What is a business plan and why is it important?

A law firm business plan is a document that summarizes what you want to achieve and how you’ll run your business. This summary includes general information about your law firm, why you chose to start it, major goals, the services you offer, a budget, and a strategy for gaining and managing clients.

A business plan is essential to any law firm as it documents, and serves as, a roadmap for the future.

As you think through what it is you want to achieve, what type of clients you want to serve, how much to charge as a lawyer, and what type of matters you want to handle, your business plan may evolve. That’s okay! Your law firm business plan can change as your goals change, so don’t feel pressured to have all the answers upfront.

That being said, the more thought you put into your business plan now, the better you’ll set yourself up for success in the long run.

What to consider when creating your business plan

Before you start writing a law firm business plan, it’s important to take a step back and reflect on what you want from your practice first. For a more specific, meaningful, and ultimately rewarding business plan, consider these three points:

1. What are your goals?

The first and most critical step in writing an effective plan is to ask yourself, “Why do I want to own a law firm? What do I want to achieve? What’s my definition of success?”

Starting your own law firm isn’t just about having a job—it gives you the potential to have more freedom and more fulfillment. In theory, owning your own firm gives you more control over your income.

Consider the following questions to get started:

- What do I want to achieve through starting my own law firm?

- What’s the impact I want to have?

- What am I good at?

- How do I want to service my clients?

- What problems do I want to help solve?

- What does success look like after starting this law firm?

Answering these questions might be more difficult than you think, but they’ll help you get clear on your goals for why you want to run a law firm.

2. Consider how much revenue you’ll need

Now that you have an idea of what success looks like, calculate how much annual revenue you’ll need to achieve those goals—and more.

In 2023, the median pay for lawyers was $126,930. While this isn’t a small amount of money, after factoring in living expenses like saving for retirement, rent or mortgage payments, student debt repayment, vehicles, emergencies, office lease etc., that number gets eaten away quickly.

More importantly, there’s no extra room for investment in hiring or marketing to grow your law firm. So, it may just be you and you alone until things pick up.

In that case, be generous when estimating how much revenue you’ll need, and write down a number that scares you. You’ll be much better off planning with that number in mind from the beginning.

3. Setting your fee structure

After setting your goals and estimating a few rough numbers to start, it’s time to create your fee structure.

Your fee structure should include:

- What others charge on average

- What practice area you’ve chosen

- What your business expenses are

As you might already know, each client is different which means each matter you handle will be different. It could make sense to charge a flat rate for one project but an hourly rate for another.

Understanding what your competitors are charging and how they’re structuring their pricing is a good starting point to then build out your own fee structure.

Luckily, there are so many incredible tools out there such as Clio’s Legal Trends Report, which can help you understand average hourly rates; a benchmark calculator for hourly rates within your jurisdiction; blog posts about billing; and more, that make it easy for you to do market research and understand what others are charging.

4. Determine how many cases you need to meet that revenue goal

If you are only handling two or three cases per month, the number you came up with above might look outrageous. It’s not.

For example, let’s use the 2023 median pay of $126,930 a year in annual revenue as our goal, with a flat fee of $3,000 per client.

$126,930 per year in revenue = an average case value of $3,000 – $3200 = 40 cases per year = 3 – 4 per month.

$126,930 per year might seem crazy if you’re only working a couple of cases per month, but keep in mind that you’re going to gradually work up to it.

The number of cases you’ll need may differ depending on your location and practice area, so do your research to make sure you come up with a realistic case goal (even if it still feels like a stretch).

This brings us to the next part of developing your business plan—writing it.

How to write a law firm business plan

Once you’ve got the starting points of your business plan worked out, it’s time to put pen to paper.

