid faster.

- Offer a better client experience: Sending consistent invoices helps your client with their accounting processes. When your client knows when and how you’ll bill and precisely what you’re billing with, your client will have an easier time getting their accounting in order. Ultimately, better and consistent invoices help your firm provide clients with a client-centered experience.

Using a template doesn’t mean you have to start from scratch. If you already have a documented billing process, incorporating a legal billing template is easy. A legal billing template also helps you skip the entire invoice creation phase.

Want even more template resources? Be sure to take a look at our legal templates hub.

Legal billing best practices

Time is especially precious to lawyers. Lawyers already spend too much time creating invoices, tracking hours, or following up on late payments. These activities take up time that you can’t bill for. A legal billing template is only the start of refining your legal billing process.

Here are a few best practices to keep in mind:

- Set expectations up front: Nobody likes to receive a bill that is more than they expected. Ensure your clients know what they can expect to see on invoices, when they’ll receive the invoices, and how they can pay.

- Track your time: Guessing your hours could potentially lead to underbilling. Keep track of your billable hours with a timer, stopwatch, or whichever method works best and most accurately for you.

- Be clear and detailed: Adding clarity and details to your legal bill will ensure your client understands the value you provide. With a clear and detailed law firm invoice, your client will understand exactly what they’re paying for.

- Be consistent: When your clients know when they will receive your law firm bill, you will not need to send as many (if any) reminders to your clients. With a regular and consistent billing schedule, your clients will also more likely pay their bills on time, which improves your firm’s cash flow.

- Level up with automation: With tools like Clio Manage, you can schedule and automatically send Outstanding Balances to clients to ensure you never miss a billing deadline.

Building out your legal processes includes so much more than just billing—there’s also reporting, monitoring, and more. Read the Guide to Law Firm Billing for a comprehensive look at creating and refining your legal billing process.

Want to see how Clio can help your law firm simplify running your firm? You can see Clio in action.

Law firm collections best practices

When it comes to maintaining cash flow for a law firm, billing is only the first step—getting paid is the ultimate goal. One of the most important ways to improve your law firm’s cash flow is diligent record keeping. Knowing where your time is going and ensuring that it’s appropriately billed to the correct client is the foundation for a healthy collections process.

Ensure your bills are understandable by writing in plain language. Also, you need to send invoices early or right after a case is closed. By making it easy for clients to pay you, you can help streamline your collections processes.

