Investing in new technology for your law firm is never an easy decision, and chances are—if you haven’t already—you’ve considered adopting some form of legal billing software.

Legal billing software is becoming highly prevalent among legal practices. More and more lawyers are looking to save time on cumbersome administrative tasks that take them—or their valuable staff—away from other work they could be doing.

In fact, according to the ABA’s 2019 TECHREPORT, 74% of law firms report already having some sort of time and billing software in place.

Despite wide adoption, legal billing software may not be needed at every firm. If you’re still on the fence about whether legal billing software will benefit your law firm, the decision will likely come down to two questions:

- Does billing take up too much of your time or the time of your staff?

- Does your law firm suffer from a steady backlog of outstanding bills?

If either of these issues are a problem at your practice, chances are that they are a symptom of inefficient billing practices, which can be improved with legal billing software.

But you’re probably wondering just how much of an improvement it can make.

At Clio, we’ve done extensive research into understanding the issues that lawyers come across in dealing with the day-to-day challenges at running a law firm. The information in this post is based off of thousands of interviews and conversations focused on helping lawyers open up more time, and feel more confident in their daily operations.

This post is based on all of the learnings we’ve gathered as a company, and will help you quantify just how much time legal billing software can save you and everyone at your law firm, helping you make the decision as to whether it’s worth the investment. We’ll also look at ways in which legal billing software can improve how you manage bills and collect more payments over time.

Question #1: How much time does your law firm spend on billing each month?

Ultimately, the decision to invest in legal billing software comes down to a question of efficiency, and how much time can be opened up for other work at the firm.

While there are additional benefits to consider—such as better, more accurate record keeping—we’ll focus on the time factor first, since it’s easier to measure, and often a scarce resource for lawyers.

Without legal billing software, many law firms often spend several days, if not more than a week, getting their bills out to clients each month. The process ends up being a burden for the person assembling the bills as well as everyone inputting their time and reviewing the bills before they go out. And if you’re doing it all on your own, it can be a doubly painful process trying to stay on top of everything while avoiding errors.

A major part of the problem stems from having to do a significant amount of manual data entry—often duplicated across multiple formats or software platforms.

Calculating time spent on billing

The first step in determining whether legal billing software will be a good investment for your law firm is to calculate how much you spend (and everyone else at your firm spends) on your monthly billing processes. All things considered, billing is likely taking more time than you think.

Ask yourself the following questions to get a view into how it all adds up:

- How much time does your firm spend creating invoices each month? Typically, without an automated billing system, every bill needs to be manually created in a Word document, each requiring unique information for the client name, date, individual time entries, task descriptions, tax calculations, and net totals. Inputting and calculating this information is time consuming, and it only gets more burdensome as a firm grows and takes on more clients.

- How much time does your firm spend reviewing bills each month? Even if you already have a time-tracking solution in place, or manage your time meticulously in a spreadsheet, it takes a significant amount of time to put that information into your monthly invoices, and then to check that the information is accurate to its source. If these bills are being printed and reviewed by hand, it takes staff even more time to revise those bills before they go out.

- How much time does your firm spend sending bills each month? Once everything has been finalized, it takes time to manually send each invoice to its respective client, whether through email or an envelope.

- How much time does your firm spend processing payments each month? Checks need to be delivered to the bank and itemized in your firm’s records. If you’re tracking this information in a spreadsheet, this is often where systems break. Every invoice that comes in needs to be logged and referenced, but there’s no way to know if anything was missed, which isn’t ideal if you end up following up with a client who’s already paid their invoice.

For even better insight, ask your team to estimate the number of hours they spend in each of these four areas for a week or a month and tally the totals. Depending on how data-driven you want to be, you may even want to track non-billable time spent on preparing and sending out bills to give yourself an unbiased view into how much time billing really takes.

What’s reasonable will depend on your practice area and the number of open cases you have, but as a rule of thumb, if multiple people at your firm are spending more than a full day each month on billing, it could be time to look into legal billing software.

How legal billing software reduces monthly billing to under an hour

Legal billing software gives you the means to create a more efficient and accurate system for tracking time, calculating bills, sending them out to clients, and processing payments.

One of the advantages to many legal billing softwares is the ability to track time directly within the same system, either by running a timer or logging work events throughout the day—at your computer or through your mobile phone. The benefit of tracking all of your work directly within your billing software is that you don’t need to input and calculate each individual invoice—the software does it for you.