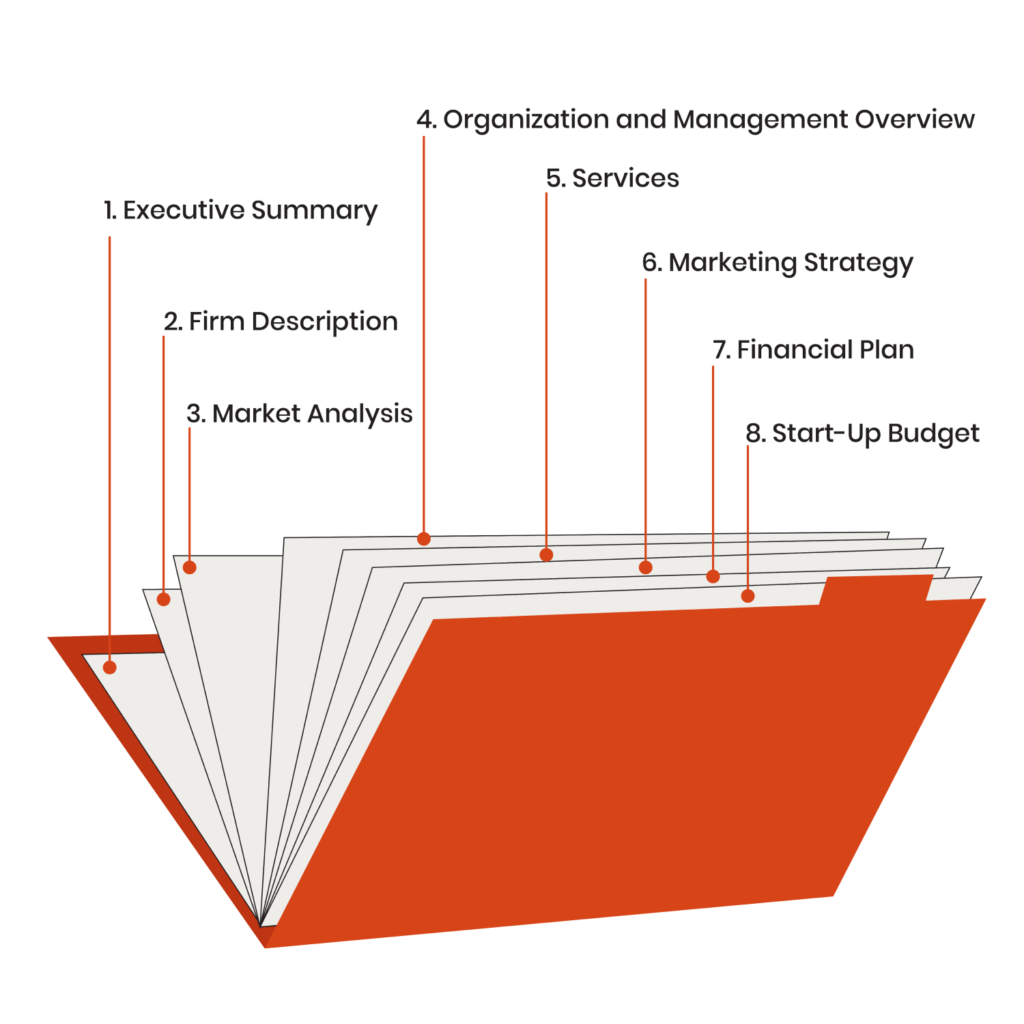

While your law firm business plan should be tailored to your unique situation, the following list will walk you step-by-step through all key sections you need to have a comprehensive business plan:

1. Executive summary

An executive summary is a one-page, high-level overview of all the key information in your business plan.

Law firm business plans can cover a lot, so it’s worth having a succinct high-level overview to keep things simple (hint: While this section should come first in your plan, it’s actually easier to write this section last, after you’ve laid out your plan).

Your executive summary should include:

- Mission statement: One or two sentences describing your firm’s purpose.

- Core values: What values are most important to the firm?

- Major goals: What are your firm’s overarching goals and objectives?

- Unique selling proposition: What sets your firm apart from other firms?

2. Firm description

Next, write a company summary for your firm, something concise that provides a general overview of your firm, while providing important details describing your practice and clients, including:

- Service(s): What type of law do you practice? What types of clients do you serve?

Firm values: Restate your mission statement and core values. - Legal structure: What sort of business entity are you? Are you in a sole proprietorship or a limited liability partnership?

- Location: Where is the office geographically located? What areas does the firm serve?

- Unique selling proposition: What makes your firm stand out? What technology or services give your firm an edge?

3. Market analysis

A little bit of preliminary market research goes a long way.

Look at bar association listings to see how many other firms in your area offer similar services. Is there a high demand for what you’re offering? If not, how can you ensure you stand out to potential clients? This will greatly inform the message you choose to use in your marketing efforts.

Create a market analysis for your firm, including the following:

- Ideal client: What demographics (like location, age, occupation), needs, and motivations would signify the best client match for your firm, and why?

- Industry description: What is the current and projected size of the market your firm is in? What are the trends in your legal niche?

- Competitive analysis: Who are your direct and indirect competitors, and how are they serving your target market? Where do your competitors succeed? What opportunities are there for your firm?

- Projections: How much can your ideal clients spend on legal services? How much can you charge?

4. Organization and management overview

You know that you’re the best person to lead the firm, but does everyone else know it too? This section is your opportunity to provide important details about yourself—and the key players in your firm.

- Highlight your experience and the educational background details that set you apart.

- Add the same for other members of your team, if applicable, including what makes them right for their specific roles.

- If your practice is on the larger size, this section is a great place to add quick visual aids like an organizational chart.

5. Services

Outline the types of legal services your firm provides.

For example, if you practice family law, what will you provide in your portfolio of legal services—cohabitation agreements? Wills/estates? Pre-nups?

You also want to include who your services are for. For example, you might offer legal tech services to start-up companies and high-tech clients.