Billing reminders

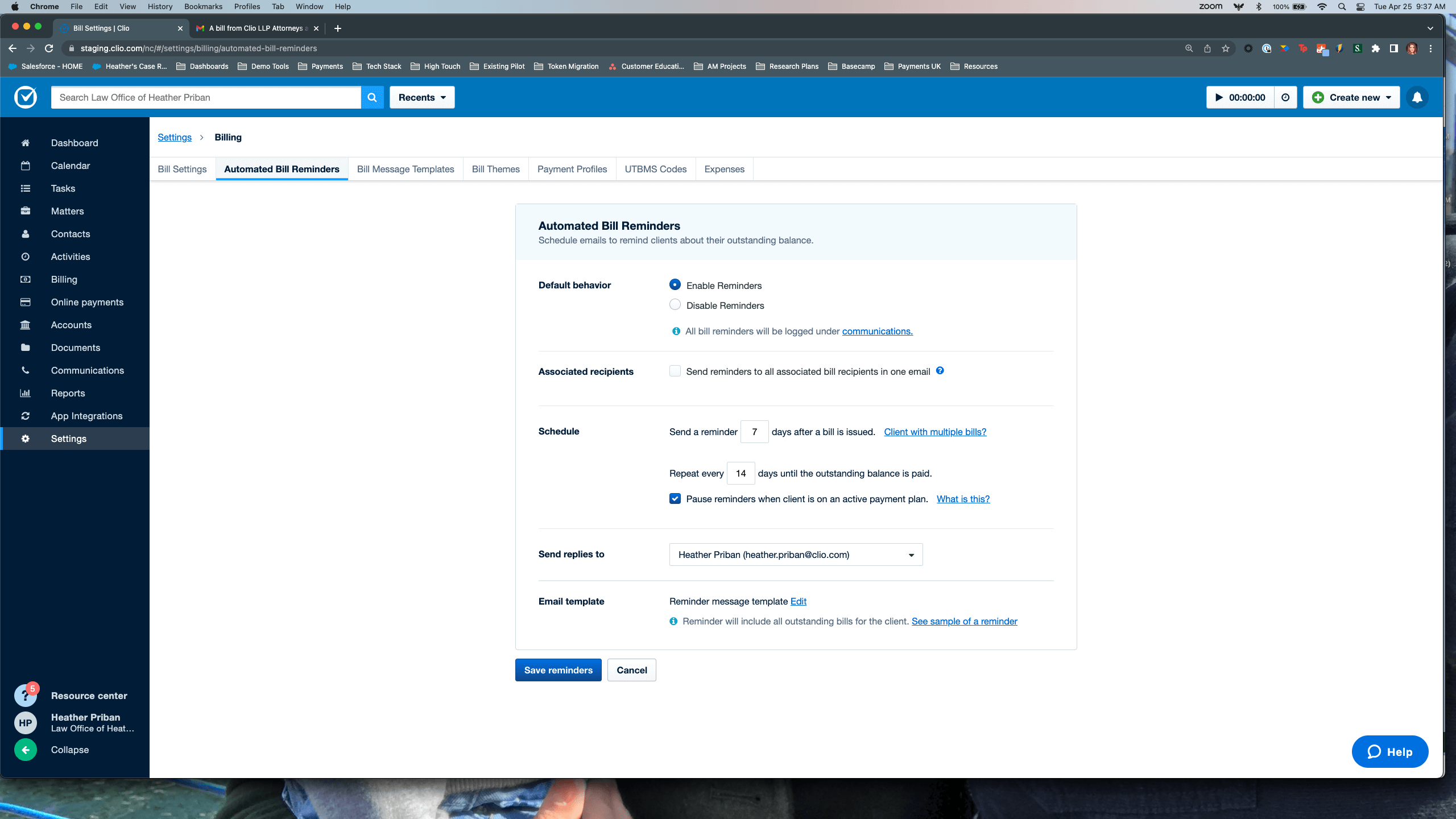

One way to do this is to take advantage of automated billing reminders.

Clients do not always pay bills fully on time, and it takes significant time and effort to manually track and send clients reminders.

Having a software that enables you to automatically send outstanding balances to your clients and bill bill recipients based on a schedule you can customize allows your firm to spend more time on billable work instead of reminding clients to pay you.

