Creating a law firm budget and organizing your finances is arguably one of the most important starting points when hanging your shingle.

No matter how much money you have, what practice area you’re in, or how long you’ve spent practicing, you’ll need a budget to help your law firm succeed. The basics of a law firm budget include startup costs, marketing recurring subscriptions, and projecting revenue.

Why it’s essential to have a law firm budget

A budget sets your expectations for cash flow and expenses throughout the year, reducing the chances of missing an expense or bouncing a check. You will also be able to set revenue benchmarks—giving your law firm a measuring stick to know if you are meeting your goals or need to adjust your business plan to succeed.

It’s also wise to take note of seasonality in case work. Depending on your practice areas, you may have more work in certain months and less in others. In this case, it’s practical to have a budget that estimates your costs throughout the entire year so you can weather quieter seasons and stay focused on the bigger picture.

Another significant benefit of a budget is being able to set aside funds to cover the larger lump-sum expenses most law firms encounter, such as:

- Annual bar dues;

- Malpractice premiums;

- Quarterly self-employment taxes; and

- Research and software subscriptions (which are typically cheaper on an annual license rather than monthly).

- Marketing expenses

What to consider before you create your budget

Like any good legal document, there’s always a disclaimer: Every law firm’s budget differs.

Why? Lawyers in different practice areas may need additional equipment and supplies. In addition, lawyers at different stages of their career may receive certain benefits. For example, lawyers fresh out of law school often get discounts on bar dues, CLEs, and even malpractice insurance, while those further along in their career do not.

While budgets can vary, certain line items are the same across the board and should appear in every lawyer’s budget.

Want more? Watch our on-demand webinar on law firm budgeting essentials.

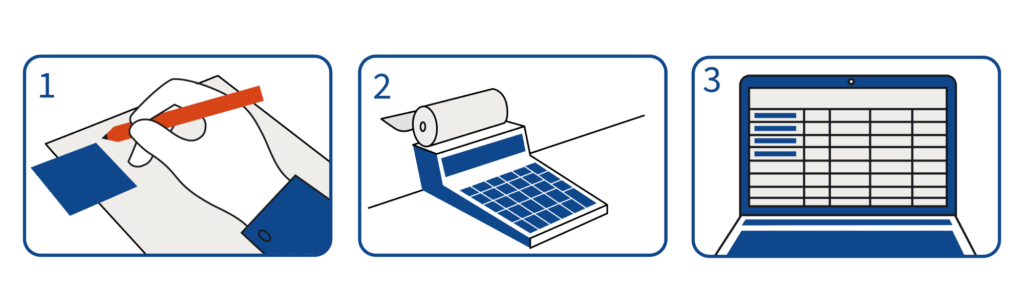

Three steps to create a budget for your law firm

1. Brainstorm your firm’s expenses

The first step is the easiest: Brainstorm mandatory expenses. You’ll also want to outline what resources you have on hand (starting capital, existing equipment, etc.) and set aside some money, either as a recurring expense or a percentage of your revenue, for any potential surprises you’ll encounter.

Here is a non-exhaustive list to get you started. Some of these are optional, while some can be found for free or repurposed from what you have on hand (a laptop that is in good shape, or a smartphone). Some of your firm’s expenses will be incurred yearly, some monthly, and some only once.

Possible law firm expenses

- Bar association dues (state and/or local bars)

- Mandatory continuing legal education (MCLE) subscriptions

- Malpractice coverage

- Office space

- Co-working space

- Shared office

- Utilities and internet access

- Hardware:

- Laptop or desktop computer

- Backup cloud drive

- Monitor(s)

- Printer and consumables (paper, ink, etc.)

- Scanner (either part of a printer or separate)

- Fax machine

- Landline or VoIP business phone

- Smartphone

- Mouse

- Computer charger(s)

- Software and services:

- Cell phone service

- Productivity suite software (such as Microsoft Office or Google Workspace)

- Law practice management software, such as Clio

- Accounting software

- Legal research software

- Marketing

- Business cards

- Website

- Advertising costs (pay-per-click ads, social ads)

- Networking events

- Miscellaneous expenses

- Mousepad

- Laptop stand

- Office chair

- Office desk (standing/sitting desk)

- Lockable file cabinets

- Tape

- Envelopes

- Pens

- Paper

- Highlighter

- Dividers

For each item you’re considering striking from this list to save on costs, ask yourself three big questions:

- Will this save me time that I can put towards more billable work?

- Will this help me find more business?

- Do the benefits outweigh the cost?

For example, every lawyer could get by using their local law libraries for research, but if you have to research often and the library isn’t next door, investing in the subscription might be worth it. And, while a legal conference might seem like a luxury, the referrals gained could pay off exponentially.

2. Project your revenue

Once you’ve itemized all your expenses, the next step is to project your expected revenues honestly and accurately. Consider this step a mapping exercise, as a budget should be your guiding point to building a successful law firm.

Incorporating your personal and business goals into the process is also a good idea. For example;

- Do you need to meet certain revenue marks to keep the office lights on, or more importantly, to provide for your family?