With the click of a button, you can generate a batch of bills from all the unbilled time logged in your billing system. This process literally takes seconds. From there, each invoice can be reviewed and revised as needed by the billing attorney—again, from directly within the system. Once finished, all of the firm’s invoices can be sent out with the click of a button.

Let’s take a look at what this process looks like:

- Each lawyer at the law firm logs all of their time into the firm’s legal billing software as they work or at the end of each day.

- When it comes time to bill each client, the billing software will put all unbilled time into customized invoices with the appropriate client names, addresses, invoice numbers, and issue dates.

- Responsible attorneys then review each bill to ensure all of the time entries are accurate and complete. Any edits they make will be reflected in their original list of time entries and associated matters, for consistent recordkeeping across the system.

- At any time, you can pull a list of approved invoices and email them in bulk to their respective clients.

Learn more about how to streamline your law firm invoicing process.

There are two key takeaways here:

- This process can take a little as a few minutes.

- The time savings compared to a traditional billing process are often enough to justify the cost of legal billing software.

Think of it this way: If it takes you three days to get your invoices out, how much does that cost in terms of a lawyer hourly rate or staff wage? Also, how does this process affect your firm’s client services?

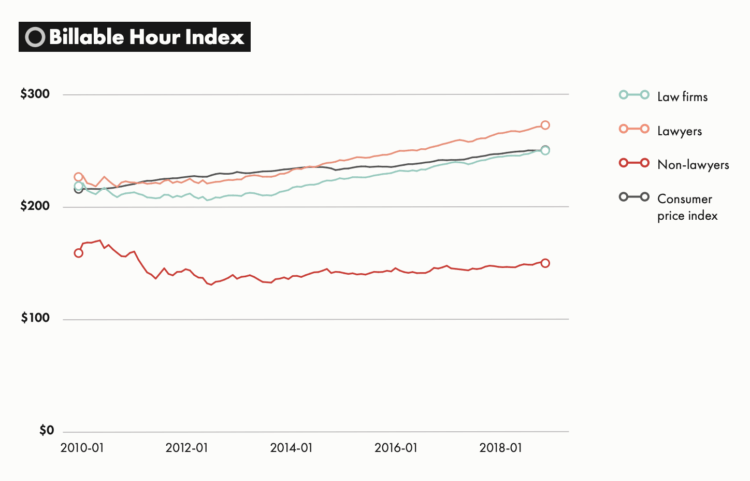

For example, consider a partner at a small firm who spends eight hours per month reviewing bills and cross-checking time entries. The average lawyer in the United States bills at a rate of $253 per hour, according to the 2019 Legal Trends Report. If this lawyer put those eight hours toward billable client work instead, that’s a $2,024 increase in revenues for the firm.

For administrative staff members, dealing with billing each month can be repetitive and stressful, increasing the risk that something important will fall through the cracks. Alleviating this challenge gives staff the bandwidth to focus on creating good client experiences through timely and thoughtful client communications—work that pays dividends in the form of better reviews, more referrals, and more clients for your firm.

If billings take up several days at your law firm, adopting legal billing software means getting most of those days back.

Question #2: How much do outstanding invoices hurt your law firm?

Unpaid bills are a problem for several reasons:

- It takes time to follow up with clients who haven’t paid.

- It takes time to identify which invoices haven’t been paid (it’s common for law firms to have trouble identifying these invoices at all), how long they’ve been overdue, and when to follow up.

- The longer bills go unpaid, the less likely they are to actually get paid. Not getting paid essentially means having worked for free.

- As the number of unpaid bills increases, they become more challenging to manage, especially if dealing with the intricacies of client payment plans.

Legal billing software can help here: It doesn’t just help you get bills out to clients more quickly, it also helps manage follow-ups. And, it gives you the ability to automatically accept electronic transactions, which means you get paid faster.

To get a sense of how valuable this would be to your law firm, ask yourself these questions:

- How much time do you and everyone at your firm spend following up on unpaid bills each month?

- How much of these unpaid amounts does your firm end up writing off each month?

If you work with a bookkeeper, ask them to help provide an estimated answer to the second question, and for the first question, try to provide an honest estimate or track your time. If you find the amount of money and time being lost unacceptable to your firm, it’s time to look into legal billing software to get some help.

How legal billing software helps manage unpaid bills

Legal billing software doesn’t just automate your workflows for getting bills out, it also helps manage the whole billing process leading up to and including the actual collection and updating of payment records. This includes managing all outstanding bills.

When all of your time and billing information is stored in one place, you can easily sort and filter your bills according to the associated client, responsible attorney, issue date, or any other type of custom field you set for your clients or matters.