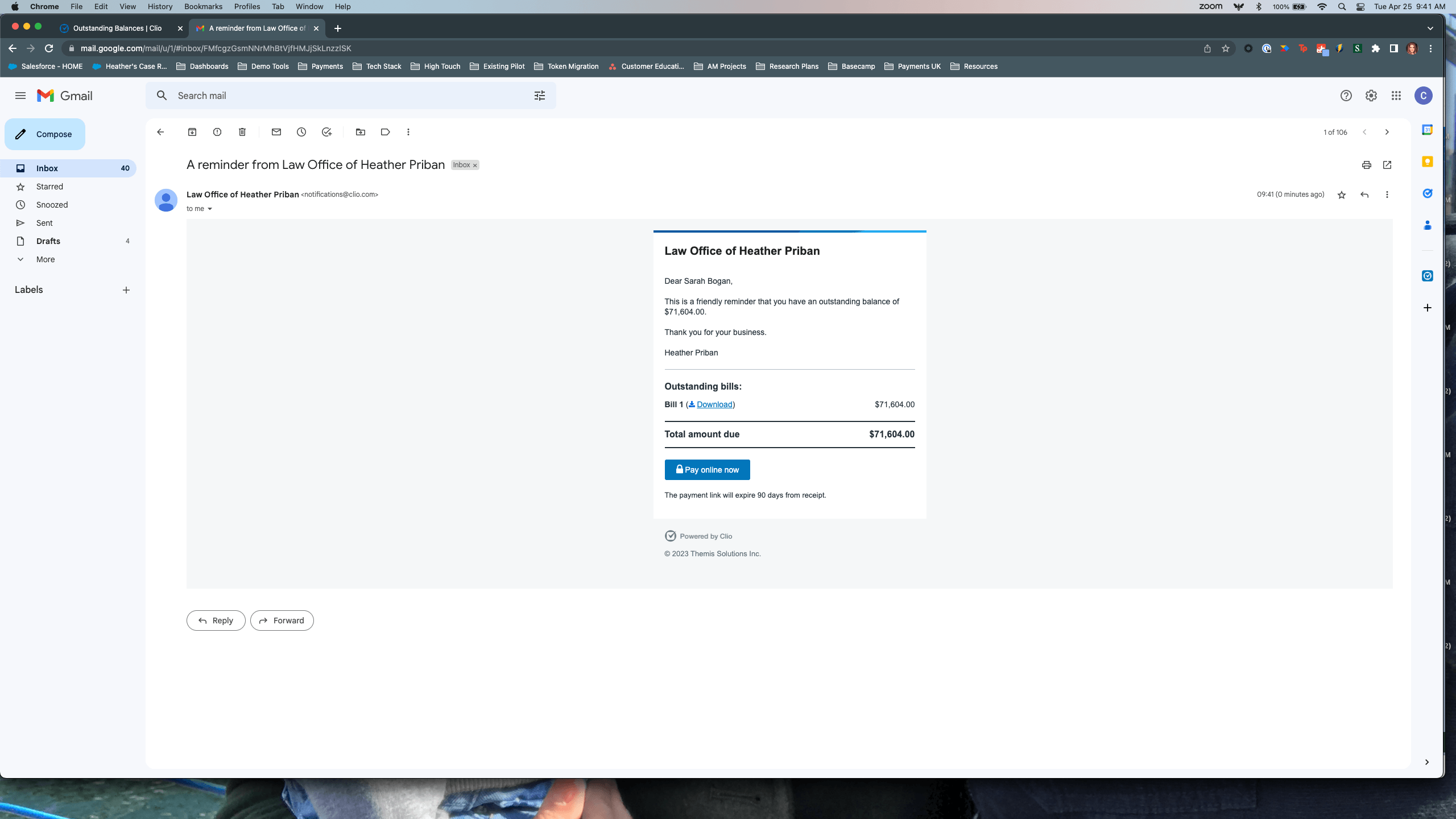

For example, in Clio, this is as easy as toggling the Reminders tab in the Outstanding Balances tab on the billing page:

