It can be intimidating to think about law firm financial management. As a lawyer, it’s not your job to be a financial expert. However, understanding the fundamentals of financial management will go miles towards putting your firm on the path to sustainable revenue growth. And the more consistent your revenue becomes, the more clients you’ll be able to help.

Law firm financial management involves planning, organizing, directing, and controlling the financial operations of a law firm. This includes, among other activities, tracking profitability and expenses to predict and plan for revenue growth.

What is law firm financial management?

Managing your firm: How to create a sustainable financial plan

A financial plan should contain long-term financial goals and strategies. Include as much specific financial information as possible when creating your financial plan. At a minimum, your plan should contain numbers for one year of operations.

As featured in our How to Start a Law Firm Guide, your financial plan should include the following:

- Monthly revenue goals: The amount of money you want to make every month. Note that some months will naturally be higher than others, given consumer trends, your area of practice, and other market factors.

- Financial projections: This is what you expect to earn. Include the number of cases you think you’ll be able to take on and what you’ll charge each client. Strengthen your projections with historical data and other reliable sources of information to determine these numbers.

- Budgets: This is a breakdown of your expenses and what your money will go towards each month.

- A cash flow statement: This statement identifies what you earn and spend each month. A cash flow statement differs from your projections and budget and should be updated as the year progresses.

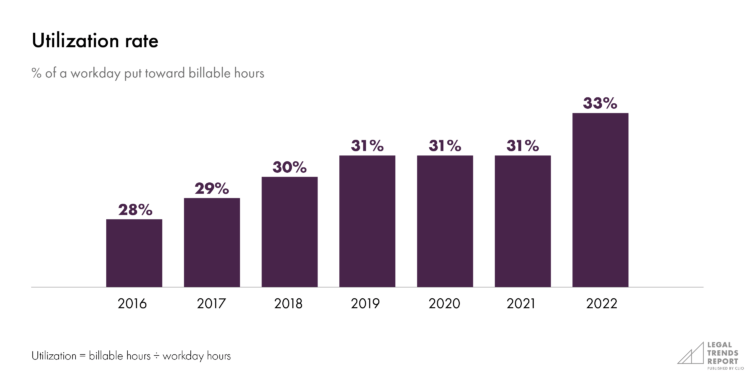

And remember, while an overly-optimistic financial plan may be exciting to review, it will eventually fail you. You can set yourself up for business success the same way you would in court: Conduct research to ensure you have reliable, unbiased evidence to support every projection, target, number, and dollar sign in your financial plan. For example: Before setting a target utilization rate for the upcoming year, find a benchmark to support your projection. The 2022 Legal Trends Report has information about average utilization rates over the past seven years. If your projections are far from industry benchmarks, you may have to consider alternative ways to grow your business.

Financial KPIs to track

Law firm KPIs, or key performance indicators, can help you accurately monitor your firm’s financial performance. Though, with so many notable law firm KPIs to measure, how do you know which ones to include in your law firm financial management plans? We’ve narrowed it down to the list below:

- Revenue billed per month.

- Realization rate (amount billed as a proportion of number of billable hours worked).

- Revenue collected per month.

- Collection rate (amount collected as a proportion of the amount billed).

- Amount of firm debt (lines of credit, credit cards, loans, etc.).

- Current run rate (projected annual revenue based on the past three months).

- Current anticipated annual costs (total amount of anticipated annual costs, including salaries, for a year, based on the last three month’s costs).

- Difference between your current run rate and current anticipated annual costs.

- Operating account balance.

- Amount of accounts receivable (AR) outstanding.

- Age of accounts receivable.

- Net income as a percentage of revenue.

On top of measuring financial KPIs, there are additional ways to support your firm’s revenue growth. Read these 10 tips on improving law firm profitability for suggestions you can bring to your firm.

You may like these posts

Diving into law firm financial management

Budgeting

When it comes to understanding and improving financial performance, a natural first step is creating a budget. A budget lays the groundwork for your cash flow, revenue growth, and, ultimately, your profitability. If you don’t know where to start when it comes to budgeting, follow our step-by-step guide: How to Create a Budget for your Law Firm.