This makes it incredibly easy and efficient to view all of your outstanding invoices in one place, ordered according to their original due date.

To simplify things even further, you can look at a list of outstanding balances—essentially a summary of all their unpaid invoices and a summary of their total sum outstanding—for each client.

Once you have a list of outstanding balances, following up is easy. All you need to do is select which recipients you want to send a reminder to, and they’ll receive an auto-generated email showing a list of their unpaid invoices and a total amount due—with a link to pay immediately online.

Getting paid faster

The other benefit to legal billing software is that it gives you the ability to collect electronic payments securely via credit card.

When issuing a bill, clients will receive a link to pay by credit card—much like they would via PayPal or any other online payment system.

Once they submit their payment information, your payment records will update automatically in your legal billing software, and the funds will be deposited directly to your firm’s bank account—saving you a trip to the bank, and removing the need to manually update the payment information yourself.

In addition, should a client dispute a credit card payment by way of a chargeback, legal billing software providers like Clio will help you navigate the chargeback process.

To add to your assessment of how much time legal billing software could save you, ask yourself this: How much time does your firm spend updating billing records every time you get paid?

In fact, giving clients the option to pay electronically by credit card has been shown to increase both the speed and the rate of collections overall.

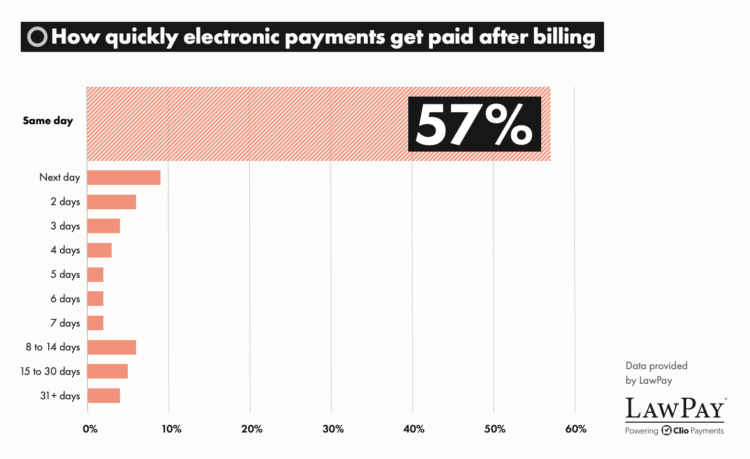

According to the 2019 Legal Trends Report, 57% of electronic payments get paid within the same day they are billed, and 85% get paid within a week. Moreover, 40% would never hire a lawyer who didn’t take credit or debit cards, so accepting credit cards is critical for providing the experience clients are looking for as well. More recent research from Clio’s team also shows that the most successful law firms have adopted online payment processing.

You may like these posts

Weighing the cost against the benefit of legal billing software

Legal billing software can:

- Save your firm time creating and calculating invoice amounts

- Save your firm time in reviewing and updating invoices before sending

- Save your firm time sending out individual invoices

- Save your firm time following up with outstanding invoices

- Save your firm time updating payment records

Often, all of these tasks can be performed in minutes. To identify the full scope of time savings, first consider how much time each individual at your law firm spends on all of these tasks, then explore how your workflows would become more efficient with the use of legal billing software.

Additionally, consider how much your firm typically loses to unpaid bills, and look at how much more you could be collecting if you were able to realize an additional 7.3% of your total billings.

Even if your firm is just starting out, having a system in place early on can help you put everything in order, making it easier to scale operations as your caseload increases. In turn, this will allow you to focus on building your business by creating effortless, client-centered experiences.

Choosing a legal billing software

All of the examples in this post have been taken from the time tracking and billing features and workflows available as part of Clio Manage (part of the Clio Suite) which offers a comprehensive solution for managing your legal practice.

The benefit of using an integrated system like Clio Manage is that it also gives you the ability to coordinate all of your tasks and time tracking into everyday legal work. This means you can track your time as you update case notes, communications, calendar entries, documents, and anything else essential to your casework.

Since Clio is also cloud-based, this means you also get the benefit of easy, secure access from anywhere—on your computer or mobile device.

The best way to assess any legal software for your firm is to see what other people are saying and to either try it yourself or sign up for a free demo from a practice management specialist.

If you’re looking to read reviews on which legal billing solution is best for your firm, these sites are a great start (be sure to look at the number of reviews for each option as well):

Otherwise, you can also read more about how to improve billing processes at your firm by reading this guide to better billing for law firms.

We published this blog post in January 2020. Last updated: .

Categorized in: Accounting, Business