When writing about your services it’s important to consider:

- What problems do your potential clients need your help with?

- How can your services uniquely help your clients solve their problems?

- What is the benefit of your services to clients?

- Why would potential clients choose your firm over another firm?

How to Start a Law Firm Checklist

Everything you need to start a law firm—in one checklist

Get the Checklist6. Marketing strategy

Marketing is a critical part of your law firm, and your business plan. It helps you understand how to make your firm stand out from others, how much you need to charge, and how you’ll get the word out and attract new clients. Learn more about how to get new clients for law firms.

Consider including the following in your law firm marketing strategy:

- Ideal client: Where would you find your ideal client?

- Marketing goals: Detail what specific outcomes you hope to accomplish through marketing. Goals should include tactical objectives (more clients? Higher billing rates?) and overall objectives (like increased name recognition).

- Unique selling proposition: Restate what sets you apart and makes you uniquely able to best serve your clients.

- Competition: Detail who your competition is—and what they’re doing to gain clients. Analyze their marketing strategies and assess where the cost of your services fits in with your competitors.

- Action plan: List the specific actions your firm will take to reach your target market and achieve your marketing goals (this could include a media/advertising strategy).

It’s also important to consider that your marketing needs will be different depending on the current stage of your law firm.

When starting your own law firm, then marketing for you might mean a lot of hustle—working referral relationships, identifying groups that you can get in front of for speaking engagements, blogging, and using social media to get your name in front of potential clients.

As you grow (or if you have existing marketing in place) you should be able to estimate the number of cases you will bring in through each channel. Then, you can quantify your marketing cost per client by dividing the total cost of that marketing effort by the number of cases you got from each marketing channel. For example, if you’re the only corporate lawyer in a small town, you’ll need to spend less on advertising than a family lawyer in a larger city.

Once you have an idea of the cost and effectiveness of your marketing efforts, implement a marketing tax on yourself—a percentage that comes out of every single case fee you collect, and that gets invested straight back into marketing efforts.

This is a simple way to think about how much you need to be charging to fuel your revenue goals. It’s also an easy way to scale and grow your marketing budget.

Once you start mapping out this information, you’ll notice that a system starts to form, which connects your goals, the number of cases you need to bring in, the profit you need to make on each case, the money you need to re-invest in marketing, and the number of people or contract resources you will need to employ to keep growing.

Learn more about how to market your law firm with Clio.

7. Financial plan

The heart of your law firm business plan is the financial plan. After all, when it comes to your business, there may not be a more important question than, “How much does it cost to run your law firm?”

The key is to include as much specific financial information as possible—particularly if you’re seeking funding like taking out a bank loan. As you start out, this financial plan should include numbers for your first year.

This could include:

- Revenue goal: How much money you want to make broken down by month.

- Financial projections: What you’ll realistically expect to earn, how many cases you think you’ll have capacity to take on, and what you’ll be charging each client each month.

- Budget: A breakdown of your expenses and what your money will be going towards each month.

- Cash flow statement: What you actually earned and spent each month. This is different from your projections and budget and should be updated as the year progresses. You’ll find that you may have budgeted for something that cost you much less than you originally thought or made more in a month than you projected, these discrepancies should be recorded in your cash flow statement.

As you start it’s reasonable to make assumptions based on your goals. You should also review and update this document for your second year, third year, and so on as time goes on.

8. Start-up budget

If you’re creating a business plan for a new law firm, you need a realistic start-up budget. To do this, you’ll need to consider a number of up-front and day-to-day costs, and account for these in your revenue goals.

Here are a few examples of costs to include in your budget:

- Hardware (laptops, printers, scanners, office furniture, etc.)

- Practice management software and other technology services

- Office space (Will you rent, or work from home?)

- Malpractice insurance

- Staff salaries (Are you planning to hire an administrative assistant or paralegal?)

- Utilities (Phone, internet, etc.)

Once you’ve laid out all of these costs, take a second look. Are there places where you could reduce your operating costs, and in turn, increase your profit margins?There are also plenty of tools you can look at to help streamline non-billable tasks and leave yourself more time to practice law. Be sure to look at these options and work them into your operating budget.

Law firm business plan templates

Here are some links where you can find examples of business plans and business plan templates for law firms:

Final thoughts on how to create a law firm business plan

Having a goal and understanding how to get there is essential for any lawyer deciding to hang their own shingle. Having a written business plan does a few key things:

- It creates a concrete explanation and breakdown of why you need to work a certain number of hours this week.

- It keeps you accountable to your goals and commitments.

- It serves as a comprehensive tool you can share with your firm, investors, and potential partners.

To learn more about how to start a law firm, be sure to check out our complete guide.

And again, remember that technology is a key part of any business plan. Watch how law firms use Clio in this on-demand webinar to learn how to set up an efficient and organized back office.