Profitability analysis

Profitability analysis is a common practice in cost accounting and law firm financial management. Essentially, it’s a breakdown of the profitability of an organization’s output. Output refers to the products or services an organization is producing. So, for a law firm, output might be the hours of services provided and how many of those hours are billable. Utilization rates and realization rates directly support the profitability analysis. They are a natural starting point in determining the profitability of services at your firm.

Profit center accounting

A profit center is a component of an organization with revenues accounted for separately. Profit center accounting allows you to determine the profits of internal business areas individually. This method is useful for larger firms with multiple practice areas. For example, if your firm offers family law and injury law services, it would make sense from a law firm financial management perspective to separate these two business areas into profit centers. This method makes sense as the requirements for these two business areas differ.

For example, perhaps the family law lawyer receives ample requests for virtual consultations from working parents. However, they’ve expressed that the WiFi isn’t strong enough to support these calls. After investing in new wireless internet infrastructure, you can measure the impact on revenue in this one area of the firm without impacting the financial performance reports from the injury law division. They’re kept separate to provide more detailed, accurate financial information.

Long-term planning

Long-term financial planning is critical for paying off loans, securing long-term revenue opportunities, and growing your firm for years to come.

The timing of cash flow will determine whether something should be included in your short term or long-term planning. Generally, if it’s over a year’s time, this particular activity should be included in your long-term planning. If you took out a loan and have to pay it back over five years time, or have a case that’s longer than a year, this would be tracked in your long-term planning. Short-term planning would involve your more immediate revenues and expenses. While both are important in law firm financial management, it can be more difficult to carve out the time for long-term planning. Chances are, the lights wouldn’t stay on without some sort of short-term financial plan.

Forecasting is a valuable part of long-term planning. Forecasting involves identifying the most-likely financial outcomes for your law firm. For your forecasts to be accurate, you should use a combination of historical data industry reports and, if possible, hire a financial expert with experience working with lawyers.

You should also document a long-term financial strategy and profitability model. Keep in mind this model needs to be supported by your short-term budgets. Populating a financial strategy template is a great starting point.

The importance of cash flow

Having a reliable but flexible cash flow is integral to your firm’s success. It’s tough for any business to manage cash flow, and lawyers have specific challenges on top of this. You might not be paid until settlements are finalized, cases can take longer than expected, and professional liability risks can arise. It’s difficult to accurately forecast financial figures when you’re starting out.

This is why historical cash flow data is worth its weight in gold. If you’re just beginning your legal entrepreneurial journey and don’t have access to these numbers quite yet, do your future self a favor and track your cash flow now so you’ll have these numbers to guide future planning. Regardless of how new your firm is, it’s critical to create cash flow projections that support your law firm financial management plans. Another option is to lean on those in your network and ask if they’d be willing to share some financial information and advice with you. If you don’t yet have established contacts, you can grow your community by following our attorney networking tips.

Leveraging legal payments software

Your firm can increase cash flow by using time-saving features offered by industry-leading legal payments software. Processes such as automating billing, accepting credit payments, and offering different types of payment plans are all straightforward enhancements that come with using the top legal payments software.

Try Clio for Free

Learn how legal practice management software can support your financial management plans.

Paying yourself and your team

As a solo attorney, you might be wondering what to expect when it comes to paying yourself. It’s a valid question, and you shouldn’t feel uncomfortable about prioritizing your compensation. After all, if you can’t support yourself, you won’t be able to support your clients. There are tools to leverage when coming up with your hourly rates, such as our hourly rates calculator. In addition, reaching out to your state bar association or alumni organizations for salary insights is a sound place to start. This will help you include a realistic salary for yourself in financial plans and additional staff salaries in your long-term planning.

When it comes to the more granular details of actually receiving payment from your firm, there are two main options for solo attorneys or owners of small firms:

- Earn a salary: Pay yourself a salary as if you’re any other employee, withholding taxes from your paycheck.

- Draw payments: Involves drawing money from business profits on an as-needed basis.

Regardless of which option you choose, your firm will require some kind of payroll system. This is integral for following accounting and bookkeeping best practices. Additionally, working with a legal accountant to set up your initial payroll—especially when it comes to paying yourself—is the best way to prevent any surprises come tax season. Legal accounting software can help you stay on top of payroll.

After the initial processes have been set up and given the green light from a certified accountant, consider using technology to passively run your systems. For example, payroll automation can be made simple by using legal practice management software, which easily integrates with payroll applications. Read our beginner’s guide to law office automation to learn more.