- How can you realistically get there if you need to meet those revenue marks?

- Do you need to advertise heavily on Google Ads or Facebook?

- Will you have the time to answer and screen calls, or do you need to add an assistant or answering service to your budget?

Be sure to set your rates carefully, factoring in the goals above and average rates for your location and practice area, which can be found in Clio’s annual Legal Trends Report.

When going through this exercise, it’s also worth asking yourself a couple of critical questions:

What area do you practice in?

As mentioned above, seasonality is a key factor to consider when projecting revenue. Seasonality will vary based on your practice area (think: Lawyers who work in tax law are often busiest in the period leading up to and during tax season).

While these seasonality factors can be challenging to predict in some areas over others (such as employment law compared to the tax law example above), a good rule of thumb is that lawyers across the board report to experience lulls in the summer.

If you’re relatively new to your field of practice and still unsure of the ups and downs of case work volume, you should find a mentor that has been through the seasonalities or ask for advice through online communities and forums.

What can you do to make revenue more predictable?

Fee structures, collection rates, and payment delays can all impact your law firm’s cash flow. Setting flat fees can give you (and your clients) peace of mind. Flat fees also make it easier to create a budget than predicting the ebbs and flows of billable hours in a litigation practice.

For those who bill by the hour, evergreen retainers are a great way to prevent accounts receivable problems. Taking credit cards helps as well.

For a new firm, expect to make little-to-nothing for a few months, followed by slow growth throughout the year, unless you can afford a killer advertising setup to speed up the process. However, with a pragmatic budget and a lot of preparation, you can still set yourself up for long-term success.

How to Start a Law Firm Checklist

Everything you need to start a law firm—in one checklist

Get the Checklist3. Document and track your budget

To track your planned expenses and revenue, you can use anything from a premium solution, like QuickBooks Online to something as simple as an Excel or Google Sheets template. For example, there is a great free annual business budget template in Google Sheets’ template gallery.

When you’re starting out, it’s a good idea to assess how well you’re tracking against your budget each month after you’ve collected on all your bills. This practice will help you determine whether you need to adjust your projections or document any expenses you didn’t account for.

You should also set aside some time to formally review your budget each year. This will allow you to update your budget based on any evolving personal or professional goals and ensure that the projected amounts coming and going from your firm reflect your day-to-day operations.

For more resources on starting a law firm, be sure to check out our guide.

Work smarter, not cheaper: Tools to increase efficiency are worth the cost

According to the 2022 Legal Trends Report, lawyers spend up to 69% of their working hours doing non-billable tasks like client intake, invoicing, and logging expenses.

However, most of these tasks can be automated with a cloud-based practice management software like Clio, freeing up valuable time to deal with client matters.

While Clio covers most of your bases, here is a list of other tools you may want to consider to help increase productivity and efficiency.

- A cloud storage service, like Google Drive or Box is great for backing up your documents and accessing files on the go.

- QuickBooks Online has favorable reviews as a tool for watching your cash flow and keeping track of your finances.

- Google Workspace is Google’s personalized-to-your-business email, calendar, cloud storage, and everything else solution.

- Office 365 is a Google Workspace alternative that comes with the time-honored Microsoft Office and a cloud storage drive, personalized email, and more.

- A credit card payment processor (fees vary, many don’t have a monthly fee but charge per transaction).

- A financial institution that offers a trust account.

Most of these are monthly expenses you’ll want to put in your law firm budget. While most have an associated cost, consider whether this product will help shift most of your time from non-billable to billable tasks. If the answer is yes, the product will pay for itself in the long run.

Avoid excessive debt when you’re just starting out

One final note on law firm budgeting and debt: it’s wise to avoid dischargeable debt and spend as little as possible when starting a new law firm. For example, avoid renting office space initially, as it will likely be your most significant expense.

If having your own workspace away from home is important, then consider a more cost-effective option such as a co-working space. With little to no debt, even if you fail, at least you won’t be further in the hole.

On the other hand, you also can’t be too much of a spendthrift. A better approach is to spend wisely, and if you need to take out a small business loan or leverage a business credit card to float expenses for a month or three, consider that as the cost of making money.

If you skimp on marketing, you may have no clients at all. And if you don’t invest in the tools to make your practice run smoothly, you may not have the time to practice at all.

So how do you find balance between spending wisely and stunting your growth through stinginess? Creating that budget and getting your finances in order is the first step.

Final thoughts on law firm budgets

Creating a budget for your firm will help you forecast what money you can expect to come in. Looking at planning for the money that needs to go out means listing all of your expenses and planning out how your revenue will pay those costs.

While watching where your money is going is important, being too stingy will harm your growth. Spending money wisely, for example on tools that will help you be more efficient, will pay off in the long run. If you haven’t put together your new law firm’s budget, the best time to start is now.

Want to learn more about creating your law firm budget? Watch our on-demand webinar on law firm budgeting essentials. It covers the fundamentals of setting the right financial goals at your firm.