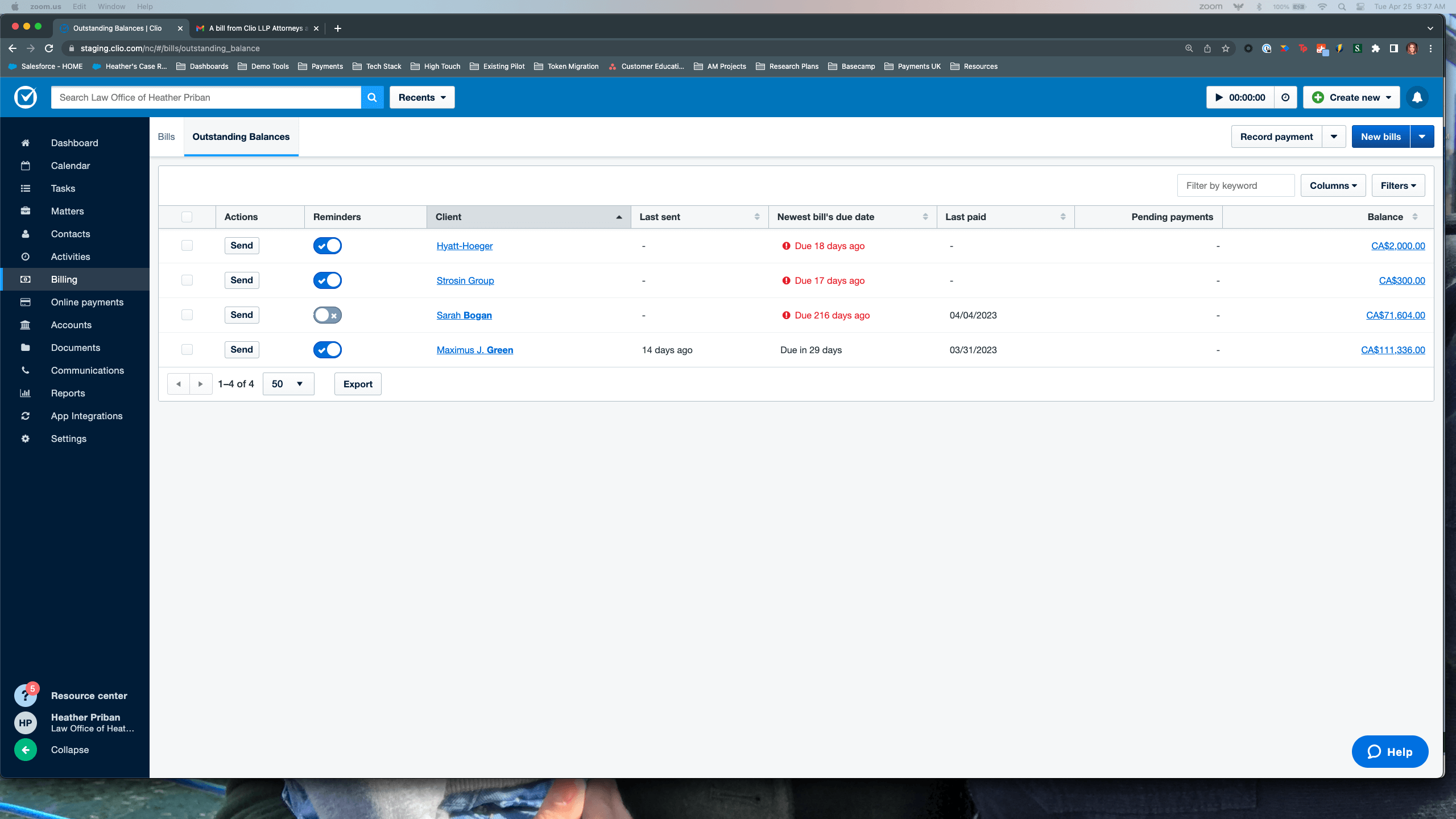

You can set a customizable schedule for automated bill reminders after a bill is issued, which can be repeatedly sent anytime between 7 to 365 days.

The default schedule is to start 15 days after a bill is issued, and to repeat every 15 days until the balance is paid.

You can also customize the wording in your reminder email.

And if you have Clio Payments enabled, your clients will have the option to make a credit card payment towards the outstanding balance in the body of the email. This not only refines your collection process, it gives your clients an easy and convenient payment experience.

A legal billing template can benefit your law firm

Building out streamlined billing processes may seem time-consuming at first. But the upfront cost in time and effort will ultimately pay for itself in the long run.

Better legal billing means higher efficiency for your firm, a better client-centered experience, and fewer headaches further down the line as you grow and scale. With a legal billing template and our billing and collections best practices, you can cut down on the time you spend chasing down invoices. You’ll also have more time to do what you do best—practicing law.

See how easy it is to generate bills with Clio. Spend less time on time and expense tracking, review bills faster and share client invoices easily.

Note: The information in this article applies only to US practices. This post is provided for informational purposes only. It does not constitute legal, business, or accounting advice.

Legal Accounting 101: Financial Tips for Long-Term Success

Struggling to manage your firm’s finances? Join our upcoming CLE webinar to learn essential legal accounting tips and tricks taking place August 7, 2024 at 11 a.m. PT | 2 p.m. ET

Register Now