Financial reporting

In simplest terms, financial reporting involves tracking, analyzing, and reporting your firm’s income. Generally Accepted Accounting Principles (GAAP) are standards outlined by the United States Financial Accounting Standards Board (FASB). The GAAP acts as a set of guidelines for companies to prepare their financial statements, such as the ones below.

Law firm financial statement examples

When creating law firm financial management processes, there are four key financial statements you should prioritize:

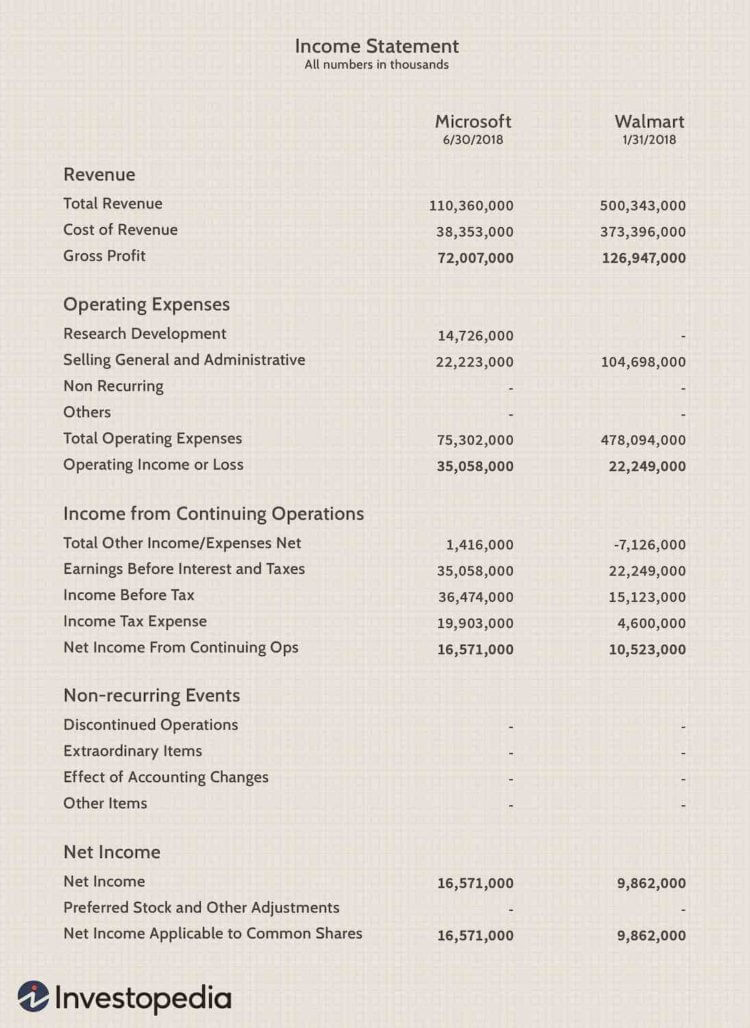

- Income Statement or Profit & Loss Statement: Lists sales and expenses, showing how much profit you’re making or money you’re losing. The income statement example below is courtesy of Investopedia.

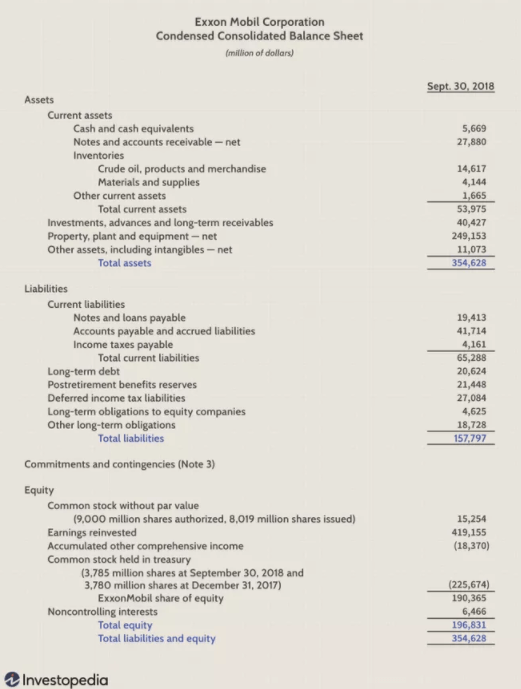

2. Balance Sheet or Statement of Financial Position: Reports the assets, liabilities, and equity of your firm on a given date. The income statement example below is courtesy of Investopedia.

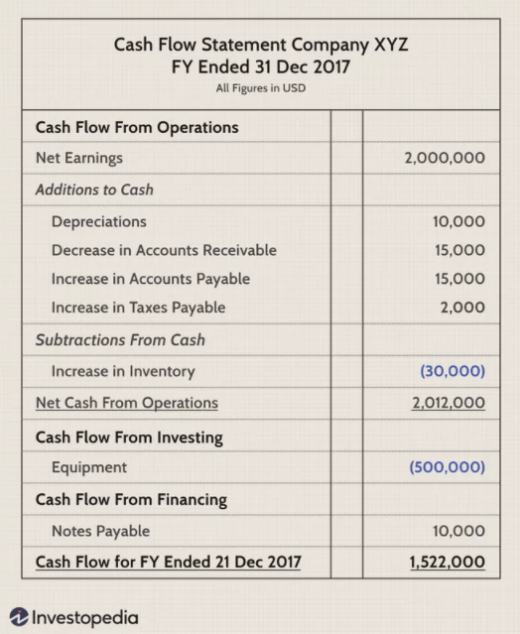

3. Statement of Cash Flows: Shows the flow of money in and out of a company. It helps you track how much money your firm is making, and how much it’s spending. The income statement example below is courtesy of Investopedia.

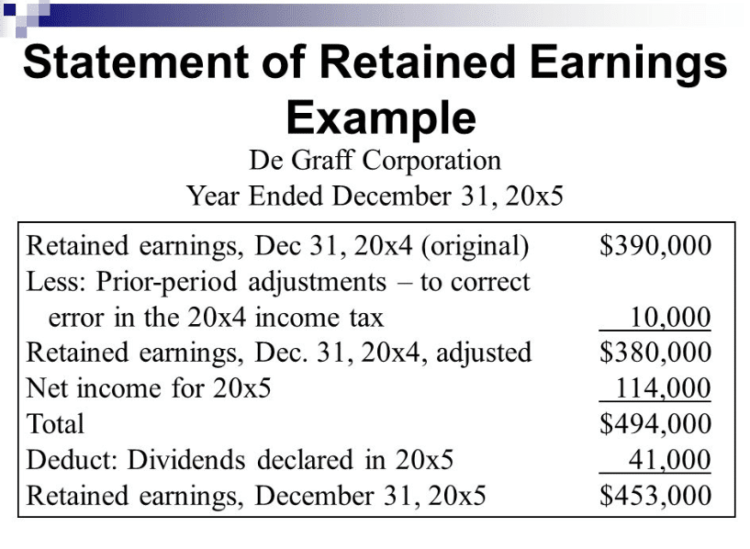

4. Statement of Retained Earnings: Outlines the changes in retained earnings for the firm over a specific time period. The income statement example below is courtesy of BooksTime.

Legal accountants can help law firms prepare financial statements like the ones above. It might be worth the investment to bring on a legal accountant to help set up your statements and other processes that take you away from practicing the law.

Tax planning and reporting

Understanding your tax responsibilities is essential for any business owner, and attorneys are no different. Your tax filing requirements will depend on your business structure. As outlined by the IRS, there are various business taxes, each with forms and returns for business owners. Your state bar association might be able to connect you with resources or financial experts, so you don’t have to go through this process alone.

Retirement and succession planning

It might seem ages away now, but it’s often said that time is your most valuable asset when planning for retirement. With so much to consider and plan for, we created a guide to preparing for lawyer retirement. This guide contains stats on the average lawyer retirement age, ethical considerations, best practices for preparing financially, and more.

Law firm succession planning is an integral part of retiring for those who own and operate law firms. To ensure your clients are supported and your firm is left with trusted and capable professionals, read our law firm succession planning guide.

Final notes on law firm financial management

While it may seem like a big undertaking, law firm financial management can be broken down into less intimidating pieces. Start by following guides and filling in pre-made templates whenever you can. And, if this is your first time implementing financial management practices at your firm, bringing in a professional to help will save you time and mitigate frustrations. This outside financial support will grant you more energy and resources to serve your clients.

We published this blog post in February 2022. Last updated: .

Categorized in: Accounting